Back

Account Deleted

Hey I am on Medial • 10m

Raising VC Money? Tips No One Tells You : 1) Don’t Chase VCs, Attract Them - Build something so good they can’t ignore you. 2) Traction > Decks - Fancy pitch decks don’t matter if your numbers don’t add up. 3) Investors Follow Other Investors - Get one solid backer, and others will follow. 4) Negotiate Smart, Not Desperate - The wrong terms can hurt more than no funding. 5) VCs Bet on People, Not Just Ideas - Show them you can execute, pivot, and win. Money follows momentum. Focus on building, and funding will come.

Replies (3)

More like this

Recommendations from Medial

Ravi Handa

Early Retiree | Fina... • 2m

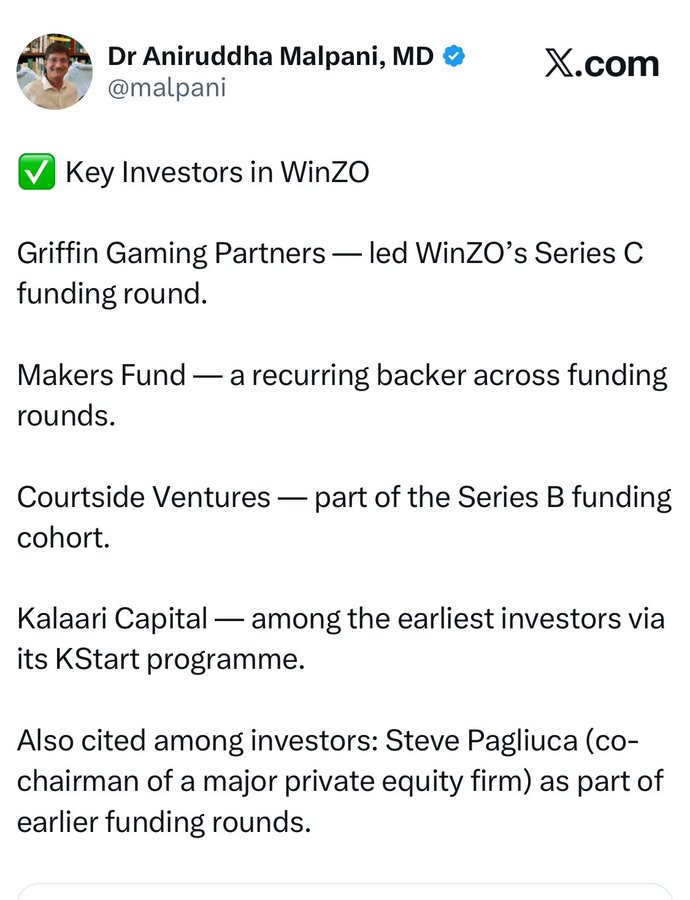

Byju Ravindran Rahul Yadav Ashneer Grover Paavan Nanda (new name in the list that @malpani is talking about) Someday, I plan to scam the VCs like these guys. It is a victimless crime. Anyways the VCs are going to lose the money. Instead of en

See More

Account Deleted

•

Urmila Info Solution • 7m

You don’t need a fancy pitch deck. You need a working AI product. Founders spend weeks perfecting pitch decks. But you know what really impresses VCs? 📱 A functional AI app ⚙️ A smooth SaaS platform 📊 Working analytics 🎯 Real users We help you

See MoreAanya Vashishtha

Drafting Airtight Ag... • 10m

Angel Investors vs. VCs: Who’s the Better Bet for Your Startup? Choosing between angel investors and VCs? Early branding gives founders a killer edge. Angels want passion and hustle—your authentic story online hooks them fast. VCs dig data and

See MoreAccount Deleted

Hey I am on Medial • 10m

A lot of founders think funding = validation, but that’s just step one. If you can’t turn that capital into real, sustainable growth, it’s just a countdown to running out of cash. Just because a startup raises VC money doesn’t mean it’s successful. V

See MoreRohan Saha

Founder - Burn Inves... • 1y

First, DHFL and now Jet Airways, both have one thing in common: retail investors knowingly invest their money in such companies that are bound to fail, and then they blame the government for losing their money. But investors don’t see their own mista

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)