Back

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

VCs don’t always invest in profitable startups—because not every great business fits the venture model. But that doesn’t mean your startup can’t thrive! Explore alternative funding options and scale on your terms. #StartupFunding #VCReality #BuildSmart

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

📚 Our education system needs to evolve! This cartoon speaks volumes each student has unique strengths, yet a one size fits all approach doesn’t recognize their individual talents. 🐒🐧🐘🐟 Just like animals with different skills, students excel in

See More

Account Deleted

Hey I am on Medial • 10m

A lot of founders think funding = validation, but that’s just step one. If you can’t turn that capital into real, sustainable growth, it’s just a countdown to running out of cash. Just because a startup raises VC money doesn’t mean it’s successful. V

See MoreAccount Deleted

Hey I am on Medial • 10m

Raising VC Money? Tips No One Tells You : 1) Don’t Chase VCs, Attract Them - Build something so good they can’t ignore you. 2) Traction > Decks - Fancy pitch decks don’t matter if your numbers don’t add up. 3) Investors Follow Other Investors - G

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Unlock the keys to successful startup funding in our latest video, "Mastering Startup Funding: Avoiding Pitfalls!" 🚀 Discover how to calculate your funding requirements without running dry or scaring away potential VCs. Learn to identify key milesto

See MoreCA Jasmeet Singh

In God We Trust, The... • 12m

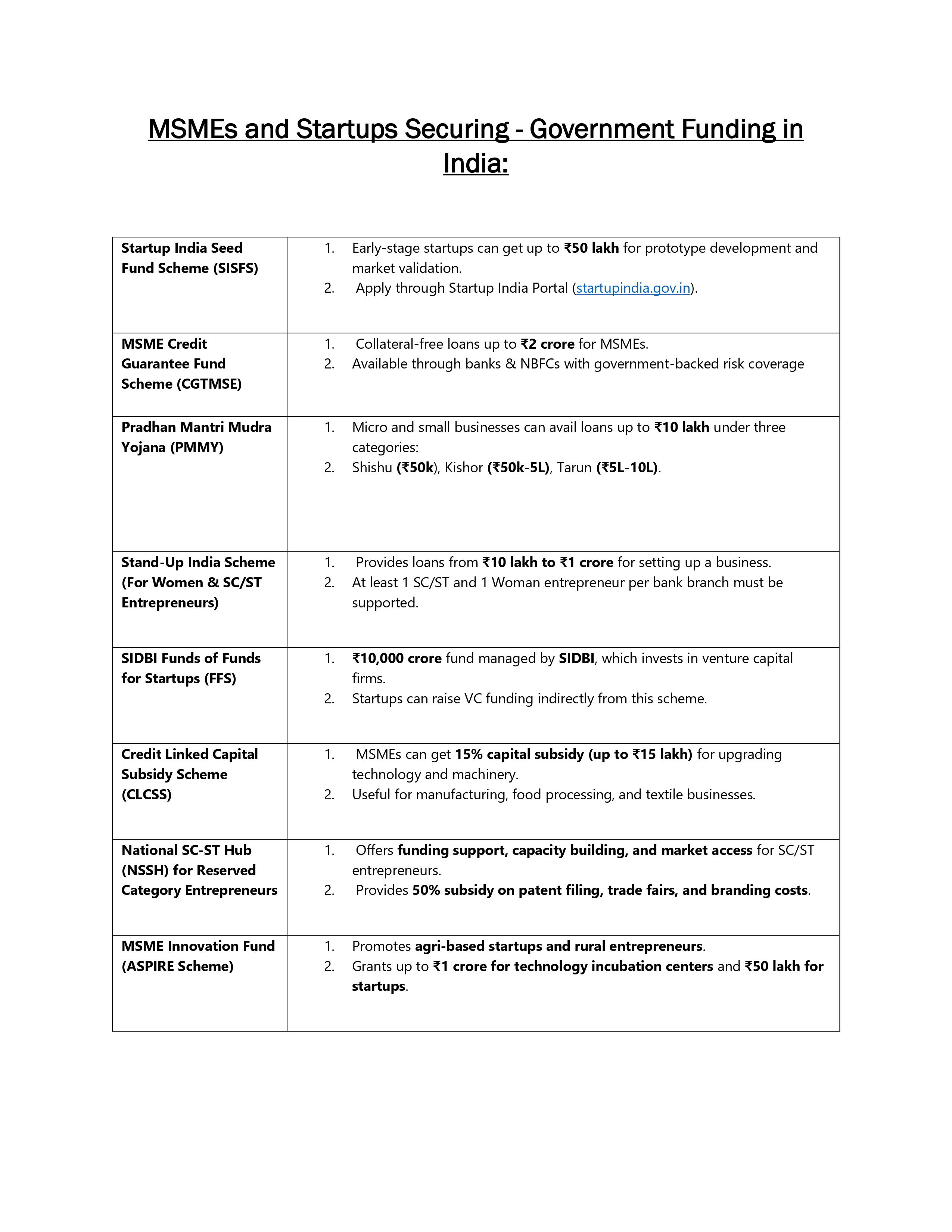

🚀 Unlocking Growth: Funding Strategies for Startups & MSMEs 💰 Access to capital is one of the biggest challenges for startups and MSMEs. Whether you're launching a new venture or scaling your business, the right funding can be a game-changer. But

See More

Account Deleted

Hey I am on Medial • 12m

Bengaluru CEO Compares Startup Funding to Dating After $3M Investment A viral post by Sumanth Raghavendra, CEO of Presentations.ai, compared startup funding to dating, saying VCs ignore struggling startups but rush in once they thrive. "When you're

See More

Vivek Joshi

Director & CEO @ Exc... • 4m

Quick breakdown for VC analysts: Family offices vs. institutional VCs — what each brings, how their mandates, time horizons, decision-making, and involvement shape startup strategy. Learn when patient capital, values-aligned investing, and flexible d

See MoreVivek Joshi

Director & CEO @ Exc... • 10m

Unlock the secrets to VC funding with our latest video, *Is Your Startup VC-Ready? Discover with the Startup Valuation Matrix!* 🚀 If you’re looking to raise venture capital, understanding your startup's value is crucial. In this video, we introduce

See MoreSairaj Kadam

Student & Financial ... • 1y

The Harsh Reality of Venture Capital: Recently, I spoke with a founder who had a fantastic business idea, but he was struggling to secure venture capital funding. Got myself thinking: why do some great ideas never get the backing they need? The tr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)