Back

Sairaj Kadam

Student & Financial ... • 1y

The Harsh Reality of Venture Capital: Recently, I spoke with a founder who had a fantastic business idea, but he was struggling to secure venture capital funding. Got myself thinking: why do some great ideas never get the backing they need? The truth is, it’s not just about having a good idea; VCs are looking for something specific, and if your startup doesn’t fit that mold, you might struggle to get funding. Here’s Why: Focus on Exponential Growth: Venture capitalists are in the game to make high returns in a relatively short amount of time. They are often looking for startups with the potential to scale rapidly and dominate a market. If your business doesn’t show a clear path to exponential growth, it might not catch their eye. For example, tech startups often attract VCs because they can scale quickly and have low marginal costs. Proof: Data from PitchBook shows that in 2023, over 70% of VC investments went into tech-related startups, leaving non-tech sectors with limited funding opportunities. Scalability and Market Leadership: VCs are also interested in whether your business can become a market leader. They want to see a clear path to capturing a significant market share. If your business model doesn’t demonstrate this potential, securing VC funding can be tough. Example: Look at companies like Uber or Airbnb. They entered markets with the potential for massive disruption and quickly established themselves as leaders. VCs funded them because they saw this path to market dominance. Risk vs. Reward: VCs are often willing to take risks, but only if they see the potential for substantial rewards. A startup that requires high upfront investment with a long time to profitability might be less attractive than one that can quickly generate returns. Insight: Research from CB Insights shows that one of the top reasons startups fail is "no market need." VCs are wary of this risk and are more likely to invest in startups that show strong demand and the ability to meet that demand rapidly. Non-Tech Ventures Are Often Overlooked: If your startup isn’t tech-focused, you might have an even harder time attracting VC interest. This isn’t to say non-tech startups can’t succeed, but VCs often gravitate toward industries where they’ve seen proven high returns, which tends to be tech. Insight: According to a report by the Kauffman Foundation, less than 10% of VC funding in recent years has gone to sectors outside of technology, health care, and financial services. The Reality Check: The sad truth is that no matter how passionate you are or how hard you work, if your business doesn’t fit into the typical VC model—high growth, scalable, and market-leading—you might face rejection. But don’t let this discourage you. There are many other funding avenues out there, from angel investors to crowdfunding, that might be a better fit for your business. ~ Kadam

Replies (1)

More like this

Recommendations from Medial

Mehul Fanawala

•

The Clueless Company • 1y

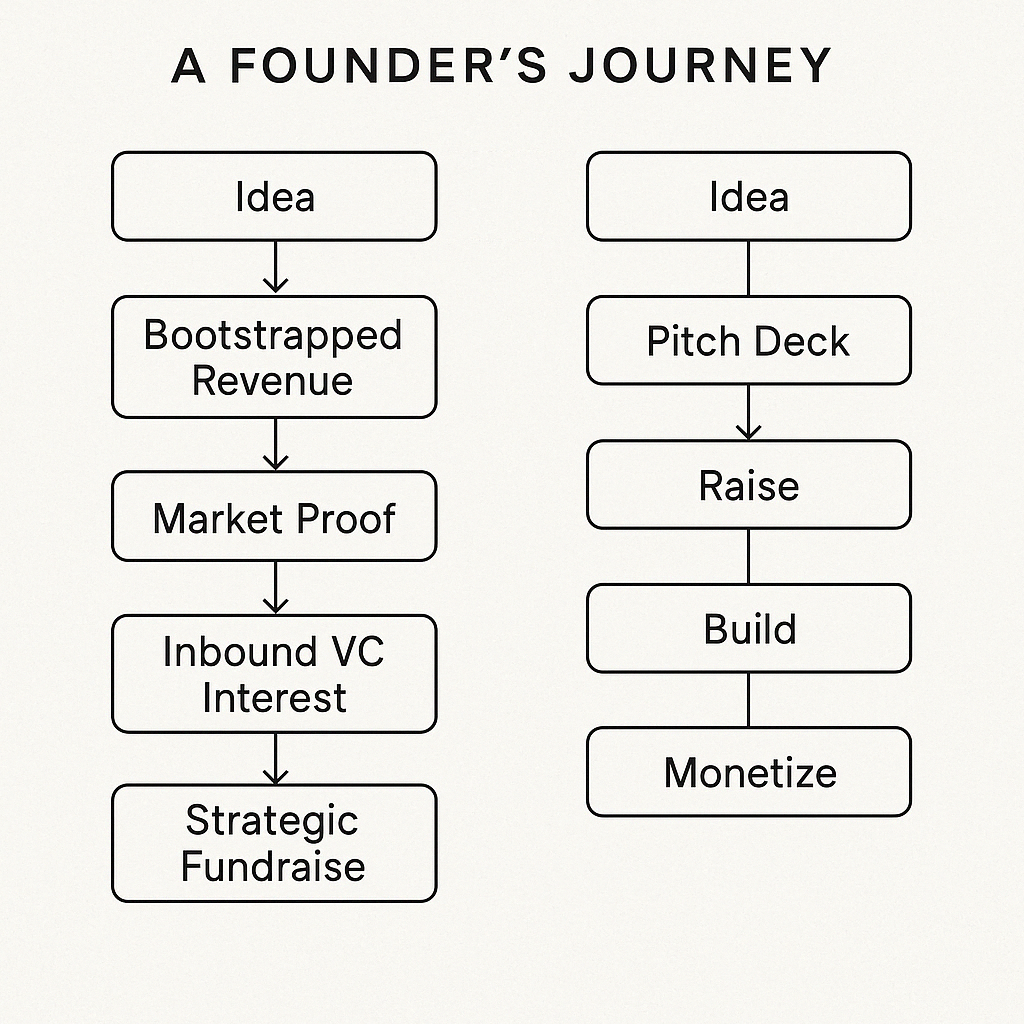

Is it better to bootstrap or seek VC funding for your startup? The endless debate: Bootstrap vs. VC funding. - Bootstrapping builds resilience and deep customer focus. You prioritize solving real problems over chasing valuations. - VC funding can

See MoreMayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreMayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing on

See More

Arcane

Hey, I'm on Medial • 1y

Even though 25% of all startups on Carta have just a solo founder, VCs hesitate to fund them. Having 2 to 3 founders seems to be the sweet spot if you were to raise VC money while building a startup. So, Is there a way to make VC funding easier as

See More

VCGuy

Believe me, it’s not... • 1y

Last week, news broke that India's former Defence Secretary launched his VC fund, Mount Tech Growth Fund. The first fund, named Kavachh, is expected to be ~₹500 Cr, supporting Defence Tech startups. ⏭️Demand for Defence Technology seems to be on t

See MoreVicky

Ask yourself the que... • 10m

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)