Back

Amanat Prakash

Building xces • 10m

Fourth: If we earn, we pay tax. If we spend, we pay tax. If we sell something, we pay tax — even on the same item we already paid tax on while buying. We pay taxes on: • Cars • Bikes • Property • Daily essentials • Educational materials • Life and health insurance • Films • Even popcorn — in short, on everything. And what do we get in return? Third-class infrastructure, third-class government employees and systems, and third-class air quality. Basically, we pay taxes for all things third-class.

Replies (1)

More like this

Recommendations from Medial

Vamshi krishna Nayini

Hey I am on Medial • 1y

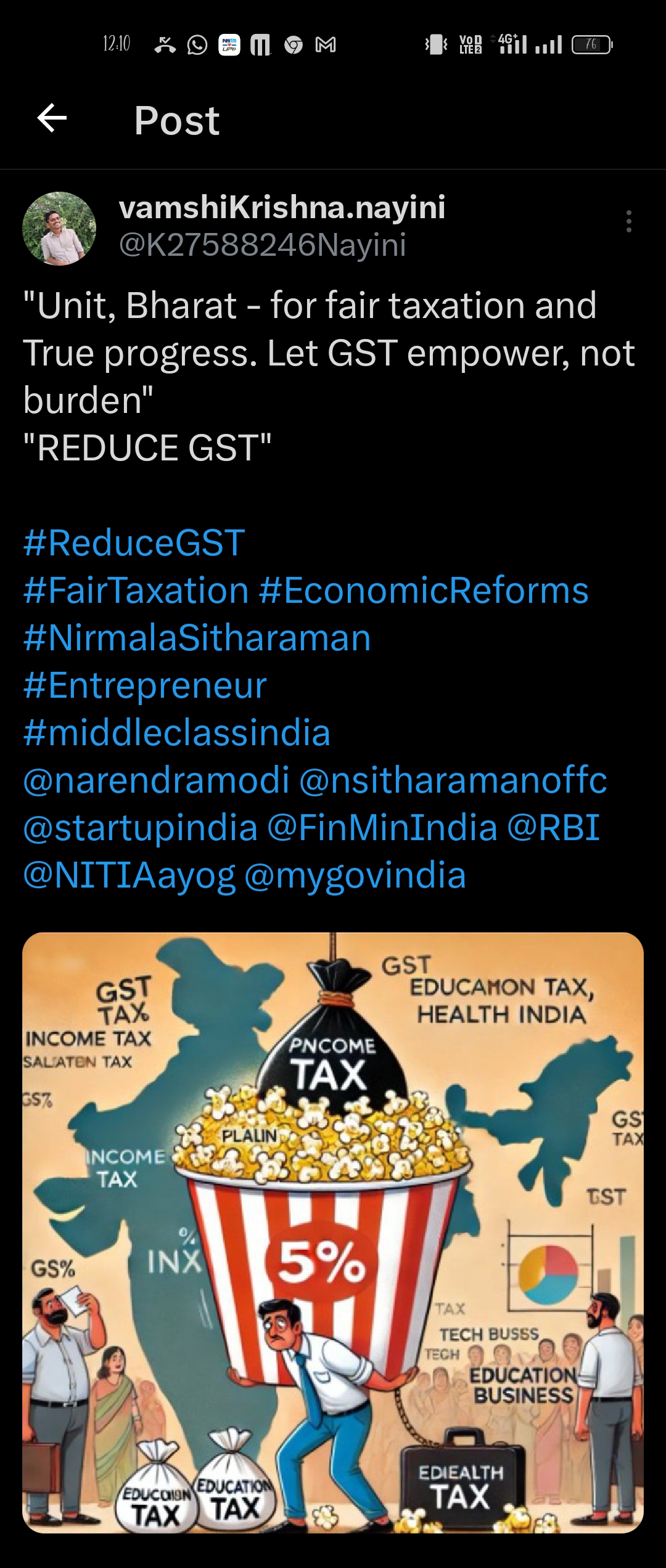

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreRishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)