Back

Gokul sai ATTULURI

•

Audisankara College of Engineering and Technology • 1y

Can anyone explain these to me we buy car and pay taxes on it and also pay toll tax on it and again use petrol which is taxed why are we paying these? Can anyone explain.

Replies (4)

More like this

Recommendations from Medial

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

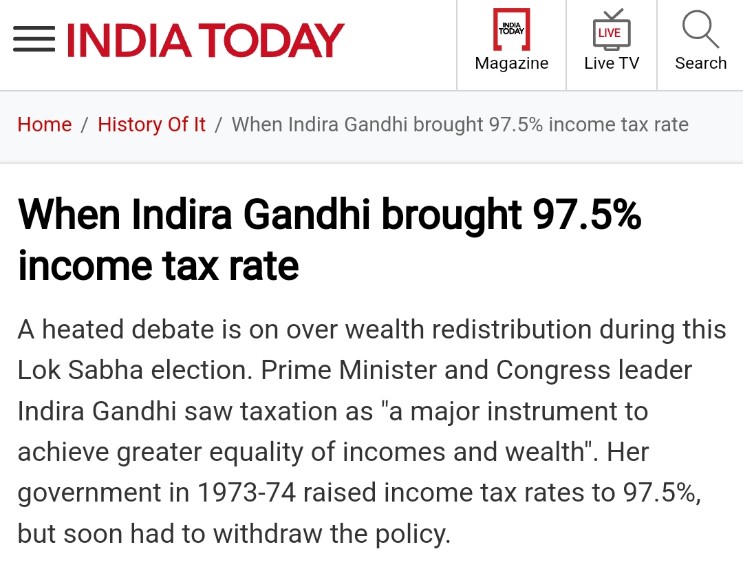

Of course the value of money has changed but it's a great comparison. It does not show Congress taxed the rich btw. Nobody was paying 97.5% tax. They were just paying bribes to Congress to keep money black. That's how they destroyed our economy.

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MorePoosarla Sai Karthik

Tech guy with a busi... • 4m

Petrol analysis: Pricing Patterns: Petrol varies from ₹82.46 (Andaman) to ₹109.46 (Andhra), driven by state VAT, not crude ($60/barrel). Taxes (50-60% of price) dominate. Consumer Behavior: High prices in Andhra/Kerala suggest reduced travel, boost

See MoreCA Kakul Gupta

Chartered Accountant... • 11m

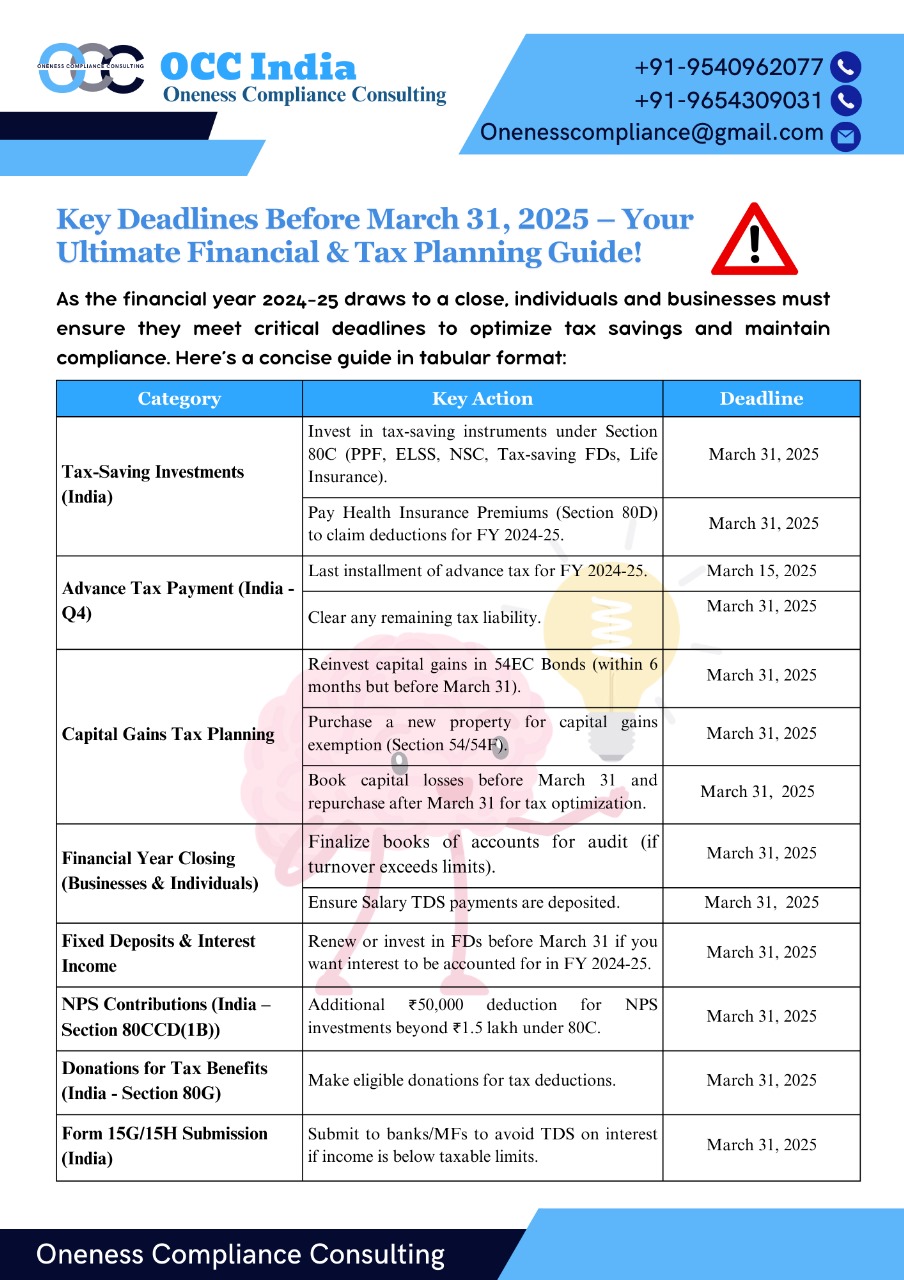

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

Nawal

Entrepreneur | Build... • 10m

Come on, just stop already - 🔥 Deeptech takes years to build, and here Indian VC give 10 mins to pitch. They don't understand the essence of R&D and want immediate results. No one wish to spend on R&D. So companies like Swiggy, Zomato fly but DeepT

See More

CA Jasmeet Singh

In God We Trust, The... • 10m

🚨 Breaking Tax News: The TCS Chronicles – April 2025 Edition 🚨 Brace yourselves, tax enthusiasts! The Finance Ministry has rolled out a new TCS (Tax Collection at Source) rule that's turning heads and emptying wallets. Effective April 22, 2025, ce

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)