Back

Amanat Prakash

Building xces • 10m

Day 2 Business Terms 1. CAC (Customer Acquisition Cost) – "If you spend ₹10,000 to get 10 customers, your CAC is ₹1,000. Keep it lower than your Customer Lifetime Value (CLV) to stay profitable!" 2. Gross Margin vs. Net Margin – "Selling a burger for ₹100? If ingredients cost ₹40, gross margin is 60%. After rent & salaries, if ₹20 is left, net margin is 20%." 3. Bootstrapping vs. VC Funding – "Bootstrap = Own money, slow but full control. VC = Big money, fast but shared control. What would you pick?" 4. Scalability in Business – "Netflix scaled globally with the same product. A local bakery? Harder to scale. Think scale when building your startup!" 5. Break-even Point – "Your business is profitable when revenue covers all costs. Example: If rent + salaries = ₹2L/month and you earn ₹2L, you’ve broken even!"

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Shubham Gupta

Passionate about cre... • 1y

Most of the D2C brands are either burning funding money or are profitable only with very unique product. Still why people are running to build consumer brands going D2C. Clothing mostly brands without differentiation will die soon when trying to

See MoreSwapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSAHA Realtors

Rediscovering lifest... • 7m

Real Estate Lease Agreements A lease is a written legal agreement between landlord and the tenant that helps to establish the following : *How much the tenant will pay in rent. *How long the tenant is legally committed to stay. *Any additional payme

See More

Yash Barnwal

Gareeb Investor • 1y

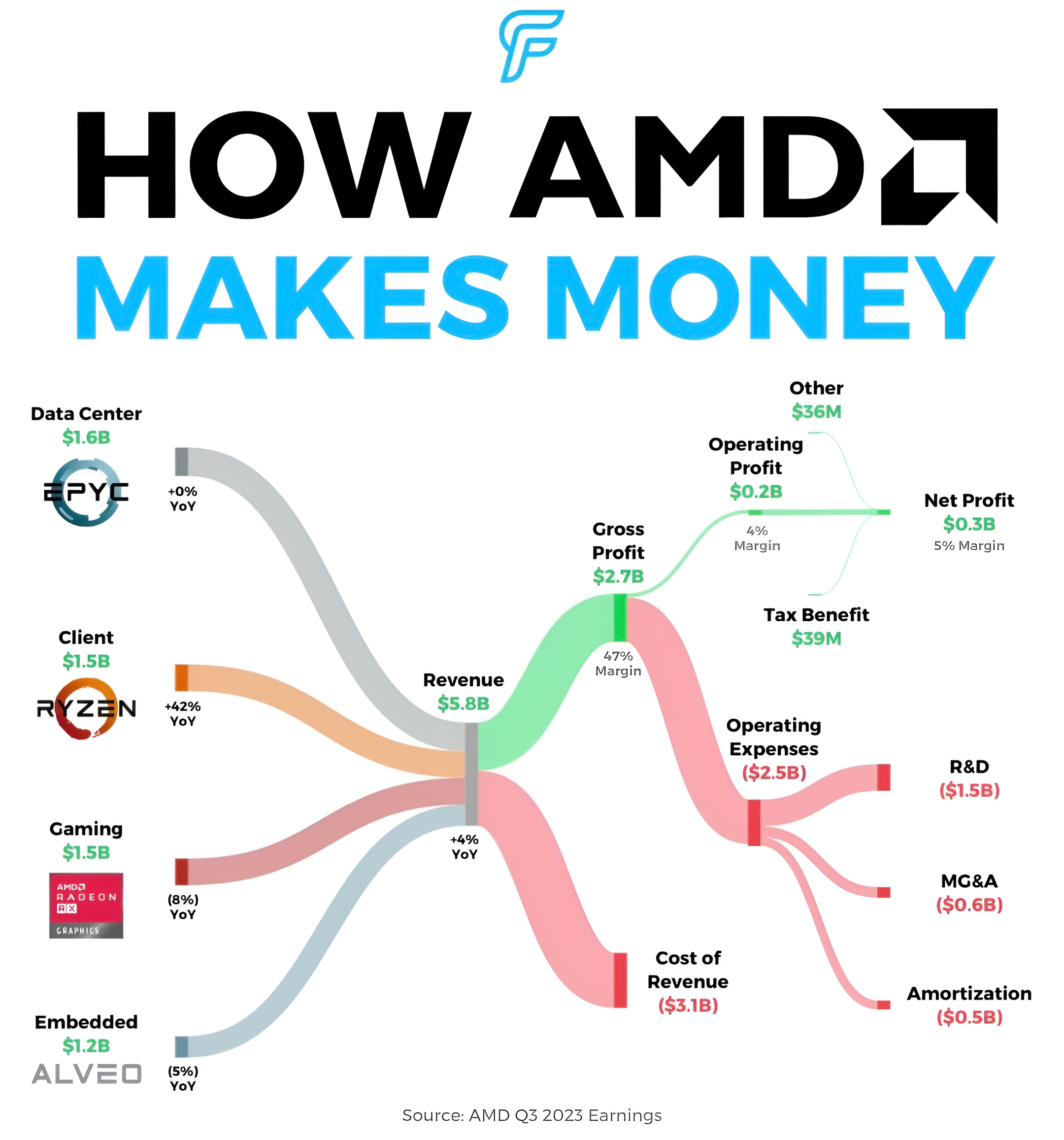

AMD generate revenue across various sectors, including Data Center ($1.6B), Client ($1.5B), Gaming ($1.5B), and Embedded ($1.2B). With total revenue of $5.8B, AMD achieves a gross profit of $2.7B and a net profit of $0.3B (5% margin). Key expenses in

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)