Back

mg

mysterious guy • 9m

Gross Margin – The Real Measure of Your Startup’s Health Revenue looks exciting. But how much do you actually keep after delivering your product? That’s where gross margin comes in — and it decides whether you’re running a business or a charity. Breakdown: 1️⃣ Gross Margin = (Revenue - Cost of Goods Sold) / Revenue It tells you how profitable your core operations are. 2️⃣ Example: You sell a product for ₹1,000 Your cost to deliver it (COGS) is ₹600 Gross Margin = (1,000 - 600) / 1,000 = 40% 3️⃣ SaaS? Expect 70–90% gross margins D2C? Healthy = 50%+ Marketplace? Lower, but scalable Why it matters: High revenue with low margins = fake success. You might be growing, but your profits aren’t. The trap: Founders often spend more on growth than they make in gross profit. That’s how unicorns bleed. Quick tip: Before scaling, ask — can I afford to fulfill 10x orders without margin collapse? 𝗥𝗲𝘃𝗲𝗻𝘂𝗲 𝗶𝘀 𝘁𝗵𝗲 𝘁𝗼𝗽 𝗹𝗶𝗻𝗲. 𝗠𝗮𝗿𝗴𝗶𝗻 𝗶𝘀 𝘁𝗵𝗲 𝗺𝗲𝗮𝘁.

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Nimesh Pinnamaneni

Making synthetic DNA... • 11m

🚨 The magic number: ₹800 Cr ⸻ VCs invest in businesses that can be big enough to return their entire fund. To get VCs interested, your startup must at least have the potential to reach ₹800 Cr+ in annual revenue or ₹8,000 Cr+ in market cap (assumi

See MoreYash Barnwal

Gareeb Investor • 1y

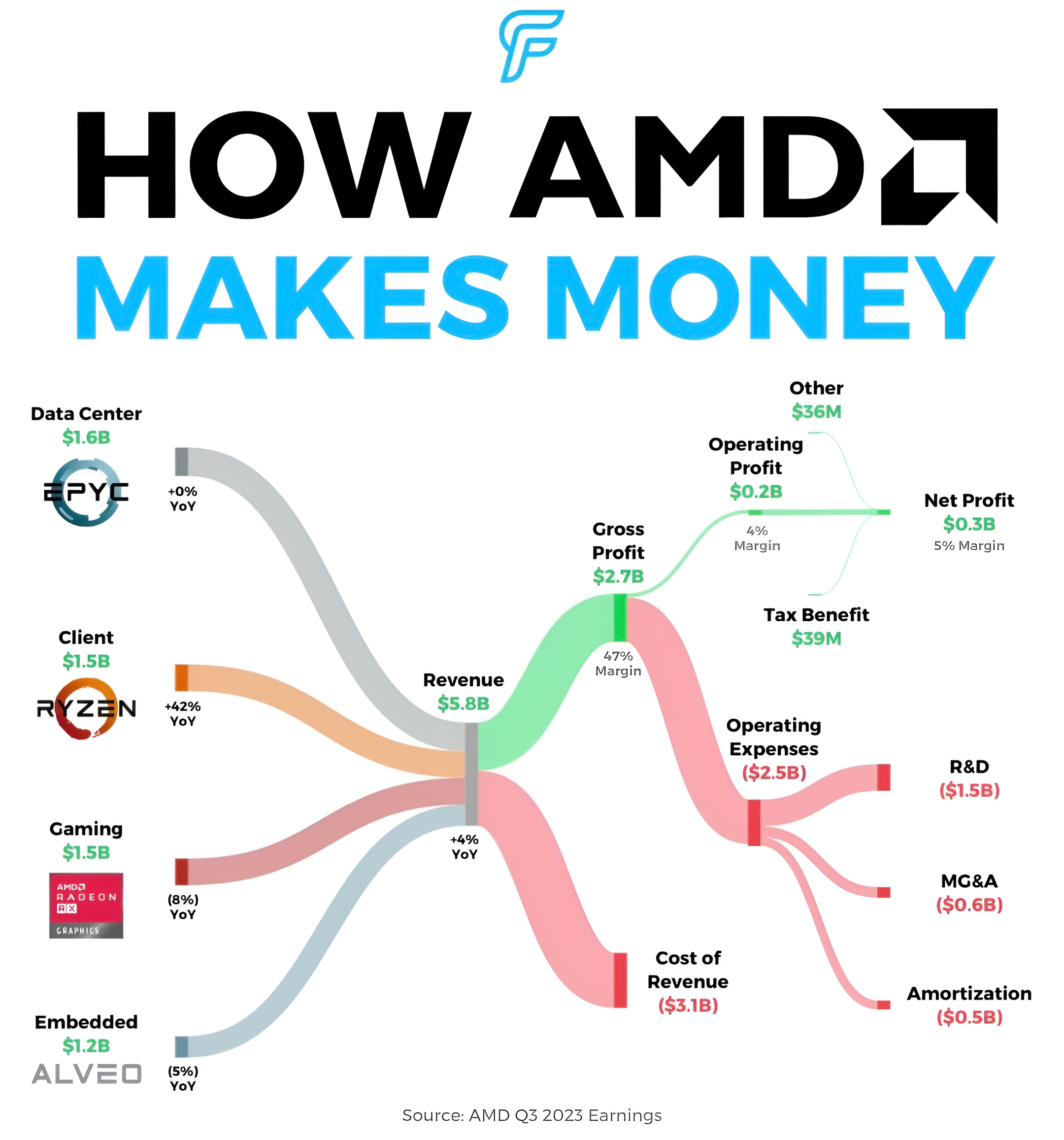

AMD generate revenue across various sectors, including Data Center ($1.6B), Client ($1.5B), Gaming ($1.5B), and Embedded ($1.2B). With total revenue of $5.8B, AMD achieves a gross profit of $2.7B and a net profit of $0.3B (5% margin). Key expenses in

See More

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)