Back

PRATHAM

•

Medial • 1y

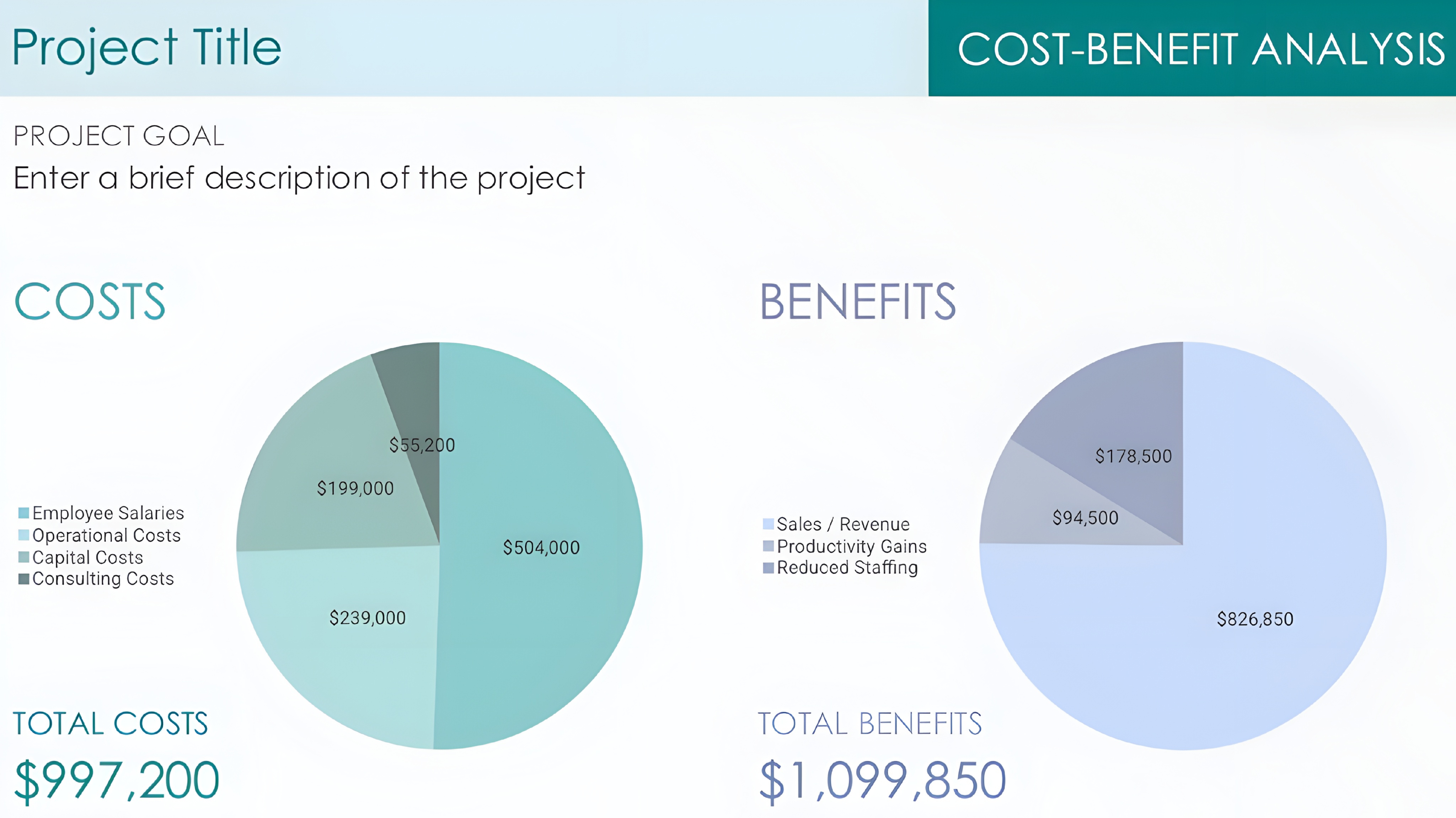

Gross margin is crucial for startups - but what is it exactly? ( Let's Discuss How You Consider Gross Margin ) Gross margin represents the percentage of revenue left after paying for direct costs associated with producing goods or services. It's calculated by subtracting cost of goods sold (COGS) from total revenue and dividing by revenue. For startups focused on SaaS or services, COGS may include infrastructure costs, developer salaries, contractor fees. For e-commerce, it's the cost to obtain or manufacture inventory. Higher gross margins mean more revenue goes toward core operations and growth rather than direct expenses. But how high is considered healthy? Target 50-60% minimum for most B2B SaaS. Focus on efficient operations and pricing power. Monthly tweaks to gross margin help course correct. Transform revenue vanity metrics into profitable reality. What's your gross margin telling you?

More like this

Recommendations from Medial

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

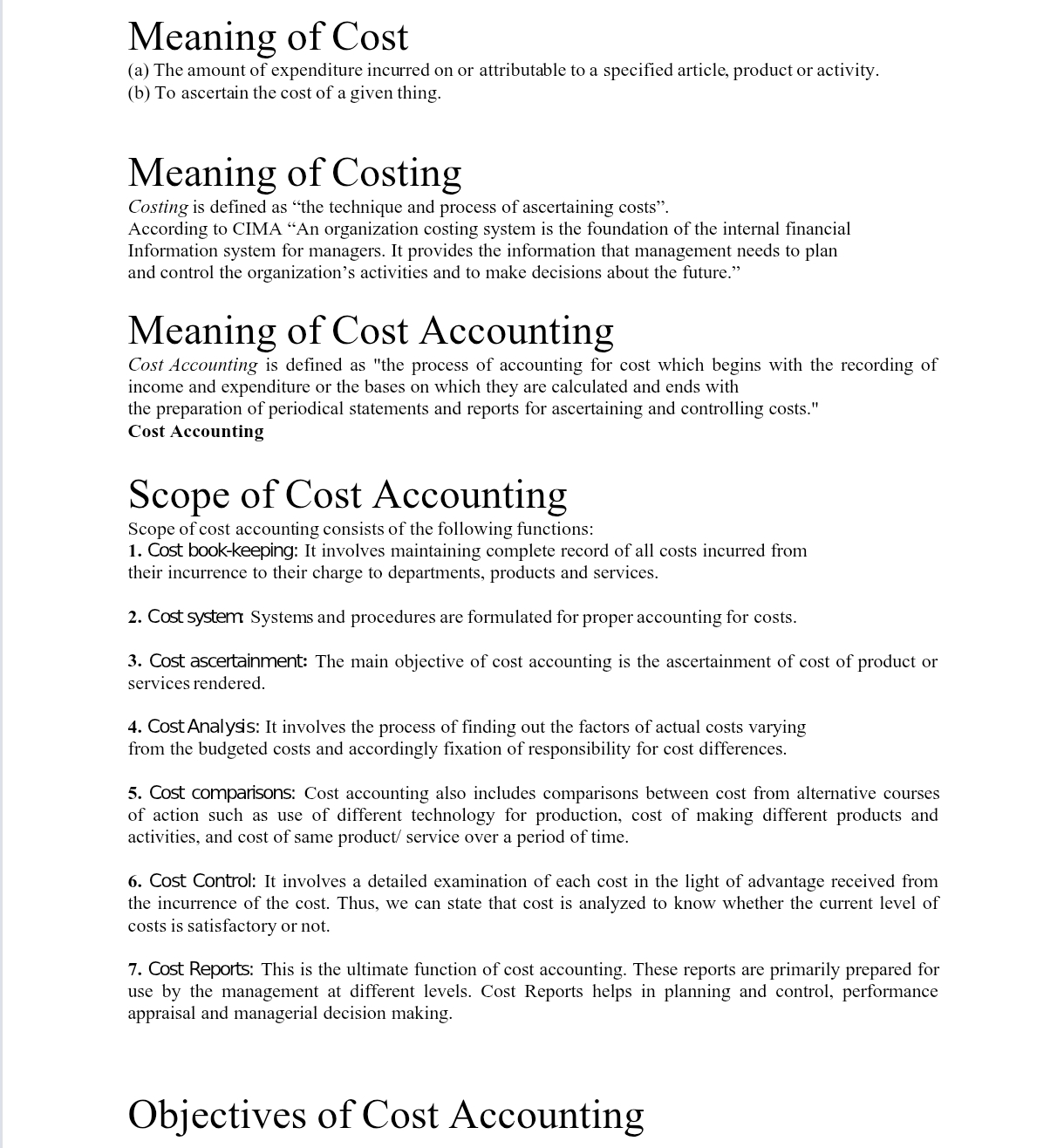

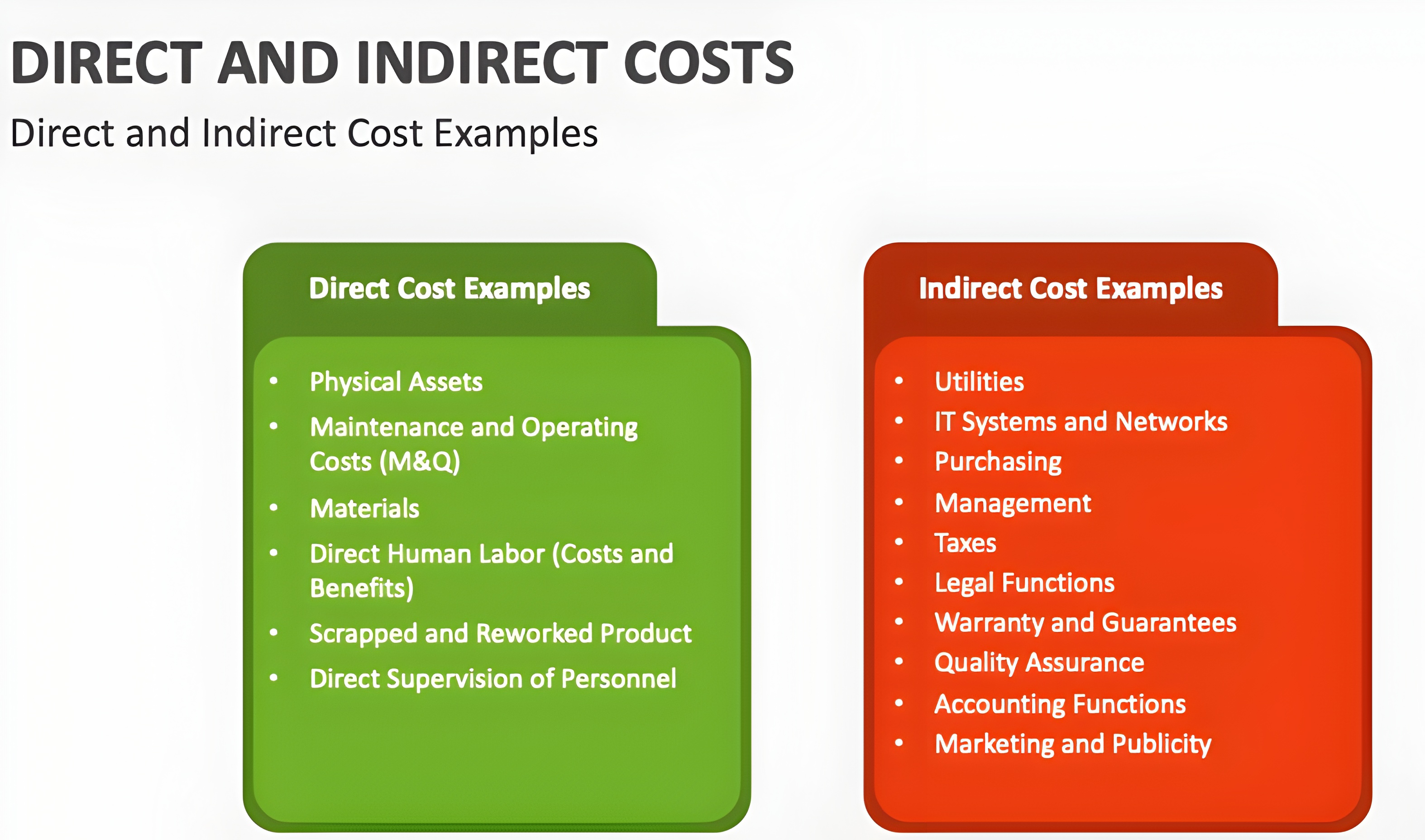

💰Learn Start-up Maths —( Concept - 2 )📊 💱 All details about “ COST ” Whenever someone asks you about the cost just tell him that “ Cost the amount of money that a business spends on the creation of something ” • There are many types of cost #

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)