Back

SiA

Let's build a commun... • 11m

I was recently eating this chocolate fudge ... and It is worth 500rs. I think they have a really Great margin on this product. If anyone knows about the unit economics or margins of such products please msg me ?

Replies (21)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets of startup success with our comprehensive guide on Decoding Unit Economics! In this video, we break down the critical components that can determine the fate of your early-stage venture. Learn how to define your unit, calculate Cust

See MoreKarnivesh

Simplifying finance.... • 1m

I’ve noticed that many startups celebrate users, orders, and revenue before asking the hardest question: does each unit actually make money? That’s what unit economics reveals. Strip away the hype, and it comes down to whether a business earns more

See MoreSwapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MorePoosarla Sai Karthik

Tech guy with a busi... • 7m

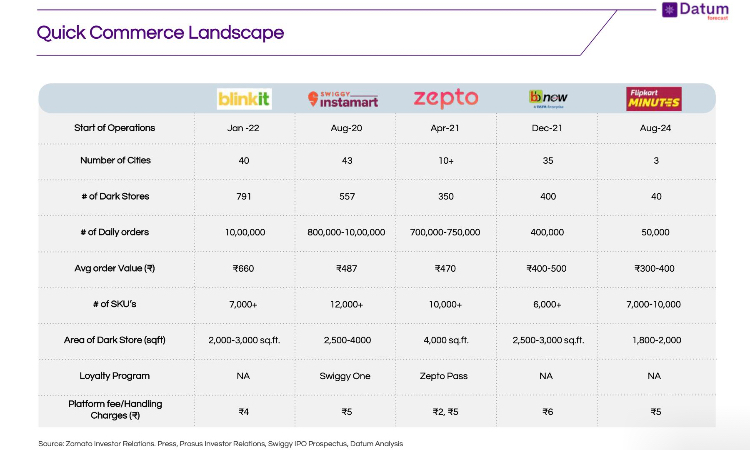

What’s Growing: • Blinkit NOV: ₹9,200 cr (+127% YoY); users +123%; 1,544 dark stores (target: 2,000 by Dec’25). • Food delivery: GOV +16%, NOV +13%, orders +10% QoQ. • District: ₹8,000 cr annualised NOV, 2M users, ₹1,700/order. • Hyperpure: +89% YoY.

See MoreSamCtrlPlusAltMan

•

OpenAI • 1y

Quick Commerce Battle: David vs Goliaths? Flipkart Minutes enters quick commerce as the newest player - but here's why size might not matter: While Blinkit processes 10L daily orders vs Flipkart's 50K... And has 791 dark stores vs Flipkart's 40...

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)