Back

Vishu Bheda

•

Medial • 1y

While taxes seem high, they fund infrastructure, education, and public services essential for businesses. 1. Google Play Fee (30%): It gives you global reach and tools—far cheaper than building your own platform. 2. GST & Taxes: These sustain the economy, infrastructure, and skilled workforce you rely on. 3. Perspective: Similar tax rates exist globally. Smart planning and reinvestment help optimize profits. Instead of resisting, focus on growth and efficiency—turn challenges into opportunities.

Replies (1)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreAditya Arora

•

Faad Network • 5m

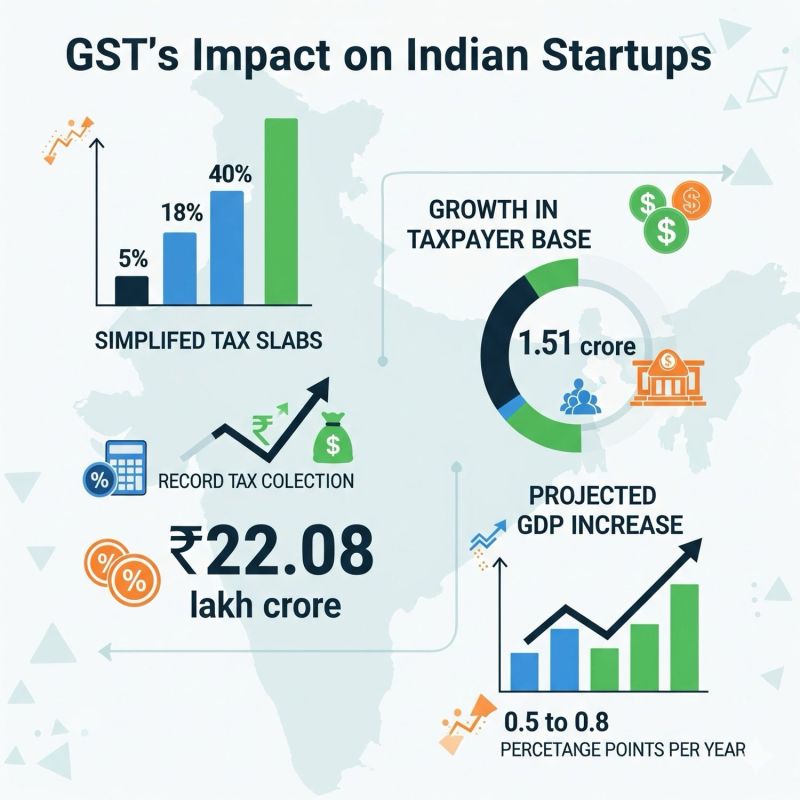

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Poosarla Sai Karthik

Tech guy with a busi... • 4m

Petrol analysis: Pricing Patterns: Petrol varies from ₹82.46 (Andaman) to ₹109.46 (Andhra), driven by state VAT, not crude ($60/barrel). Taxes (50-60% of price) dominate. Consumer Behavior: High prices in Andhra/Kerala suggest reduced travel, boost

See MoreTREND talks

History always repea... • 1y

😠 Leave India, where they even tax your popcorn – statement from a startup founder has sparked a lot of aggressive discussions 💬 🚀 The founder, who returned to India after studying at top institutes in the U.S., set up a business employing 30 pe

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)