Back

Saim

Maybe, maybe not • 1y

Tax is important but not the Indian Govt Taxation system. They impose horrendous taxation and provide nothing in return. Suppose you develop an application. You would be paying 30% to Google Play Store First 18% GST to the Indian Government Then Corporate Tax Then Income Tax It would come down to 73-75% easily. What makes you think this is "important" buddy? This is pure crime. You are merely earning 25-27%

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

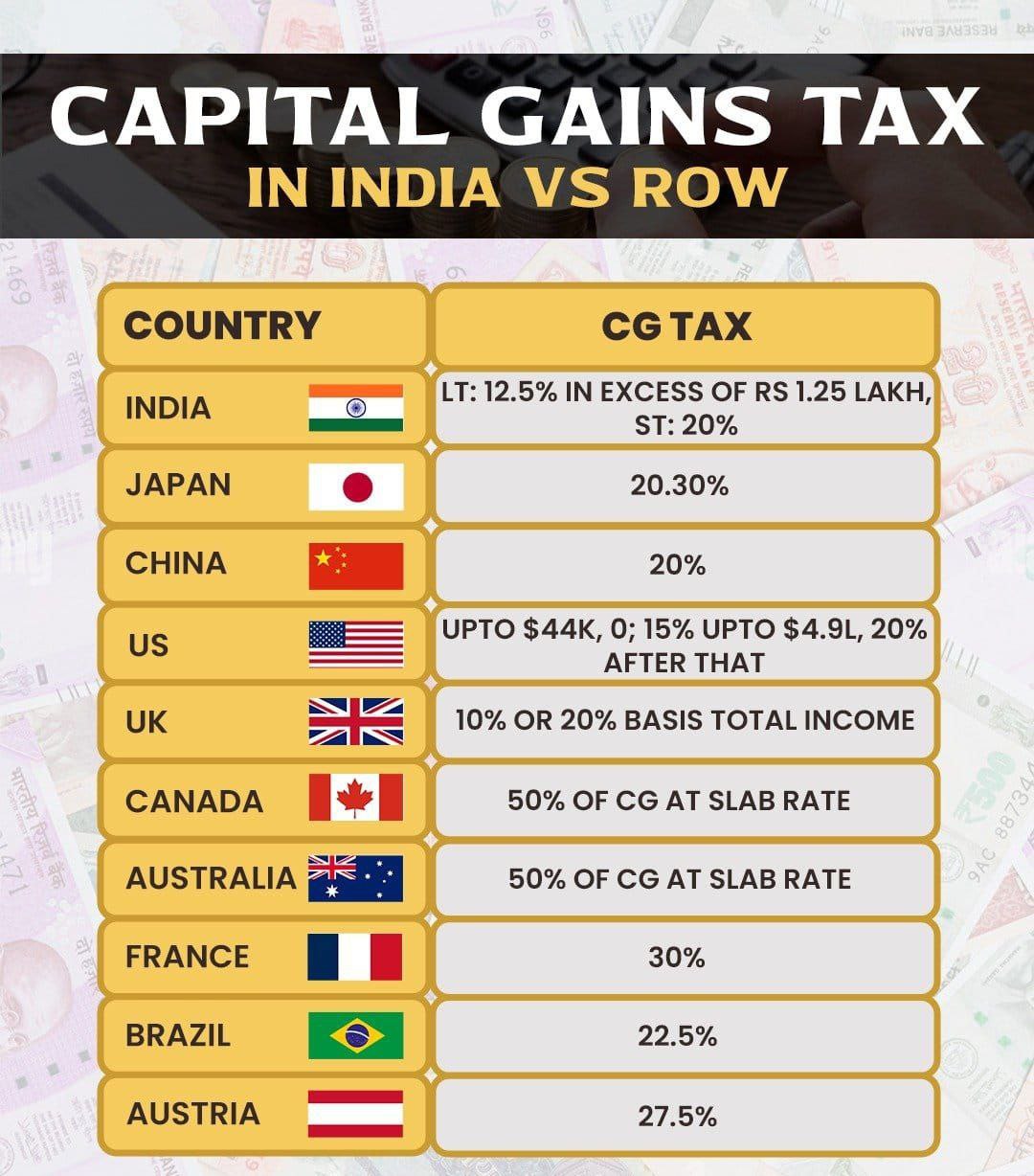

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

Rishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Shriharsha Konda

•

Start.io - A Mobile Marketing and Audience Platform • 9m

If you are a freelancer, or are just curious what it holds on the taxation front, Section 44ADA can mean huge tax savings. Here is a detailed breakdown - https://shriharsha.com/salary-to-contract-44ada/ Also bonus - a tool to compare your potentia

See More

Sai Vishnu

Income Tax & GST Con... • 11m

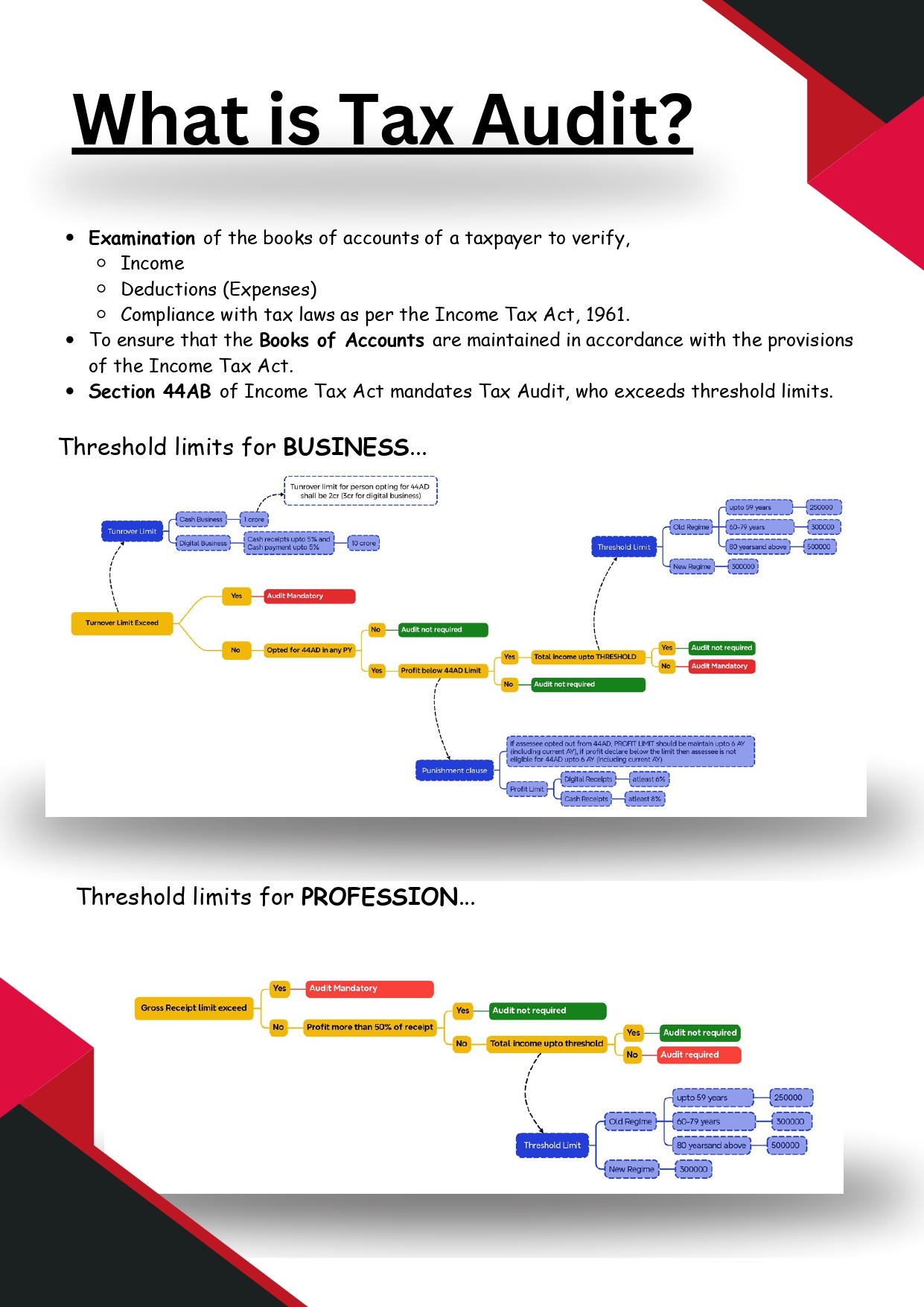

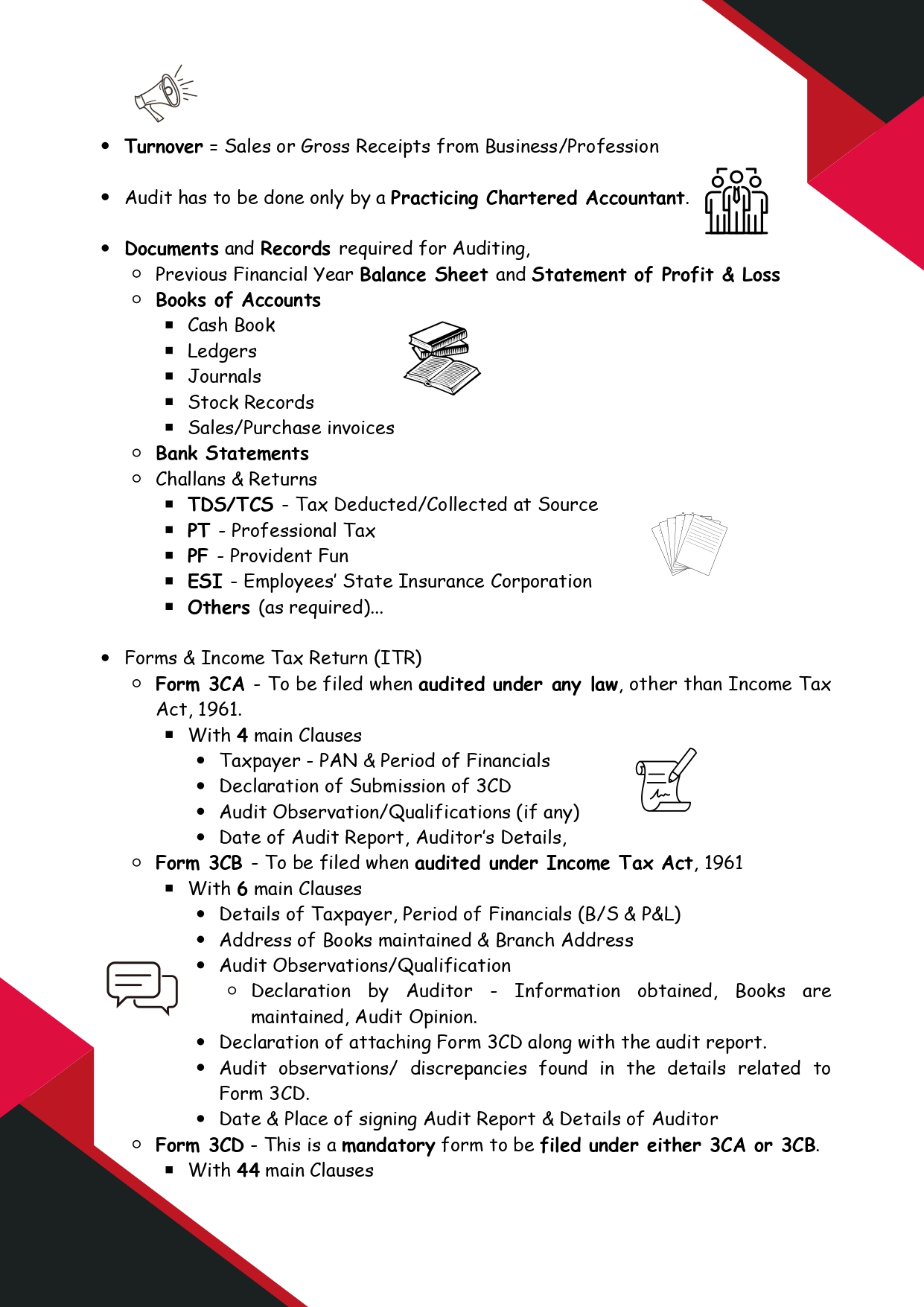

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

CA Dipika Pathak

Partner at D P S A &... • 1y

Here’s a real- lesson from July 2024: Many salaried employees, while filing their ITR, realized too late that they had missed out on crucial tax planning and investment opportunities because the financial year had already closed. Don’t let this hap

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)