Back

Account Deleted

Hey I am on Medial • 1y

Businesses can benefit from Blinkit's GSTIN feature by claiming up to 28% input tax credit, simplifying tax compliance, and reducing costs. This feature can help businesses save money, improve efficiency, and gain a competitive edge.

More like this

Recommendations from Medial

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreSai Vishnu

Income Tax & GST Con... • 11m

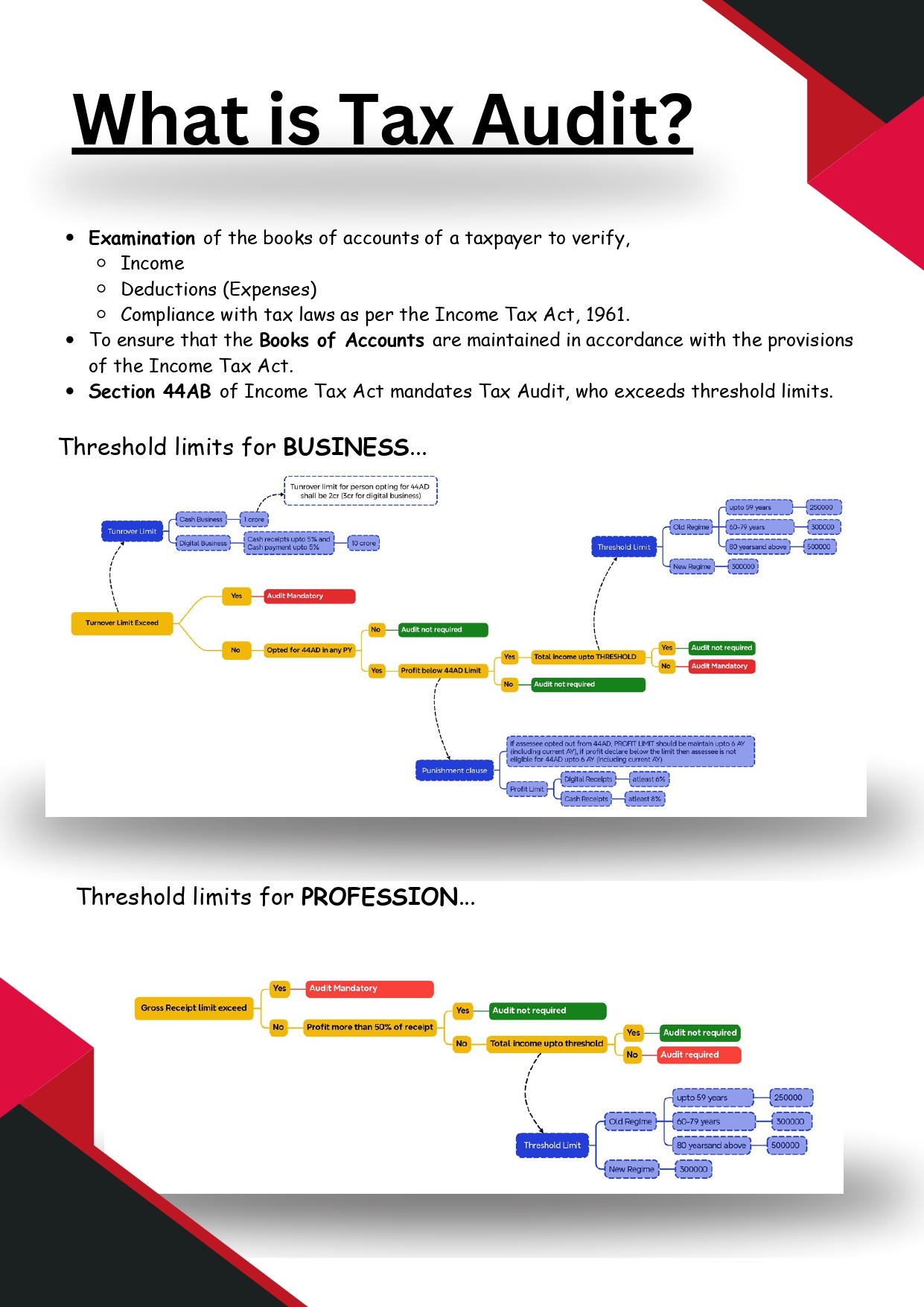

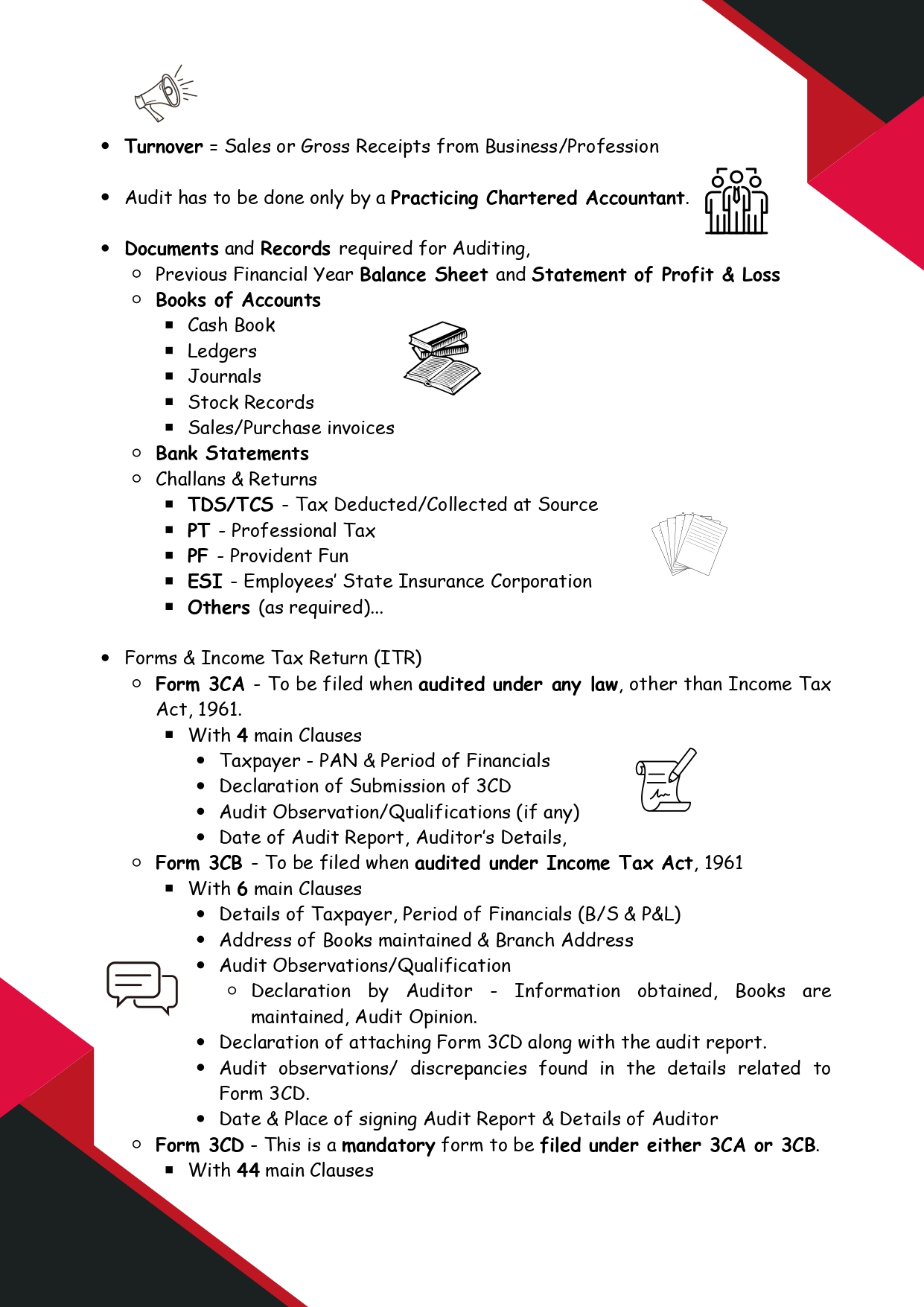

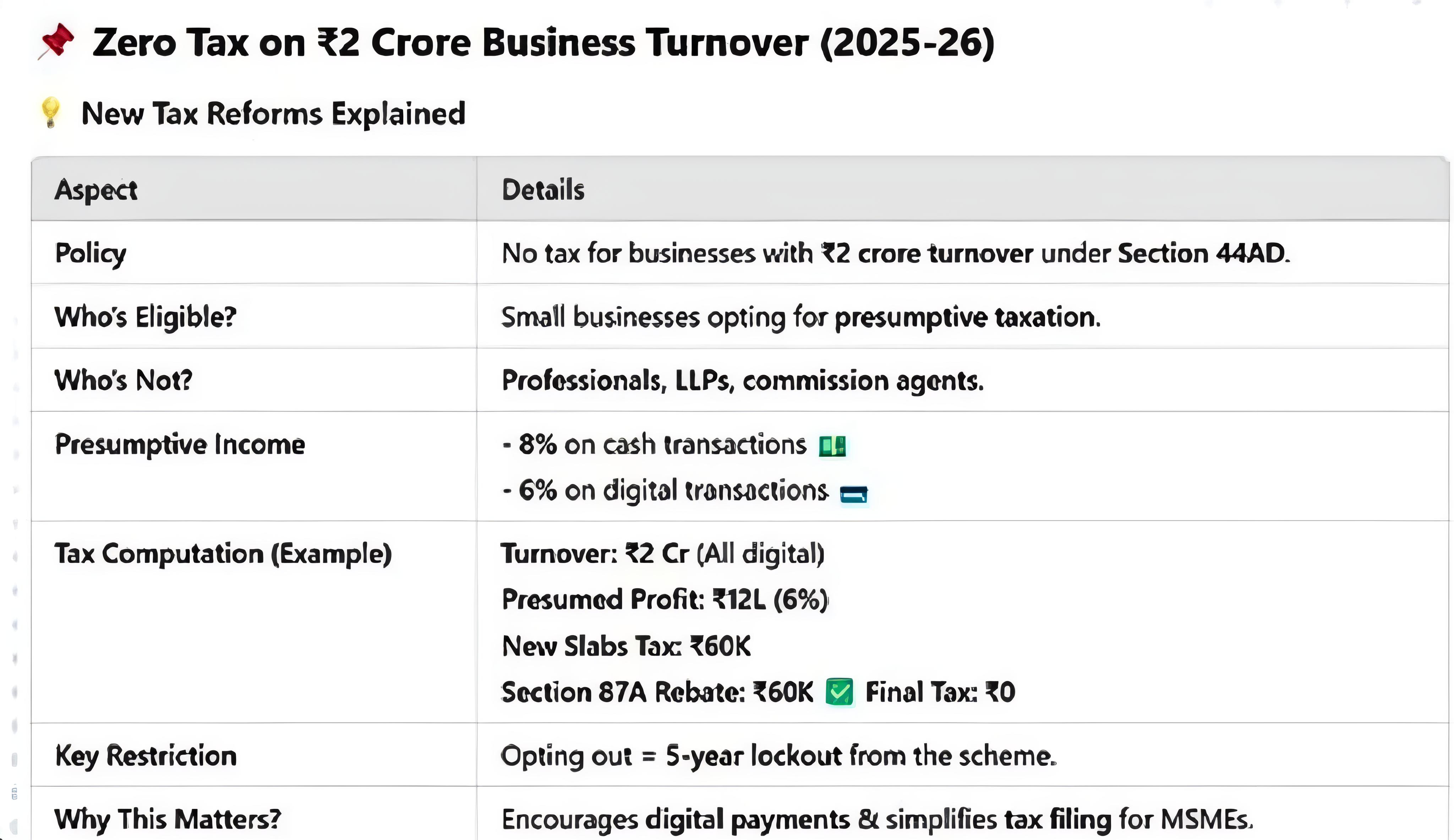

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

CA Sumit Chandwani

The New way of Compl... • 11m

Tax and Corporate Compliance have become seamless now a days with the new Virtual CFO world. Not only the Businesses have bought themselves available online, their Finance department is also now Virtually Managed. We at our firm manage our clients

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)