Back

Priyesh Pansari

Business and Managem... • 1y

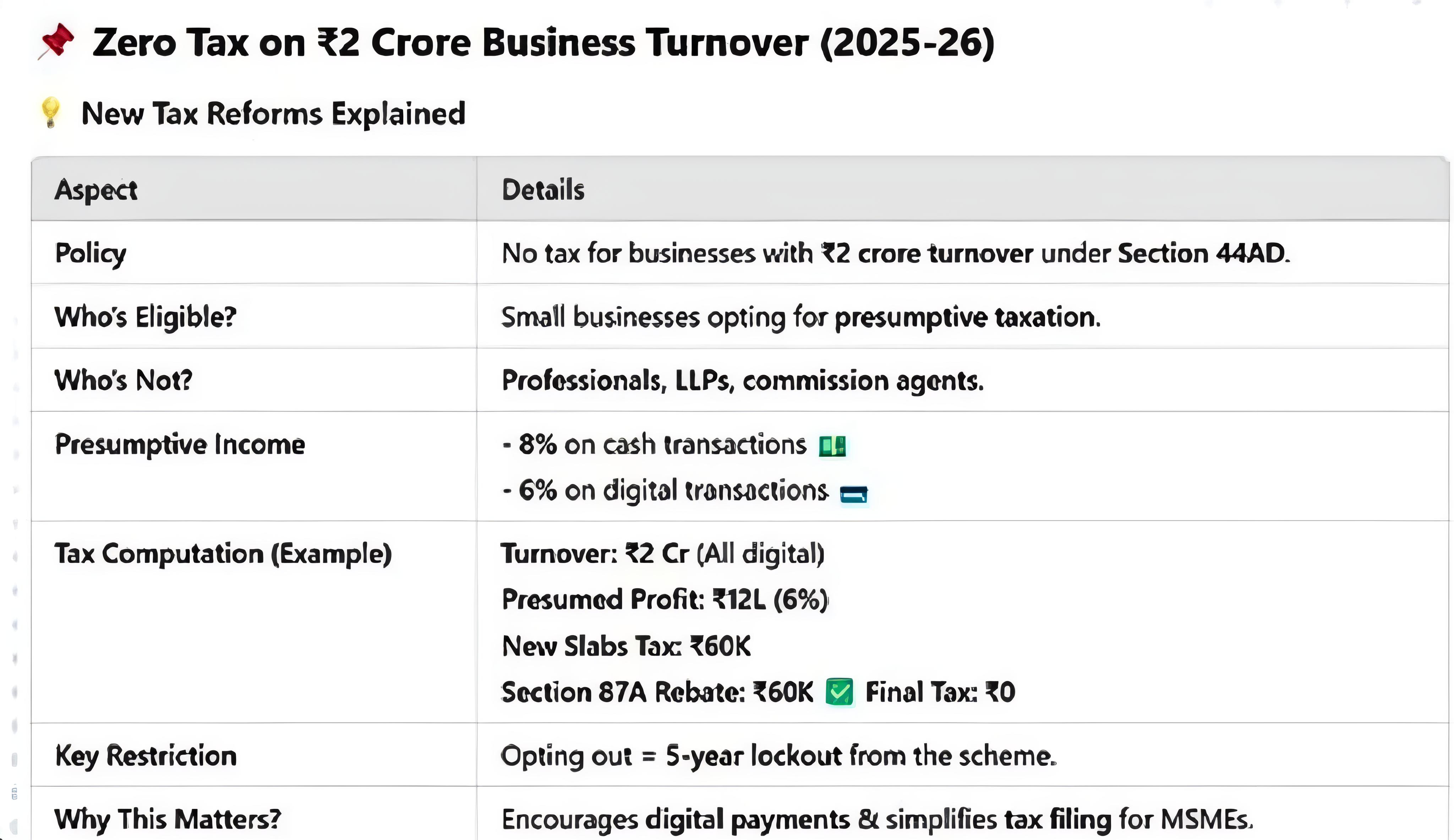

I’m thrilled to share an exciting initiative to simplify India’s complex tax system through AI-powered automation. Our platform aims to process bank statements, classify transactions, and generate tax-ready reports while ensuring compliance with regulations like GST and income tax. By leveraging natural language processing (NLP) and machine learning, our solution automates tedious processes, empowers businesses with actionable insights, and reduces manual errors. It’s designed for small businesses, accounting firms, and individuals navigating India’s challenging tax landscape. We’re seeking collaborators and feedback to refine this vision and bring it to life. Your expertise would be invaluable as we address this critical need. I’d love to explore how we could work together. Looking forward to hearing your thoughts!

Replies (13)

More like this

Recommendations from Medial

Kimiko

Startups | AI | info... • 9m

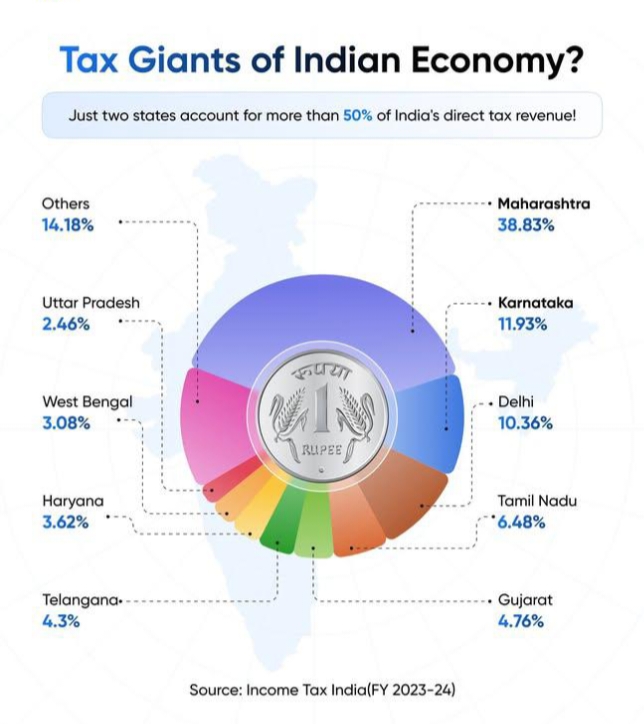

Over half of India’s direct tax revenue — from individuals, corporates, and businesses and more— comes from just two states. This revenue is the backbone funding our infrastructure, healthcare, and education. Comment below and tell us: which state do

See More

Aakash kashyap

Building JalSeva and... • 1y

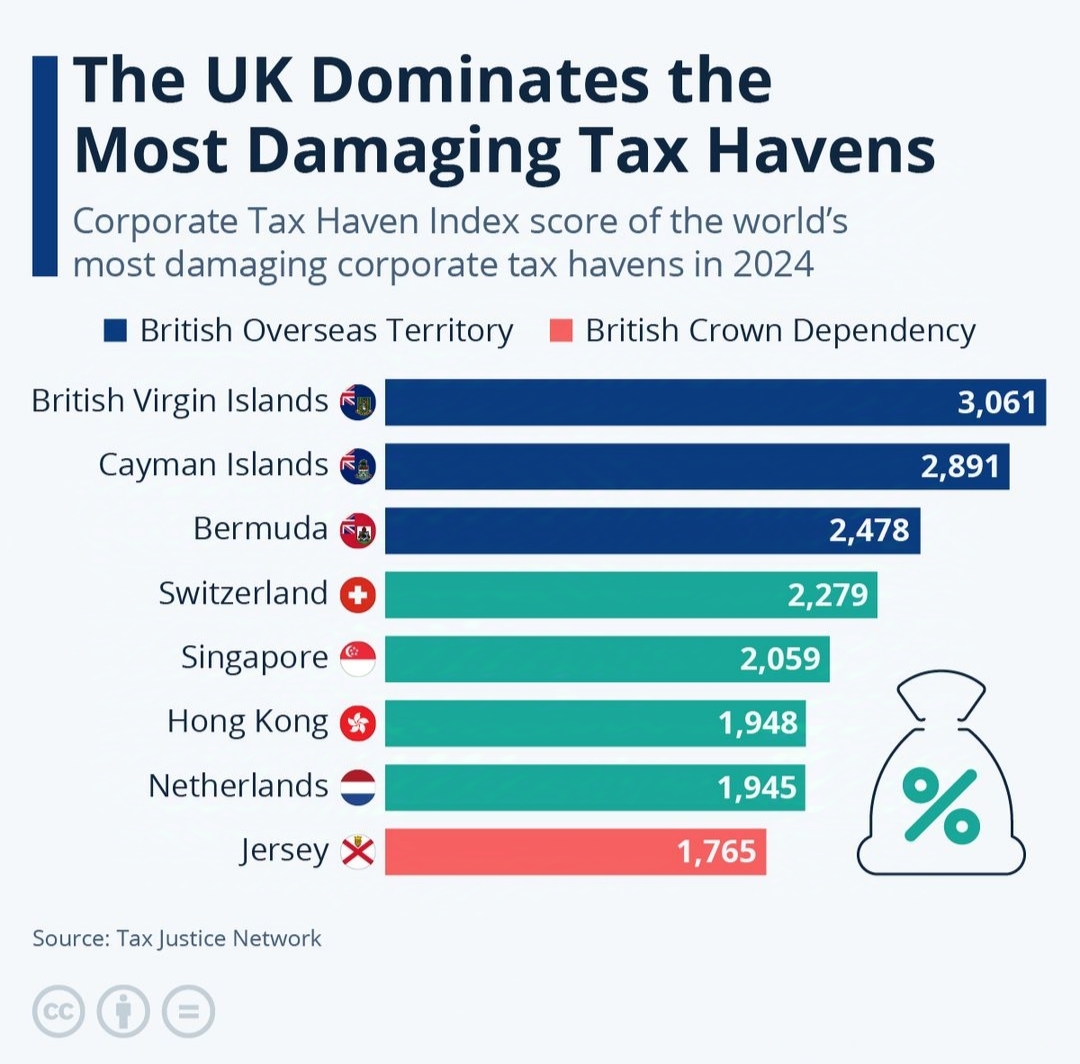

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)