Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

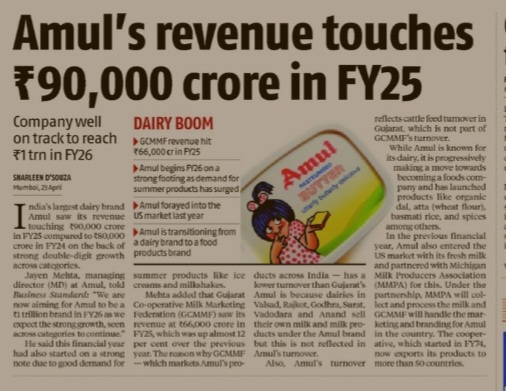

Amul sells so much cheese in India, that the none of the No.2, 3 or 4 players sell even 10% as much as Amul sells. And the dairy cooperative giant is set to push this skew further. This is really exciting! .. Amul’s gearing to bring a riot to Indian nascent cheese market. And despite the rise of several competitors over the years, it commands a massive 70-75% market share. No other player holds a double digit market share. And this is when cheese consumption is booming in the country, and when there is no dearth of powerful dairy cooperatives in India. .. And Amul doesn’t care. It’s set to expand its cheese production capacity by 55% over the next year. That’s a big investment, which will bring in even more scale, efficiency and pricing power, which driving on the top of Amul’s nightmarish deep distribution might will be a tsunami! .. Meanwhile, let’s think from the consumer’s perspective. I’m someone who probably consumes manifold higher amounts of cheese a week than the avg Indian consumes in a month. And I’ve observed over time, that when shopping at BigBasket or DMart, Britannia’s cheese and spreads are at steep discounts, while Amul’s products are never sold that way. .. I know that Britannia is anyway struggling to grow its dairy biz. But, clearly, when almost every other player except Amul is resorting to discounts, it suggests, this is not just about Amul’s deeper distribution. For many Indian families, Amul has been synonymous with dairy for generations. These habits are hard to break. Competitors need to offer something truly exceptional to disrupt that. What do you think?

Replies (9)

More like this

Recommendations from Medial

Himanshu Dodani

Start now what you j... • 10m

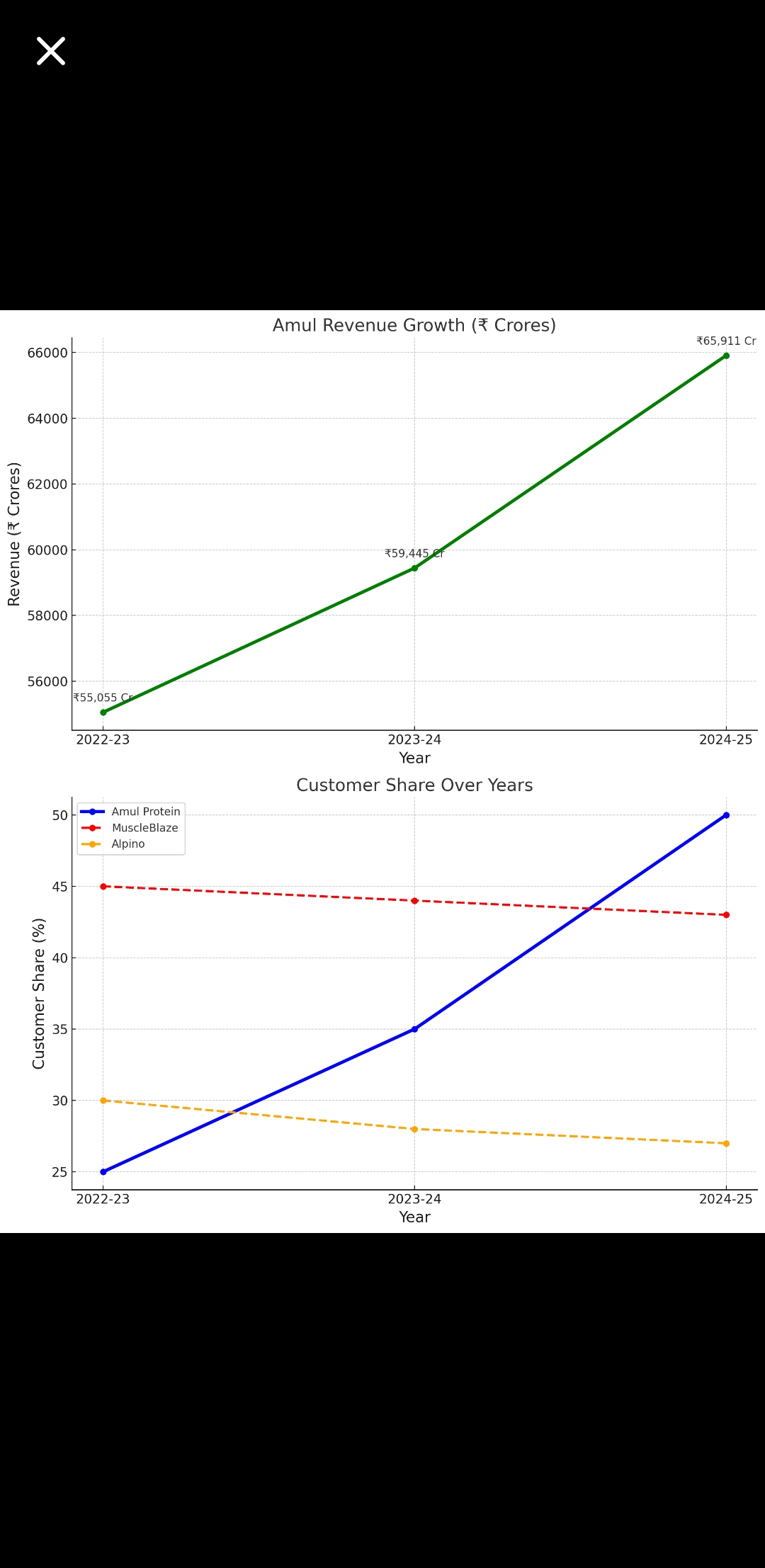

How Amul is Quietly Taking Over India's Protein Market 1.Amul has entered the ₹6,000 crore protein market with affordable, high-protein buttermilk, lassi, and shakes. Leveraging a trusted dairy brand, Amul has made protein a household essential. If

See More

Somen Das

Senior developer | b... • 1y

🌟 Proud moments! 🌟 Amul is now in the USA! 🇺🇸🥛 Amul, India’s iconic dairy brand, has teamed up with Michigan Milk Producers Association (MMPA) to bring fresh milk to the US for the first time ever! Get ready to enjoy Amul Gold, Shakti, Taaza, a

See More

Kaustubh Bhatter

Founder, Sharpener |... • 1y

Do you know: Country Delight sells milk for 2.2x the price of others, and still is capturing market share!! Country Delight should be a poster boy on how to beat big giants like Amul and Mother Dairy. I had a great time covering this story for Shar

See MoreHimanshu Dodani

Start now what you j... • 9m

I recently ordered Amul protein items, and it literally got delivered in 10 days. In today’s time, where Blinkit delivers groceries within 10 minutes, this seemed absurd. BUT here’s the catchy part — Despite the delay, people are still demanding mor

See MoreBharath Varma

Sailing the sea to g... • 1y

" Amul: From Farmers to Fridges " Amul isn't just a brand, it's a story! Forget fancy marketing, here's how a group of farmers turned their struggle into a household name: Milk Man Power! In the 1940s, farmers fought unfair prices. Amul, a coopera

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)