Back

Debroop

Doer of things. • 2y

Taking loans to repay loans is a bad idea at the outset in any case. I’m no fin expert but I’d suggest saving as much as you possibly can from your monthly income and paying off the debt before thinking of any other luxuries. If you feel the debt is too much to pay, talk to the company About your condition and get them to either a) reduce the interest rate or b) expand the tenure of the loan, thereby reducing the monthly interest

More like this

Recommendations from Medial

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreSARASHI ASSOCIATION

Hey I am on Medial • 1y

Sarashi Association Need help for startup and grow.....My aim is to provide loans to common poor business people at very low interest rates, and much lower than normal banks and finance company like half interest loans, small medical expenses loans

See MoreA Krishna chaitanya

Student at cmr in Hy... • 7m

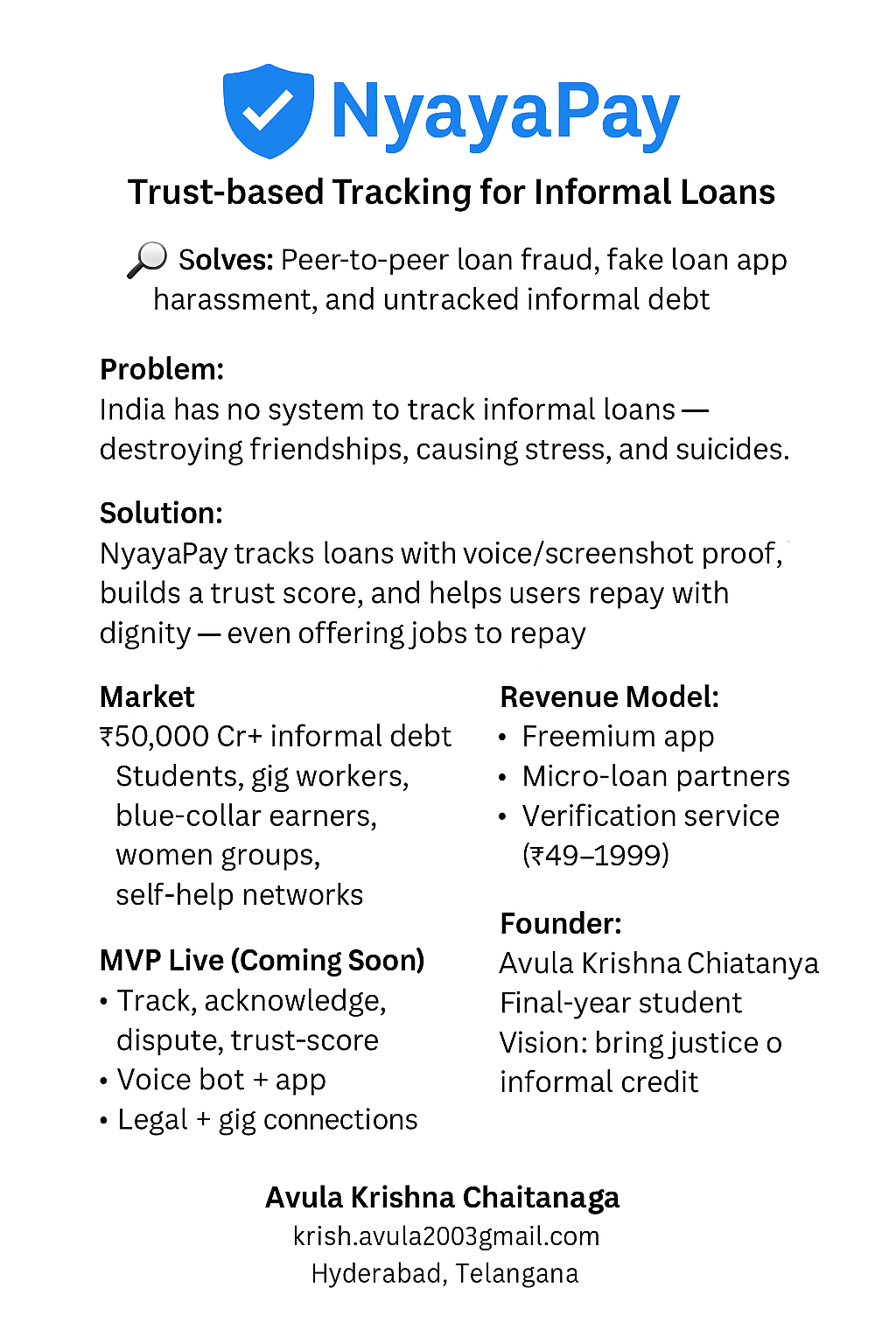

NyayaPay is a fintech idea that helps people track and manage informal loans given to friends, family, or via unregulated apps. In India, millions fall into debt traps with no proof or legal safety. NyayaPay lets users log loans, upload proof (voice

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreAnirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreShivam Malhotra

Founder of stockkhat... • 1y

Hey everyone! I'm developing a fintech app with a unique concept: offering 0% interest loans to users. While this sounds great for borrowers, I'm seeking your input on the biggest challenge - ensuring loan repayment. Here's the idea in a nutshell:

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)