Back

A Krishna chaitanya

Student at cmr in Hy... • 7m

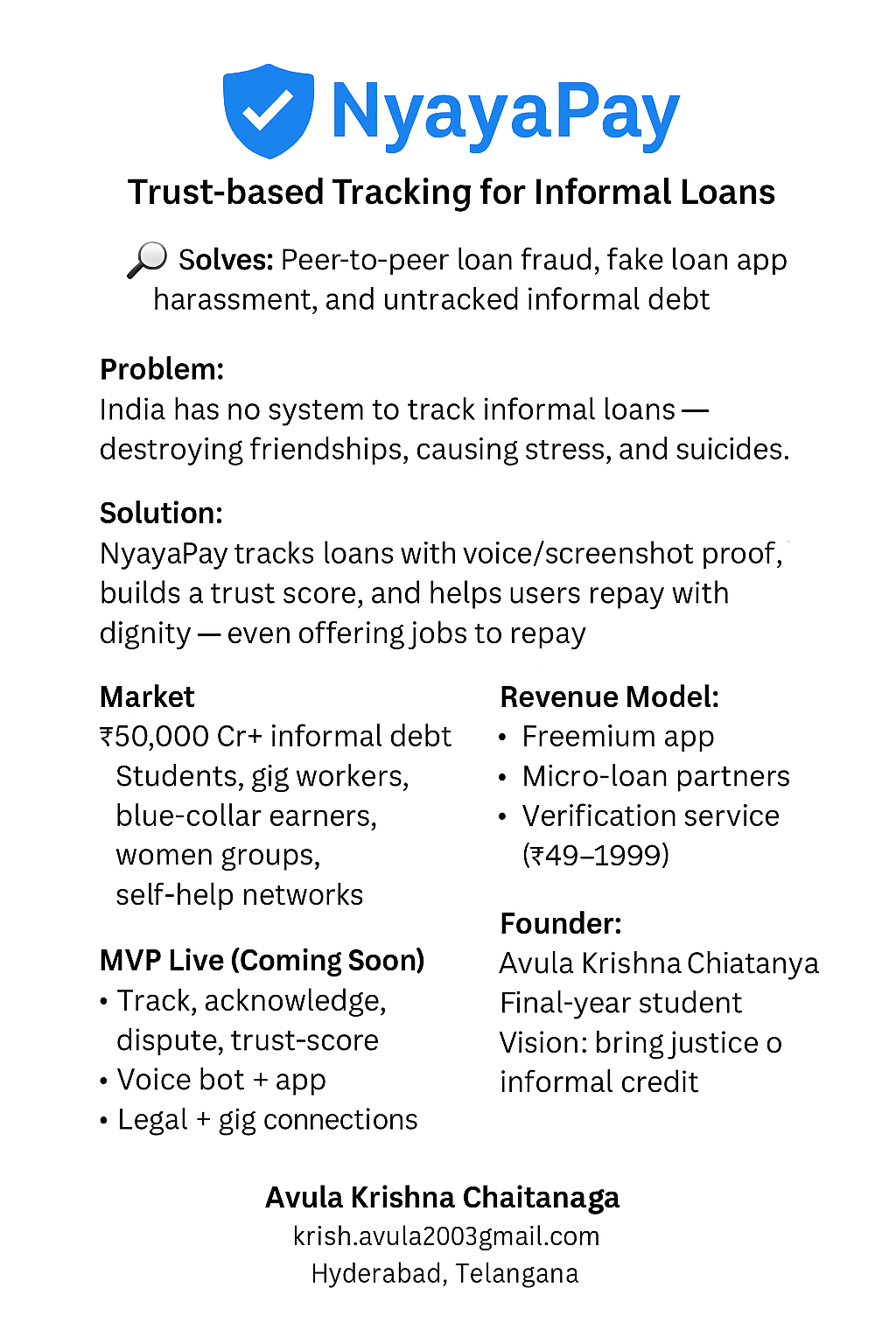

NyayaPay is a fintech idea that helps people track and manage informal loans given to friends, family, or via unregulated apps. In India, millions fall into debt traps with no proof or legal safety. NyayaPay lets users log loans, upload proof (voice or UPI), build a Trust Score, and even find jobs to work and repay. It’s designed for students, gig workers, and low-income users who need a secure, non-harassing way to deal with debt. The goal is to make informal lending transparent, safe, and respectful. We’re building a no-code MVP and seeking support to scale.

More like this

Recommendations from Medial

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreShivam Malhotra

Founder of stockkhat... • 1y

Hey everyone! I'm developing a fintech app with a unique concept: offering 0% interest loans to users. While this sounds great for borrowers, I'm seeking your input on the biggest challenge - ensuring loan repayment. Here's the idea in a nutshell:

See MoreSairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreSairaj Kadam

Student & Financial ... • 1y

I recently posted about debt financing and got some interesting responses. I want to dig a bit deeper into this topic. For those new to startups or even those with some experience, how do you feel about using debt financing? Robert Kiyosaki, from "R

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)