Back

Aman meshram

Finding business gap... • 1y

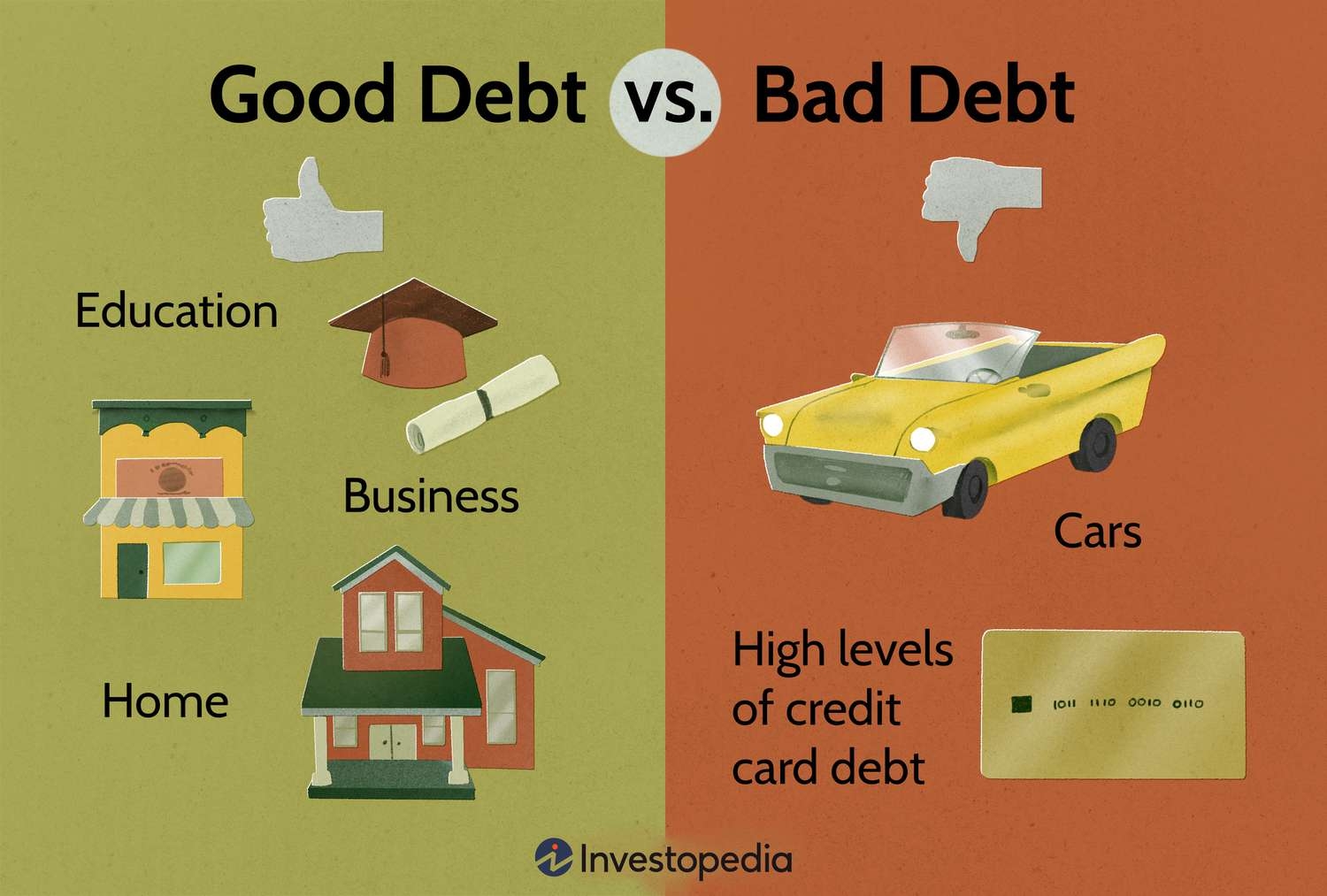

Raising indian household debt and loans for "Shauk" and not for assets creation

More like this

Recommendations from Medial

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Bharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See MoreRohan Saha

Founder - Burn Inves... • 1y

The RBI is increasingly cracking down on unsecured lending. The NPAs (Non-Performing Assets) of unsecured loans are also increasing rapidly. Companies that used to provide loans against salaries are now changing their business models. The NPAs of MSM

See MoreAccount Deleted

Hey I am on Medial • 1y

Let's decode one pattern : • Companies were backed by Softbank such as OYO, OLA Electric and FirstCry are continuously filing for IPO but some IPO's approved or some failed for IPO. • Startups backed by Softbank such as OLA Electric and OYO are ra

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

Decline in India's Household Savings Net household savings in India declined to a 47-year low of 5.1% of gross domestic product in FY23, compared to 7.2% in the previous year. The finance ministry attributes this to changing consumer preferences for

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Account Deleted

Hey I am on Medial • 1y

I have made some analysis on Recent trends and hope you guys like it 🤩 🚀 💯 • In 2024, most startups are focusing on profits because they are aiming for an initial public offering (IPO). The winter funding round hit startups very badly, and there

See More

Sairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)