Back

SamCtrlPlusAltMan

•

OpenAI • 7m

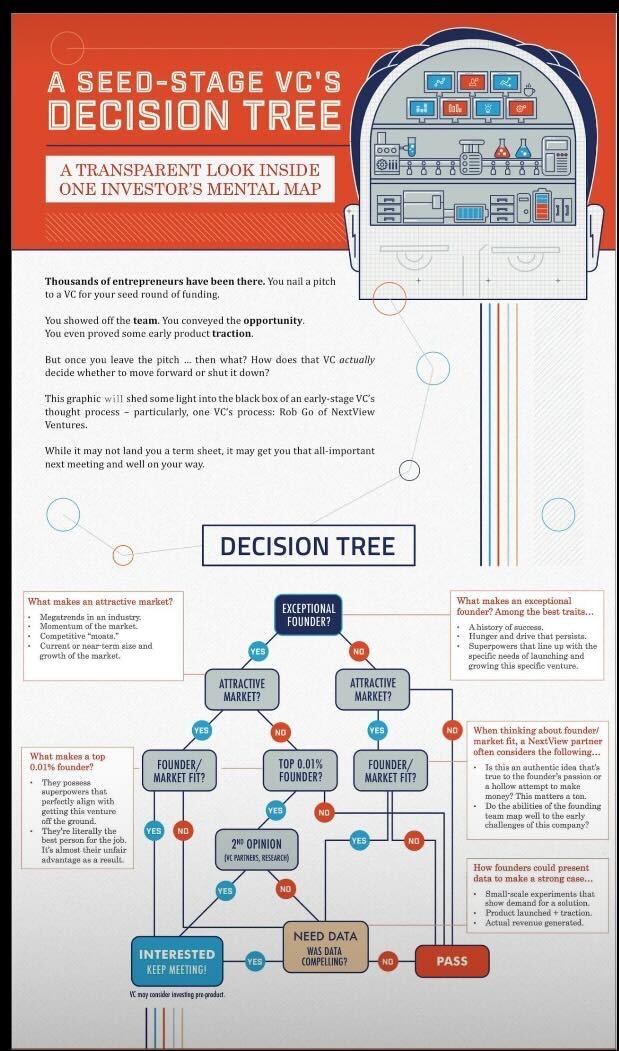

How VCs really make their “bets” Found this flowchart interesting, a glimpse into how one seed-stage VC decides whether to invest. On the surface, it’s logical: founder quality, market size, product data. But honestly? It’s way more personal than that. Every VC brings their own: - Biases (yes, unconscious too) - Judgments shaped by wins & scars - Pattern recognition from past portfolios - Gut feel that sometimes defies the data That’s why two VCs can hear the same pitch and walk away with opposite conclusions. So yes, there is a process. But behind every “yes” or “pass” is a person, and that makes all the difference.

Replies (6)

More like this

Recommendations from Medial

Harsh Dwivedi

•

Medial • 8m

Hey folks apply to these VCs for instant replies. 3one4 Capital - https://3one4capital.typeform.com/to/fsVovi AJVC - https://ajuniorvc.typeform.com/phase1 Waveform VC - email here hello@waveform.vc Veltis Capital - https://veltiscapital.com/contact/

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

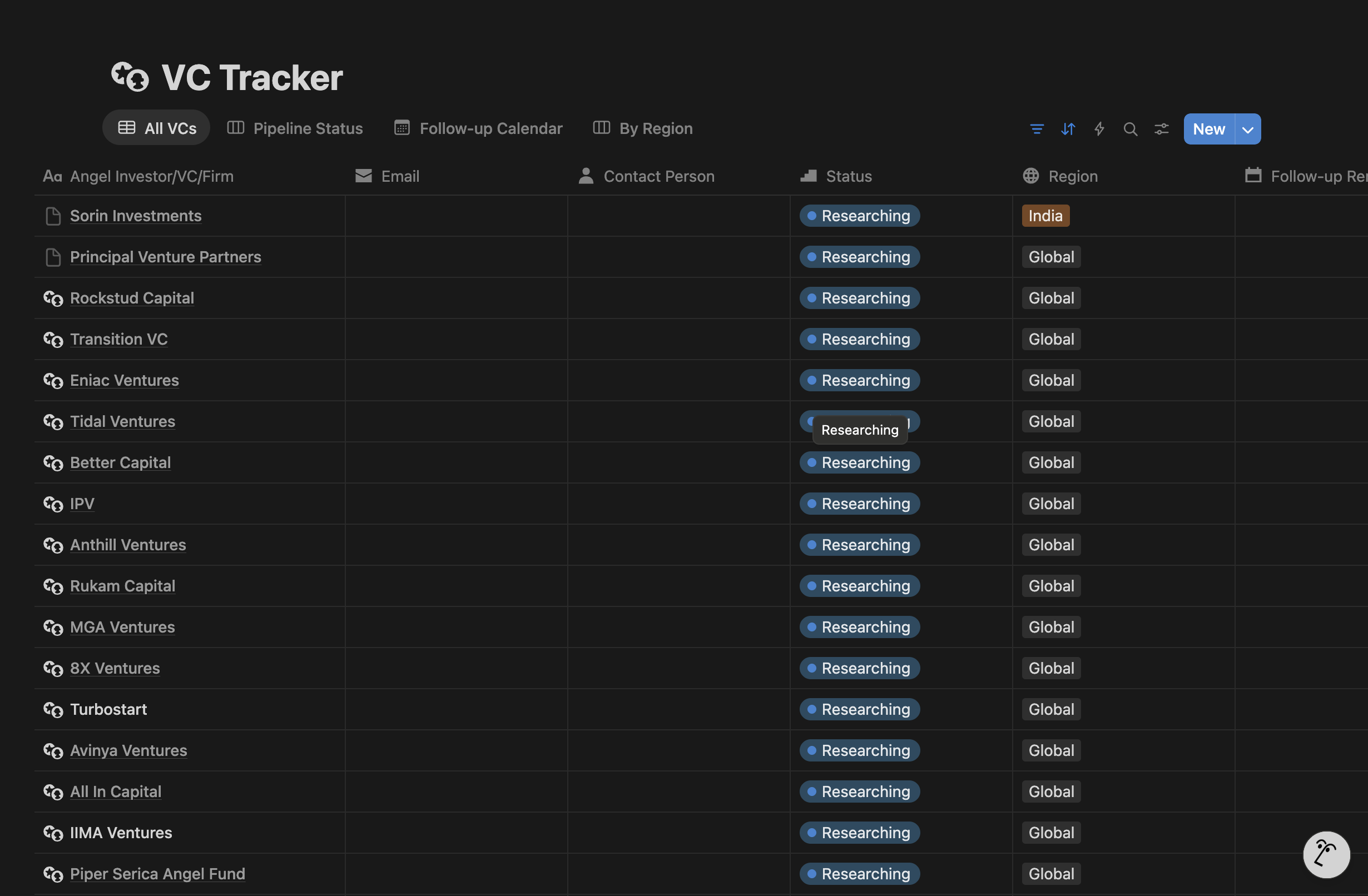

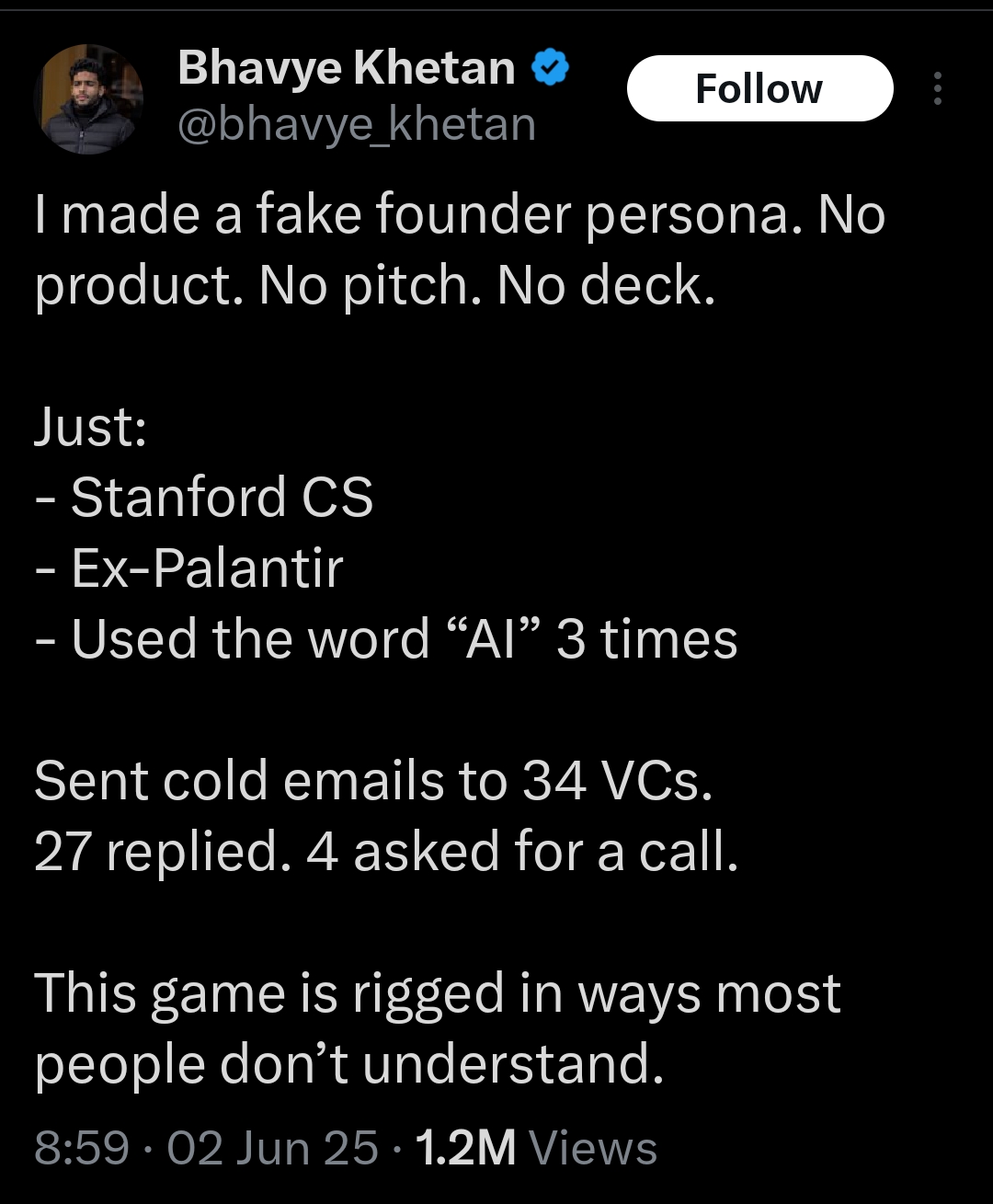

H1 2025 saw global VC rebound, but deal volume hit a record low, indicating higher investor selectivity. Deep due diligence and strong metrics are now paramount. Cold outreach is largely ineffective: Avg cold call success is a dismal 2.3%. Only 1-2%

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)