Back

Saket Sambhav

•

ADJUVA LEGAL® • 9m

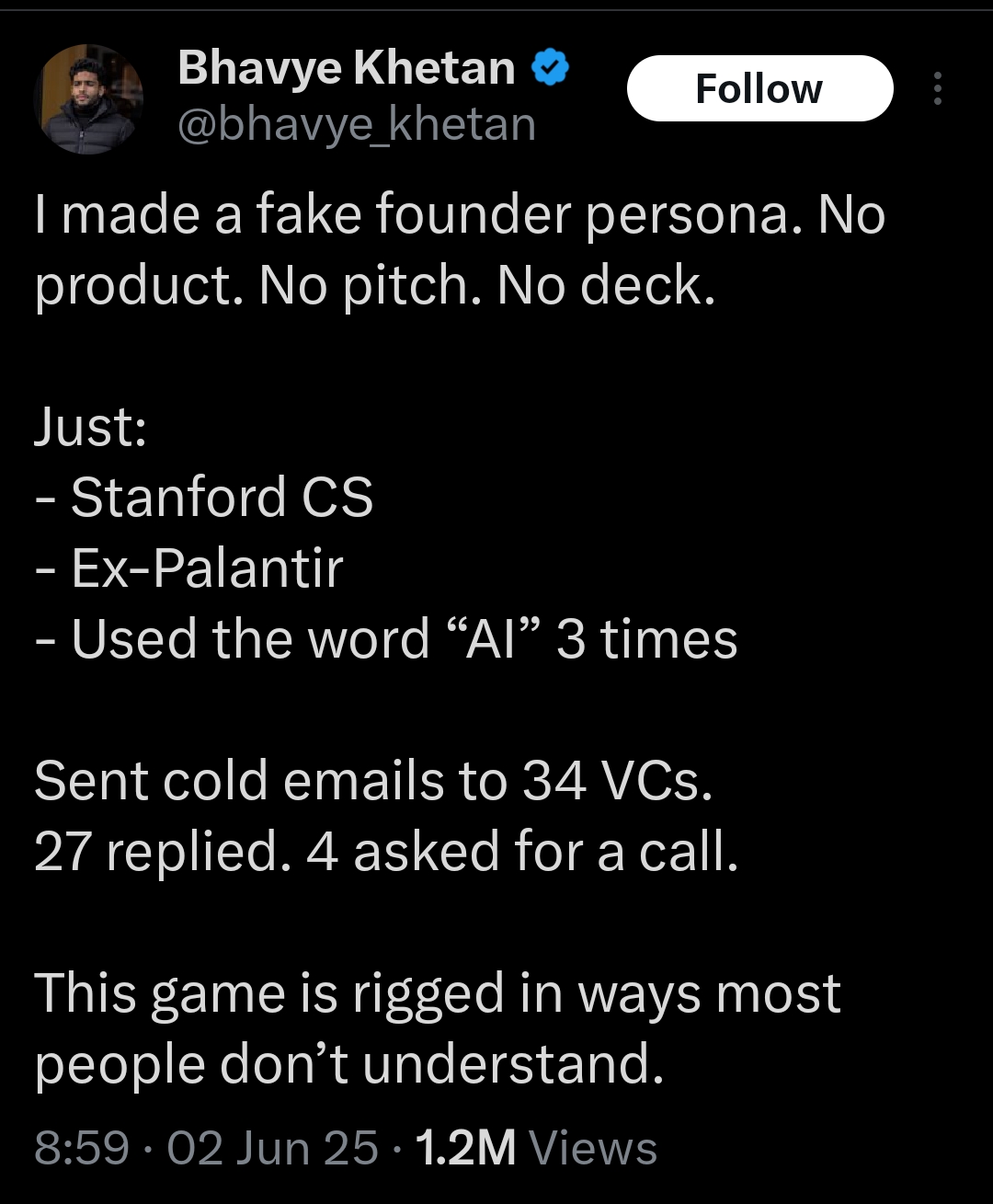

🚨 Is the VC Game Rigged? A Social Experiment Exposes the Truth! 🚀 I came across a wild experiment by @bhavye_khetan on X (Twitter) that’s got me thinking. He created a FAKE FOUNDER persona with: Stanford CS background 🎓 Ex-Palantir experience 💼 Mentioned “AI” 3 times 🤖 No product, no pitch, no deck - just a cold email sent to 34 VCs. Guess what? 27 replied, and 4 even asked for a call! 😳 This exposes a harsh reality: VCs often prioritise pedigree and buzzwords over real substance. A 2023 study by the National Bureau of Economic Research backs this up - VCs are 30% more likely to engage with founders from elite schools, even with identical pitches. Meanwhile, a 2024 Crunchbase report shows cold email success rates are usually just 1.7%. The difference? ELITE CREDENTIALS and TRENDY TERMS like "AI" play into VCs' biases. What does this mean for founders without fancy logos on their pitch stuck in a system that rewards privilege over innovation? Let’s discuss! 👇

Replies (2)

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)