Back

Priyank

•

Money • 8m

Unpopular Opinion: If you have zero traction, don’t pitch VCs yet. You know what I see too often? Founders sending decks before they’ve even tested the idea. Here’s the blunt truth: 💡 VCs don’t fund ideas. They fund signals. And “signal” doesn’t mean revenue. It could be: - 100 waitlist signups in 7 days - 5 cold DMs turning into demo calls - Users coming back without reminders or something else That’s traction. That’s momentum. So if you're at zero, stop pitching. Start validating. Should I do a post breaking down traction levels VCs actually look for? Drop a “Yes” in the comments.

Replies (22)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 10m

Raising VC Money? Tips No One Tells You : 1) Don’t Chase VCs, Attract Them - Build something so good they can’t ignore you. 2) Traction > Decks - Fancy pitch decks don’t matter if your numbers don’t add up. 3) Investors Follow Other Investors - G

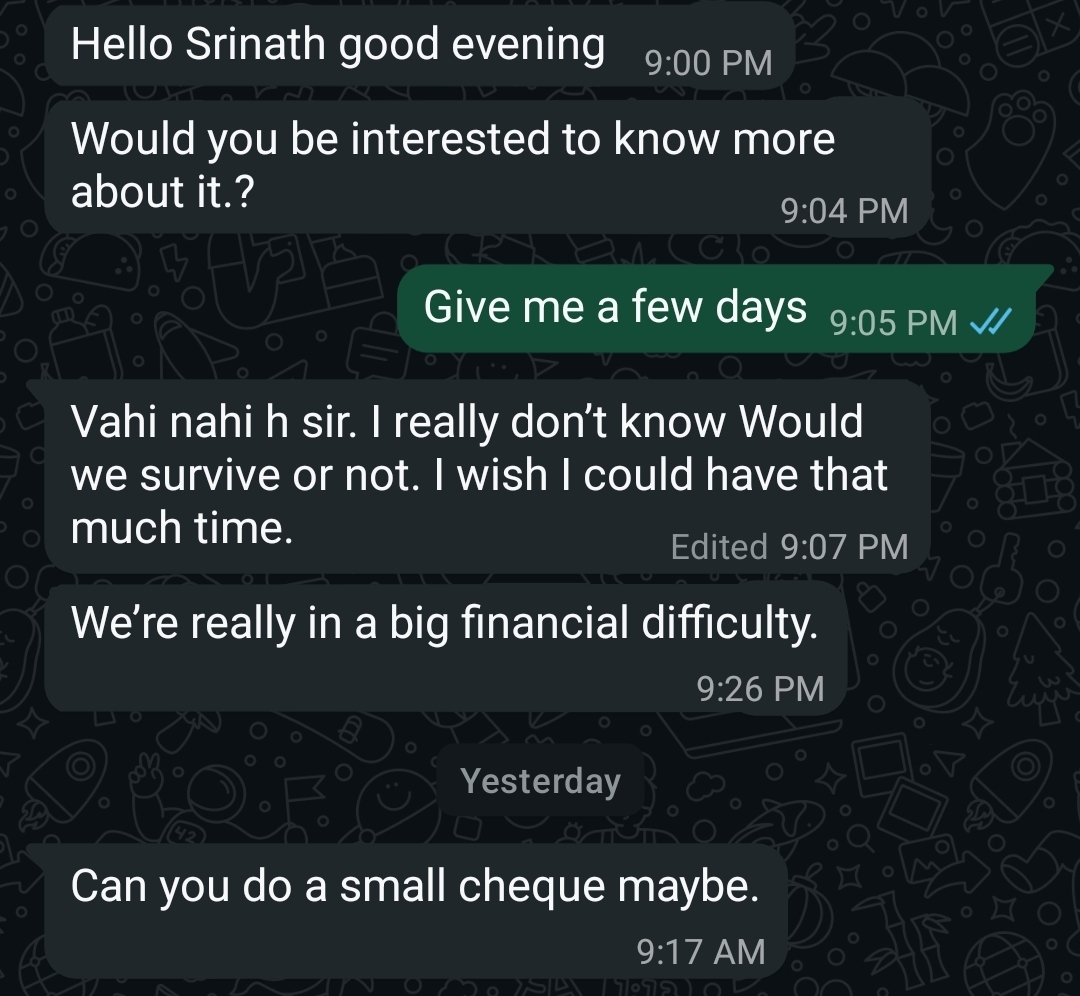

See MoreShrrinath Navghane

•

NexLabs • 2m

Founders - please stop doing this. I'm not a VC yet but even to me this screams desperate and a red flag. Nobody writes a cheque without validating the idea or seeing traction, team, roadmap etc. Ideally you should start fund raising even before yo

See More

Ayush

Let's build together... • 11m

Was talking to a founder few days back. Had a healthy talk and there was a line that deeply resonated in me - "VCs don’t fund ideas. They fund inevitabilities. Make your startup something the world can’t ignore." Niket Raj Dwivedi, you are the bes

See MoreRohan chavan

Strategic AI integra... • 2m

“Customers don’t say ‘your process is slow’ — they silently switch.” ⚠️⏳ They don’t complain. They don’t warn you. They don’t give feedback forms a second look. They just… disappear. Think about your own behavior. When a company takes too long to

See More

Anshu Katheria

Founder/CEO - Suprem... • 4m

“Just because you feel like sht doesn’t mean you have to act like sht.” I read that somewhere years ago, and it’s been stuck in my head ever since. It’s what I tell myself on the days I don’t feel like showing up. See, people romanticize this whole

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)