Back

Anonymous 5

Hey I am on Medial • 7m

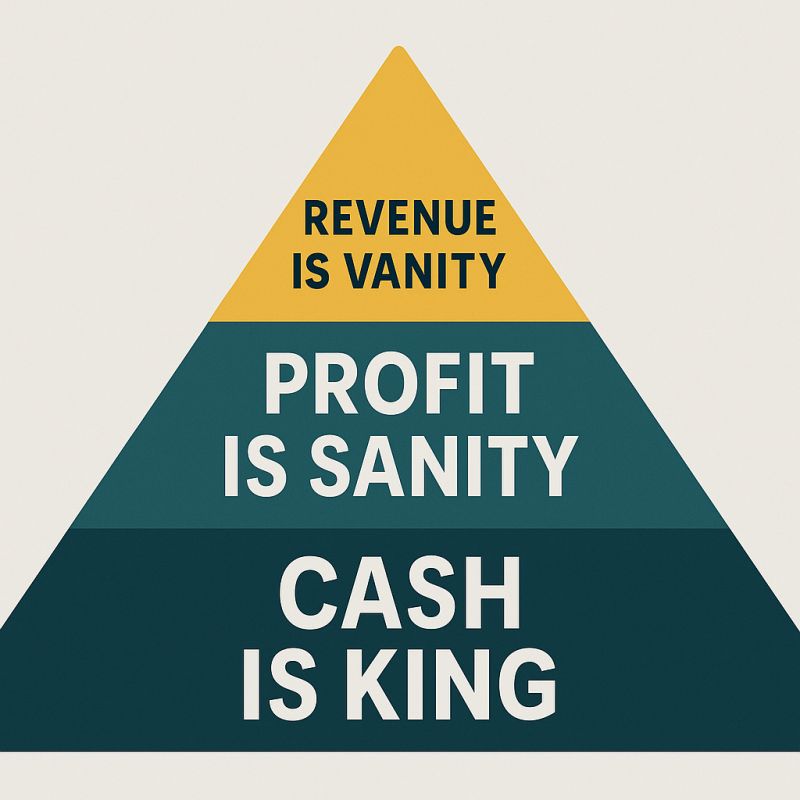

Bro asking for equity in a ₹2L business without actual cash flow is like asking for beachfront land on the moon. Build the site, get paid. Equity later.

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 2m

Before You Raise Money, Decide What Kind of Company You Want to Build Founders often chase capital without asking the real question: What type of funding actually matches your strategy? Because equity, debt, and hybrid instruments don’t just finance

See More

Karnivesh

Simplifying finance.... • 1m

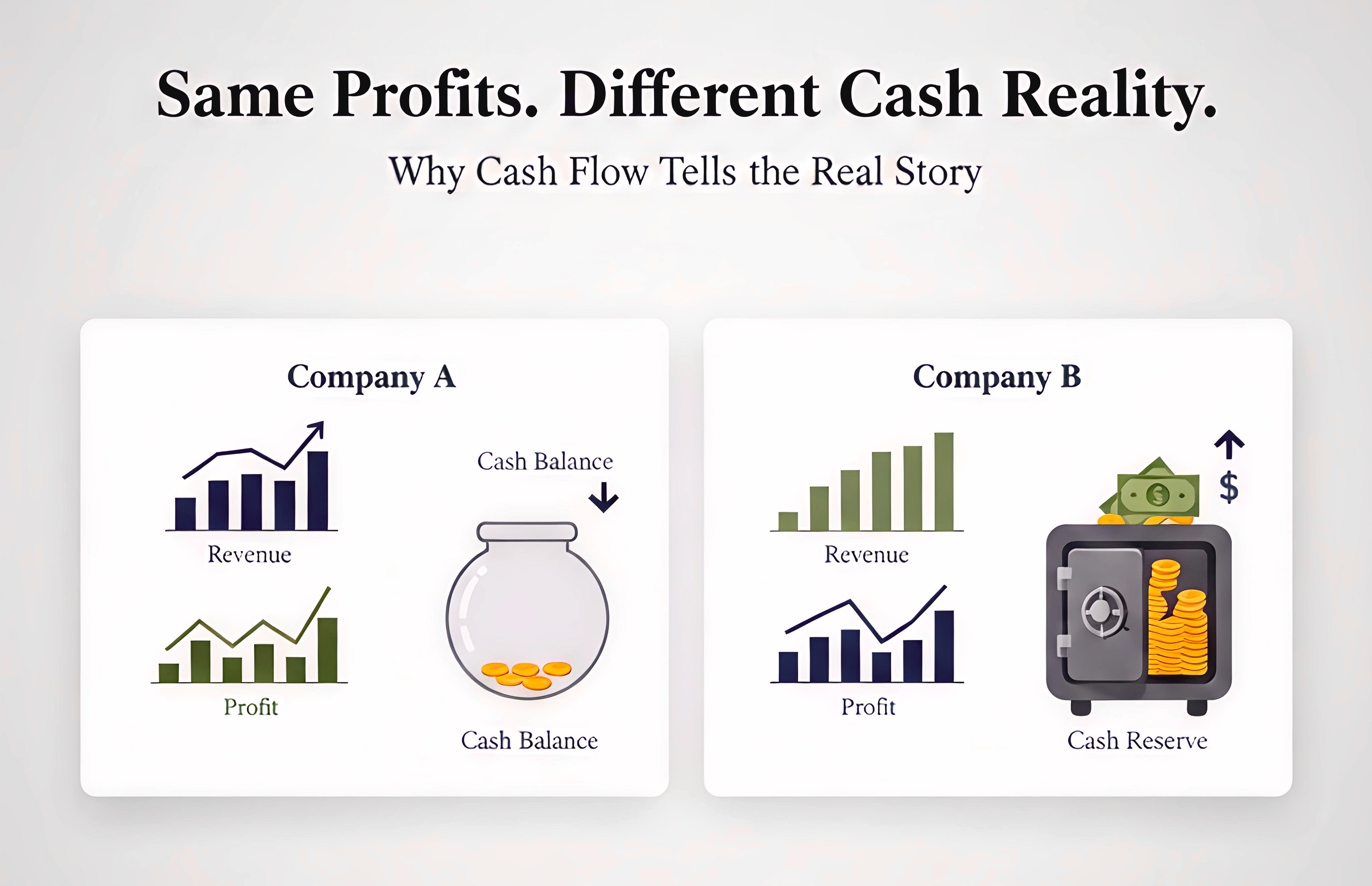

Two companies can report the same profit. Yet one constantly struggles with cash, while the other quietly builds a buffer. This used to confuse me until I started paying attention to how cash actually moves. Some businesses collect money quickly an

See More

Vansh Khandelwal

Full Stack Web Devel... • 3m

Tapzo, once an ambitious all-in-one app, failed from frequent pivots that eroded trust and an unclear value proposition; persistent negative cash flow and inability to raise follow-on funding; neglect of customer feedback and prioritizing fame over u

See MoreSanskar

Keen Learner and Exp... • 11m

Complicated Business Terms Simplified PART 2 1️⃣ Equity: 📌 The owner’s share in a company after subtracting liabilities from assets. 2️⃣ Cash Flow: 📌 The actual movement of money in and out of a business, crucial for daily operations. 3️⃣ Reven

See More

Omkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreVivek Joshi

Director & CEO @ Exc... • 2m

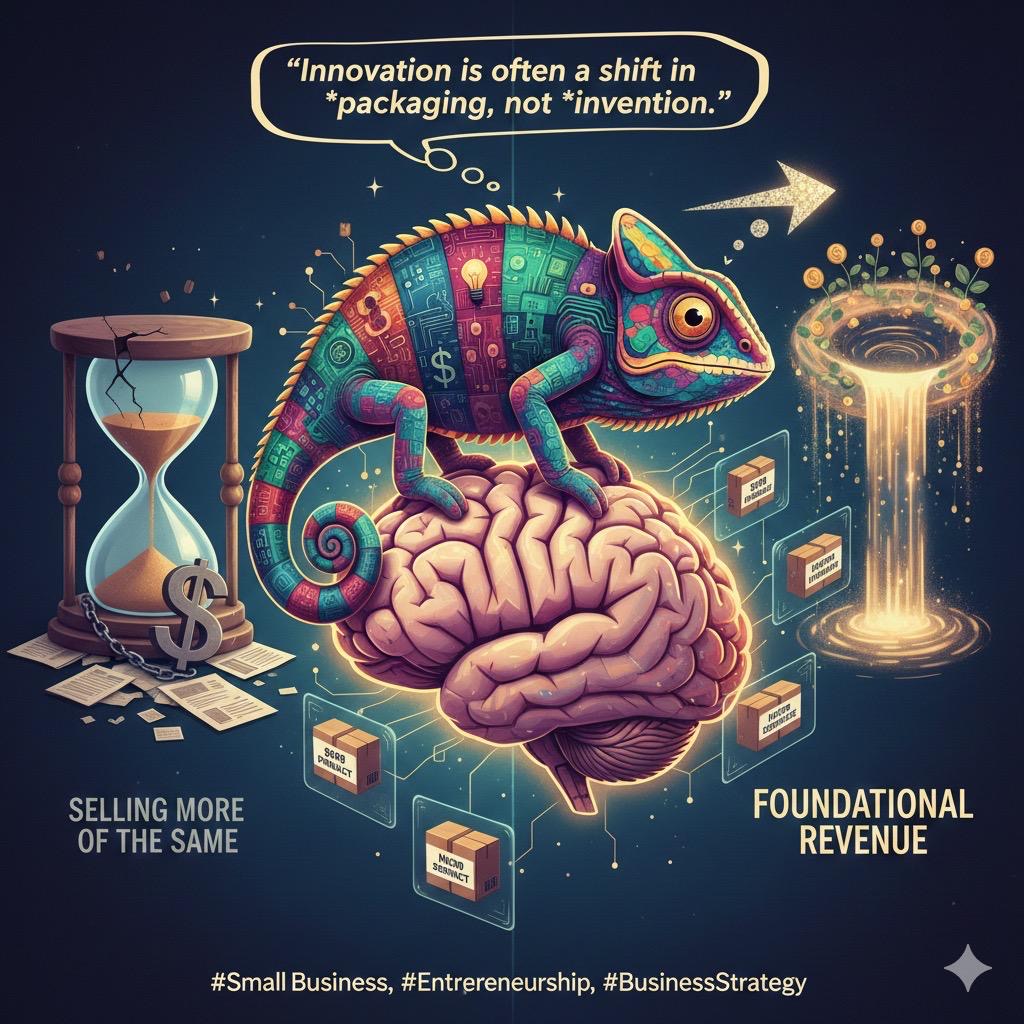

The Pivot Power Play Struggling? Your business model isn't broken—it might just be stale. Instead of trying to sell more of the same (which burns cash), shift your focus to what you already have: your expertise. * Stop: Trying to land the next $5,00

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)