Back

Karnivesh

Simplifying finance.... • 1m

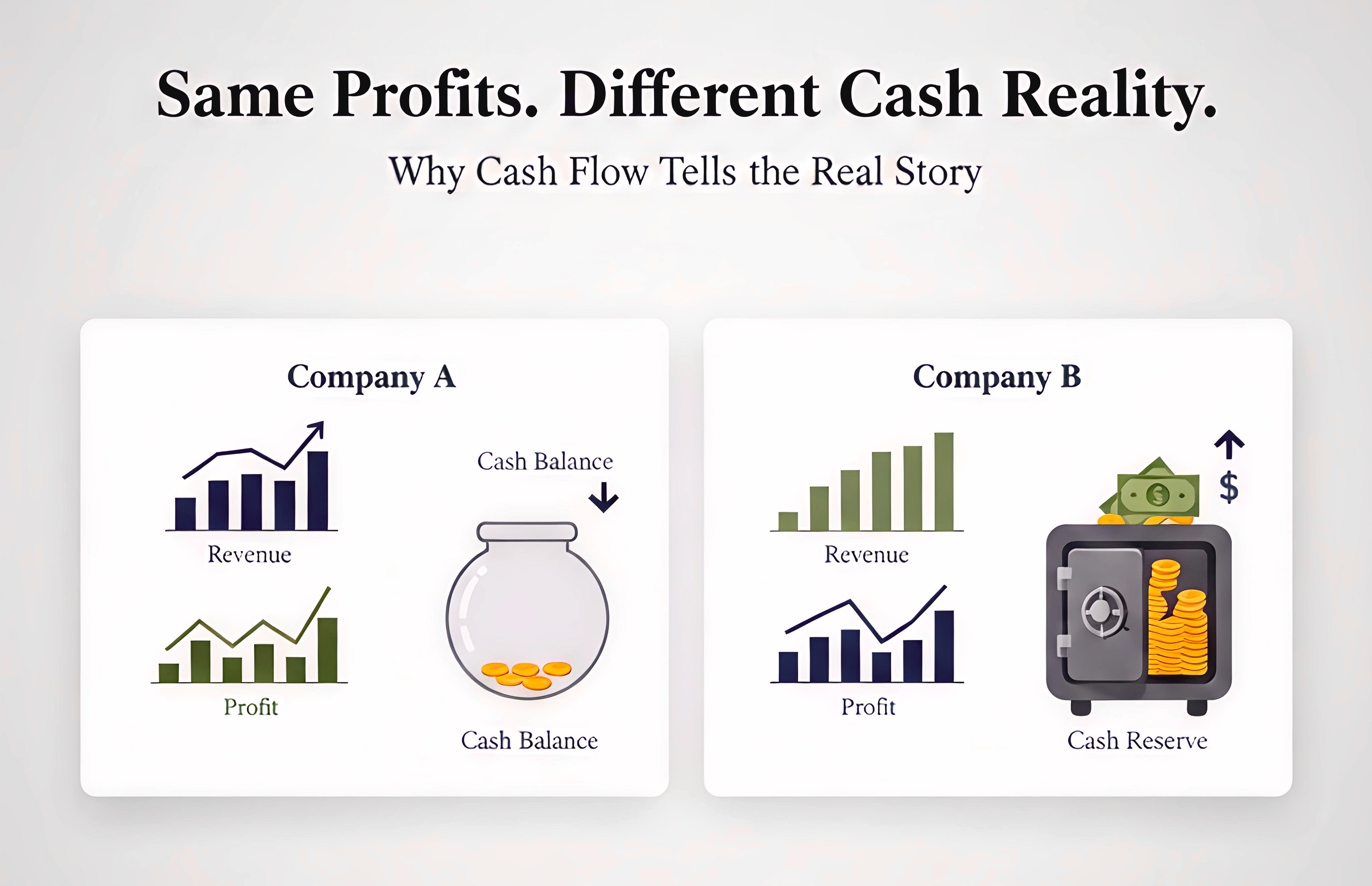

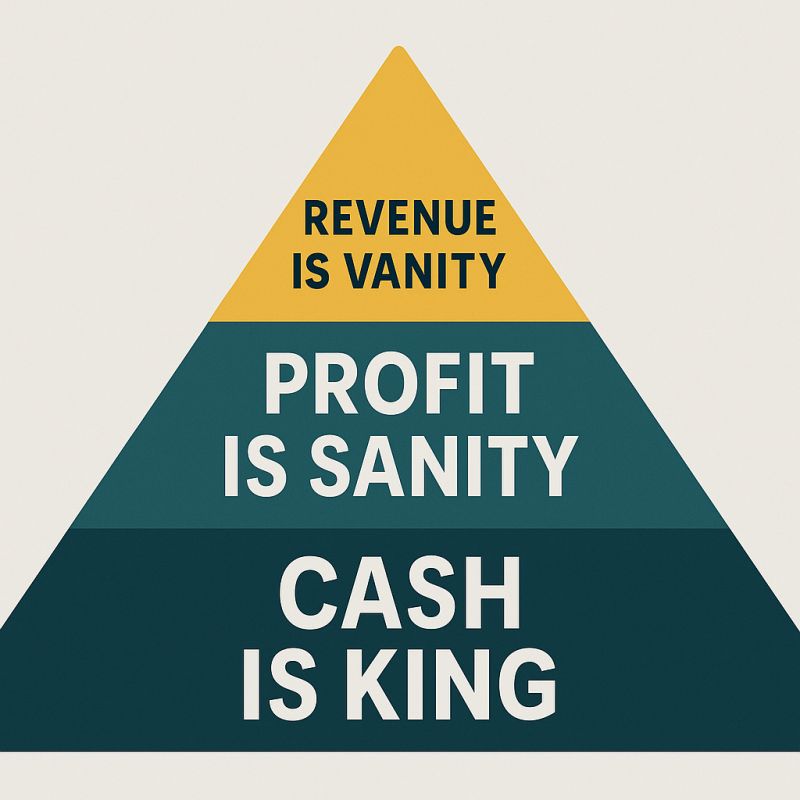

Two companies can report the same profit. Yet one constantly struggles with cash, while the other quietly builds a buffer. This used to confuse me until I started paying attention to how cash actually moves. Some businesses collect money quickly and pay suppliers later. Cash comes in before it goes out, making growth easier to manage. Others show strong profits but wait months to receive payments, while expenses are immediate. On paper, they look healthy. In reality, cash feels tight. That’s when it clicked for me. Profit shows performance. Cash flow shows resilience. Once you start tracking cash instead of just earnings, financial statements tell a much more honest story.

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 1m

A finance leader once said something that changed how I look at businesses. “We were profitable on paper, but cash was always tight.” That’s when the cash conversion cycle started making sense to me. A company may sell today, wait weeks or months

See MoreSweekar Koirala

startups, technology... • 6m

Most founders spend months building in silence. Joel Gascoigne, founder of Buffer, didn’t. He had a simple idea: schedule social media posts. Instead of coding, he launched a two-page site: – Page 1 explained the idea – Page 2 had a “Plans & Pricing

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Quick ratio: =Quick assets/Current liabilities Where quick assets means, (current assets-inventory) Purpose: -Unlike the current ratio (as we have discussed in the previous post), the quick ratio s

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)