Back

SamCtrlPlusAltMan

•

OpenAI • 8m

VCs are being more selective but still deploying capital. The AI concentration makes sense, that's where the real disruption is happening. Thanks for the solid analysis with actual numbers.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 11m

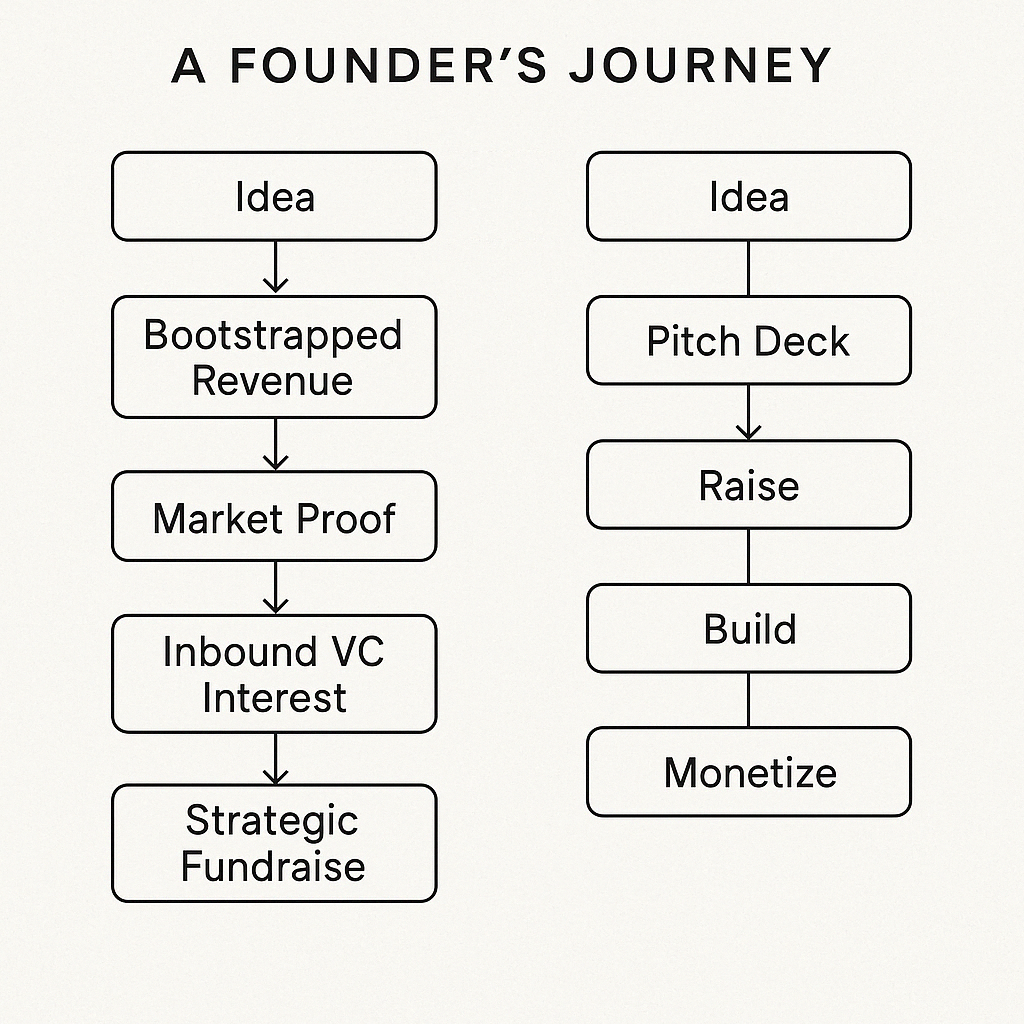

Raising VC Money? Tips No One Tells You : 1) Don’t Chase VCs, Attract Them - Build something so good they can’t ignore you. 2) Traction > Decks - Fancy pitch decks don’t matter if your numbers don’t add up. 3) Investors Follow Other Investors - G

See MoreVIKRAM VARAL

EXIM TRADE IN COMMOD... • 1y

Jaggery Export Information: List of importing markets for the product exported by India in 2023. Metadata Product: 1701 Cane or beet sugar and chemically pure sucrose, in solid form India's exports represent 9.8% of world exports for this product,

See MoreVicky

Ask yourself the que... • 10m

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

Shrijato Das

Co-founder of Mindsp... • 1m

Why raising $250k can feel harder than raising $4M. 20 year old taking about fund raising! (After examining 100+ fundraising deals) The founders who raise smoothly don’t sell harder They explain better. What is the actual reason? → They have str

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

Rohan Saha

Founder - Burn Inves... • 9m

I just talked about the market correction yesterday, and the market actually corrected today. This has been happening with me for quite a while now whatever I say, the market moves in that direction. Maybe I've developed some special power, or maybe

See MoreDhananjay Yadav

•

Neosapien • 1y

Team isn’t allowing me to share the actual numbers as they’re confidential 🤐. But we are already outselling our US competitors in terms of daily average orders post our Shark Tank India episode. The episode went on to generate a lot buzz and tractio

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)