Back

Account Deleted

Hey I am on Medial • 8m

May slowed down. Deal value dropped to $22.5B, down from $25.8B in April. That’s also around 34% lower than May last year. But YTD still ahead - $161.5B raised so far compared to $129.5B by this time in 2024. So there’s movement.. just more cautious. 1) What stood out: •TMT(tech/media/telecom) continues to lead - $7.4B raised across 373 deals •Application software was the busiest subsector with 193 rounds 2) Mega-rounds haven’t stopped: •Acrisure - $2.1B (Bain Capital) •HUB International - $1.6B •Grammarly - $1B from General Catalyst 3) Accel and Khosla were two of the most active firms - each jumped into 12 deals in May 4) Some serious capital still chasing AI and infrastructure bets But overall: •LPs and GPs are pacing their moves •AI’s still hot, but most of the cash is flowing into the top 1% •Corporate VCs are still active - driving nearly half the global deal value so far this year Feels like AI’s soaking up all the attention while the rest of the market stays quiet.

Replies (4)

More like this

Recommendations from Medial

Rajan Paswan

Building for idea gu... • 1y

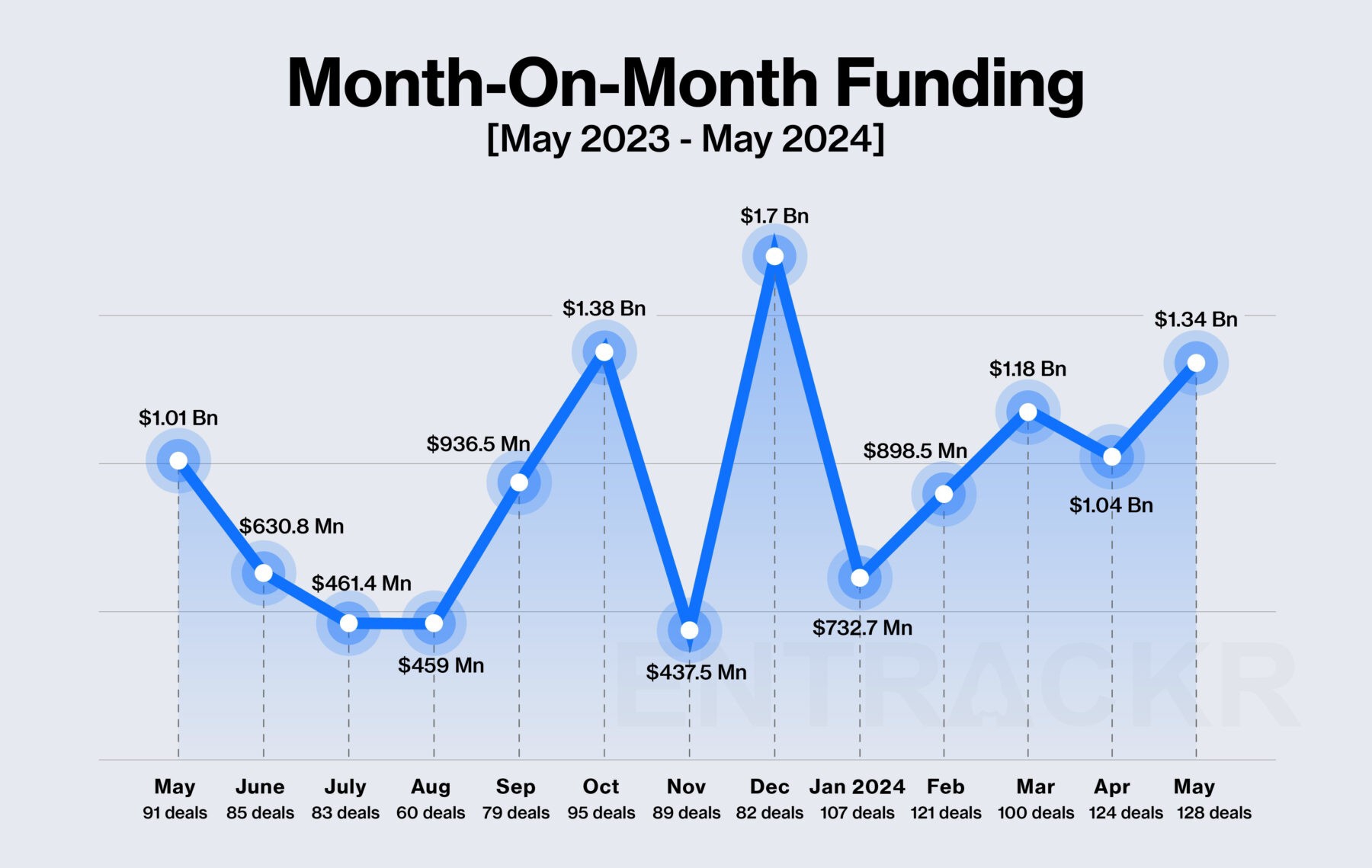

May 2024: A Landmark Month for Indian Startup Funding! In May 2024, the Indian startup ecosystem witnessed a significant surge in funding, raising $1.3 billion, the highest monthly total this year. This growth was driven by several large deals, incl

See More

Linkrcap Studio

A digital news platf... • 6d

Indian startup funding stood at $200.2 Mn across 31 deals, up 42% from the preceding week. Between February 16 and 20, 16 startups collectively raised $118.3 Mn a sharp 69% drop from the $200.2 Mn secured across 31 deals in the preceding week. Peak

See More

Venture Linkup

Where Businesses Con... • 10m

Between April 7 and 12, Indian startups collectively secured $195.1 million across 20 funding deals, reflecting a 35% increase from the $144.4 million raised by 22 startups the previous week. While fintech emerged as the top-funded sector, it was ec

See MoreAditya Aryan

Co-Founder @Nomadiq • 6m

Marriages may happen in 10 minutes, groceries may arrive in 10 minutes… but the best flight deals? That takes a little longer. 😉 At Nomadiq, we don’t promise speed — we promise savings. Because finding the lowest ticket price is worth the wait. ✈️ #

See More

Account Deleted

Hey I am on Medial • 10m

Between March 31 and April 5, Indian startups brought in a total of $144.4 million across 22 deals. That’s just a slight bump around 0.5% - compared to the $143.7 million raised by 16 startups the week before. Among the investors, Peak XV Partners, Y

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)