Back

More like this

Recommendations from Medial

Suman solopreneur

Exploring peace of m... • 1y

The Polgar sisters' success wasn't due to talent but a culture of obsession with chess. Their upbringing shows how deeply our habits are shaped by the environment and social norms. Choose your surroundings wisely, and your success will follow natural

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Account Deleted

Hey I am on Medial • 11m

You always hear about startups failing, but no one talks about VC funds going under. It happens more often than you think. Most fail because they chase hype instead of solid businesses, burn through capital without a follow-on strategy, or simply get

See MoreMehul Fanawala

•

The Clueless Company • 1y

Is it better to bootstrap or seek VC funding for your startup? The endless debate: Bootstrap vs. VC funding. - Bootstrapping builds resilience and deep customer focus. You prioritize solving real problems over chasing valuations. - VC funding can

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Navigating the world of VC funding can be challenging for startup founders. In this video, we explore what you should and shouldn’t expect from startup consultants, handholding services, and venture scouting companies. Learn how to leverage their exp

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

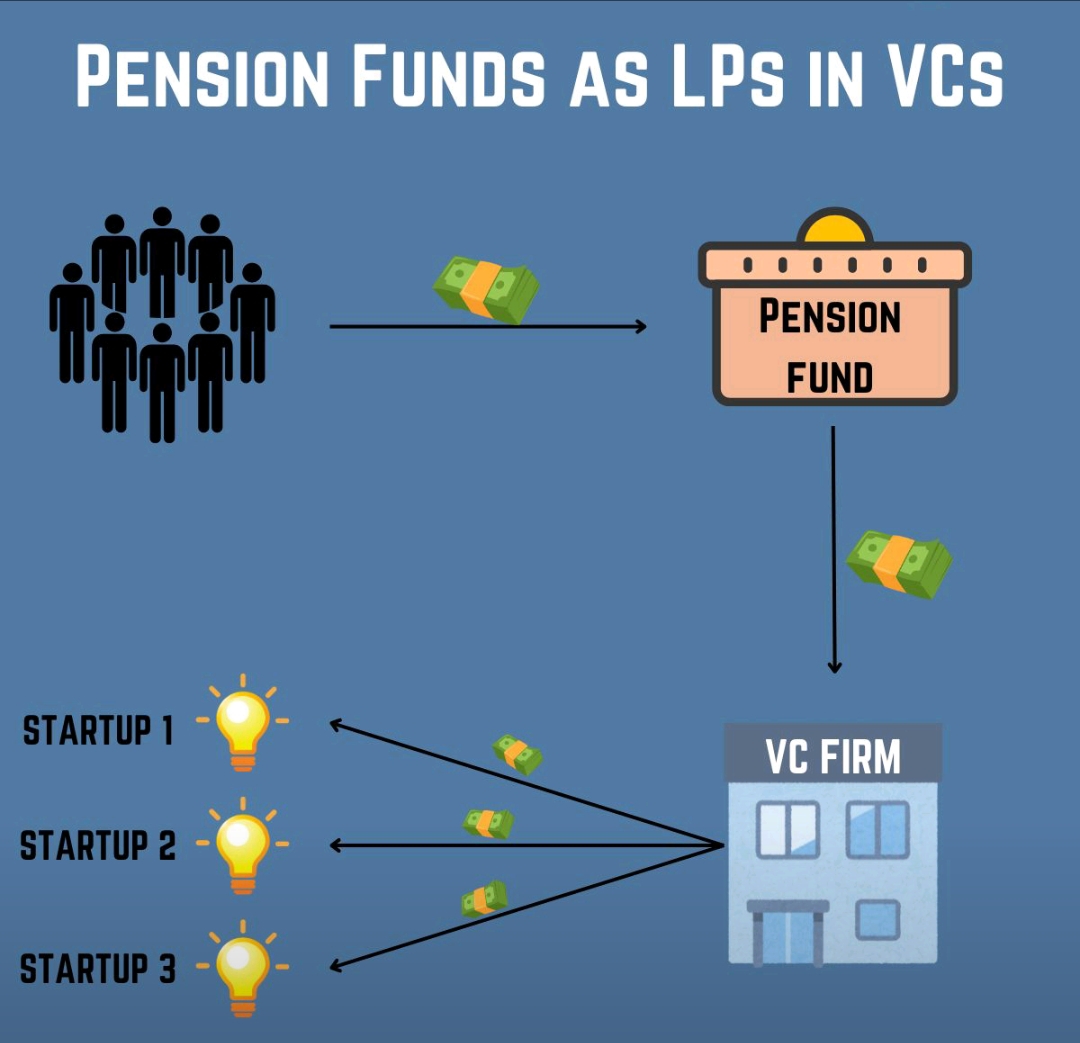

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Bhavin Bhavsar

Entrepreneur and You... • 6m

saw this meme today and had to share it because honestly the startup scene sometimes feels exactly like this VC backed founders royal life jeete hain bootstrappers quietly build karte hain, har rupee aur har customer count karte he TBH I saw both ar

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)