Back

Sagar Anantwar

•

SimpliFin • 1y

Are you investing for growth or regular cash flow? When it comes to mutual funds, choosing the right scheme can make a big difference in your returns. But what do terms like Growth, IDCW Payout, and IDCW Reinvestment mean? Let’s break it down in simple terms: 🔹 Growth Option ▶️ How It Works: In the growth option, your profits are reinvested back into the fund. This means the Net Asset Value (NAV) of your units increases over time as the profits accumulate. ▶️ Who Should Choose It: Ideal for investors looking for long-term capital appreciation without worrying about regular income. Think of it as letting your investment grow continuously through compounding. 🔹 IDCW Payout Option ▶️ How It Works: IDCW stands for Income Distribution cum Capital Withdrawal. In this option, profits are distributed to you as payouts at regular intervals (monthly, quarterly, or annually). ▶️ Who Should Choose It: Best suited for those who want regular cash flows from their investments. This could be retirees or anyone looking for a steady income source. 🔹 IDCW Reinvestment Option ▶️ How It Works: Similar to the IDCW Payout option, but instead of receiving the payout, the profit is reinvested to buy more units in the same scheme. ▶️ Who Should Choose It: Suitable for those who prefer regular compounding without receiving the income directly but want to grow their investments in the same scheme. Which One Should You Choose? ▶️ Choose Growth if you’re focused on long-term wealth creation and don’t need regular income. ▶️ Choose IDCW Payout if you’re looking for consistent cash flows to supplement your monthly income. ▶️ Choose IDCW Reinvestment if you want to benefit from compounding while keeping your investments within the same scheme. Remember, each option has its own benefits depending on your financial goals and income needs. Have you reviewed your mutual fund choices lately? Choose the option that aligns best with your goals! #Investing #MutualFunds #IDCW #GrowthOption #FinancialPlanning #Simplifin

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

Imagine a predicament. You are at a job interview, and your employer gives you two offers to choose from. The first option offers an in-hand salary of ₹30,000. The second offer is a salary of ₹20,000 with a generous ESOP. Which option will you choo

See MoreAhemad Raza

Senior Graphic Desig... • 1m

Be honest - which sketch would you choose for your brand? Option A: The chat symbol - built on conversation and clarity. Option B: The “V” - a sharp, structured mark from the brand name. Both began as sketches. One becomes the identity. 👇 Drop yo

See More

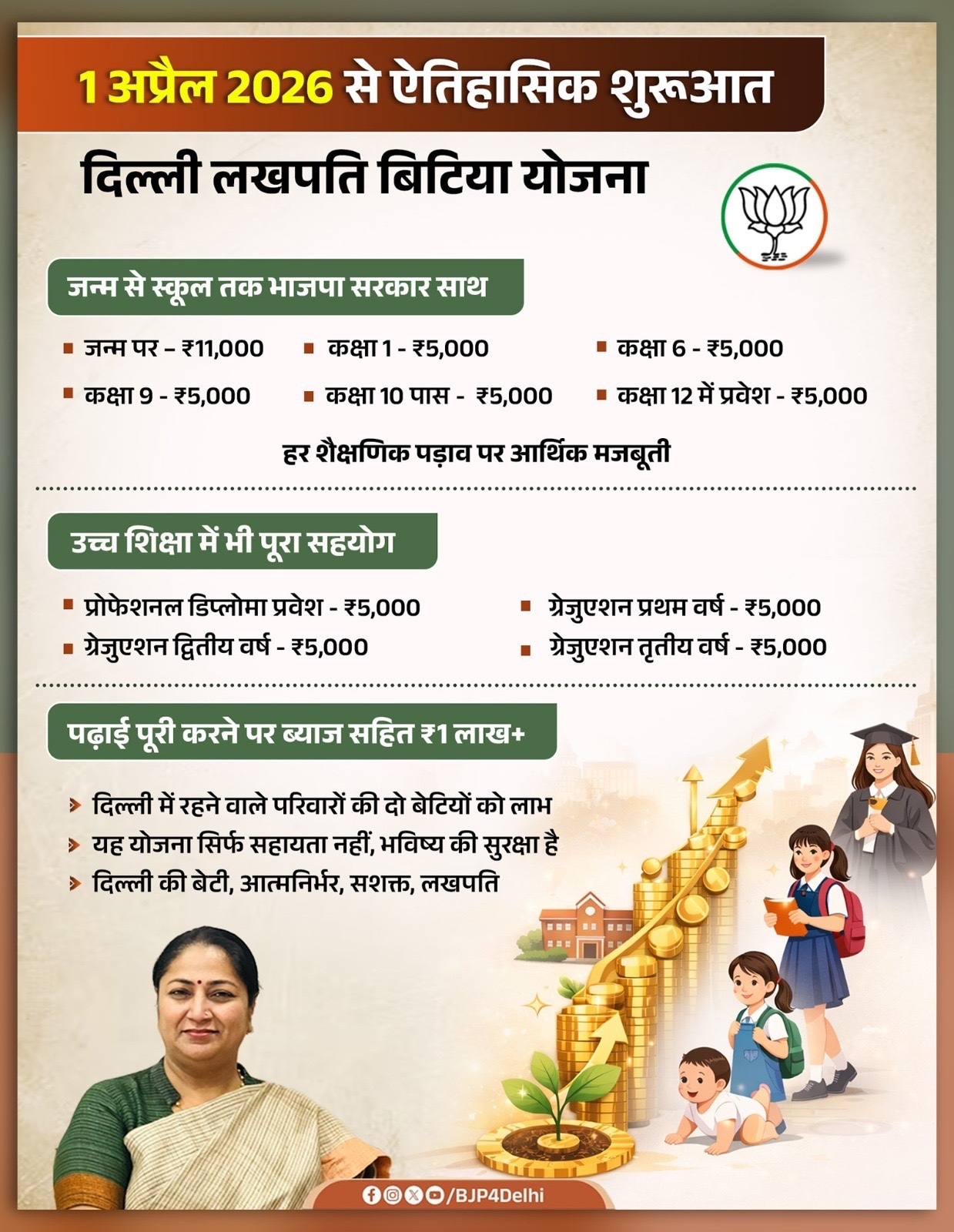

Government Schemes Updates

We provide updates o... • 22d

Delhi is set to introduce a revamped financial security scheme for girls — Delhi Lakhpati Bitiya Yojana — starting 01 April 2026. Announced by Chief Minister Rekha Gupta, the scheme focuses on long-term structured investment for girl children belong

See More

Akshay Chandromittal

🚀Building Wheeloy |... • 1y

Rolling the Startup Dice 🎲 Day - 1 💭 When Thinking About a Startup... How many of you have honestly asked yourselves: ▶️What problem am I solving? ▶️Have I personally faced this problem? ▶️What makes my startup stand out? ▶️Will people pay for m

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)