Back

Replies (1)

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 3m

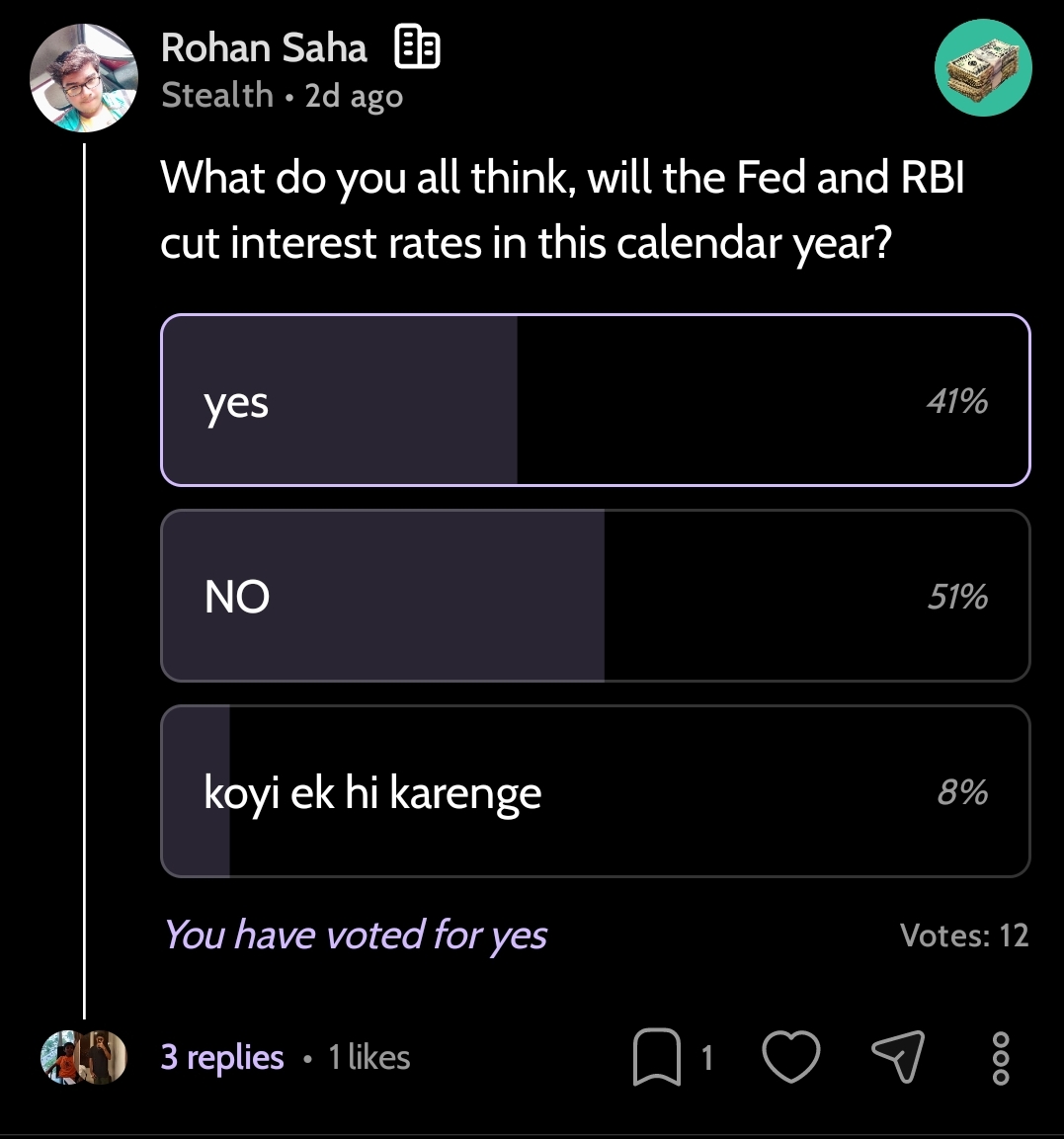

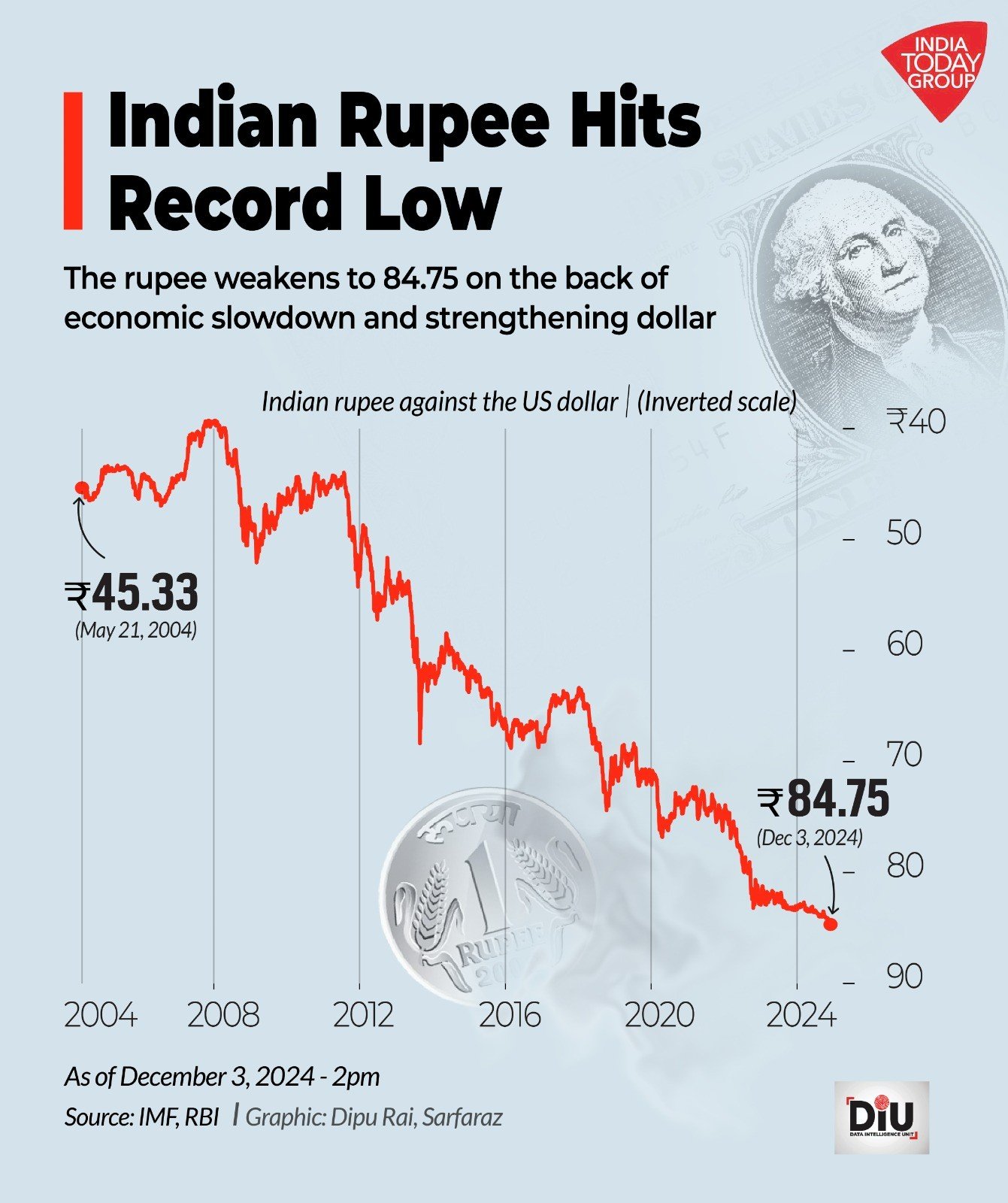

RBI Hints at a Rate Cut: RBI Governor Sanjay Malhotra says there’s room to cut the repo rate as inflation cools and the data lines up. Many expect a 25 bps cut in December. Let’s break down what this actually means on the ground. Lending and Banki

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreTushar Aher Patil

Trying to do better • 8m

📢 **RBI MPC Delivers "Hat-trick" Rate Cut; Shifts Stance to 'Neutral'** The Reserve Bank of India (RBI) today announced its bi-monthly monetary policy outcome, with significant decisions impacting the Indian economy. **Key Announcements & Insights

See More

Tushar Aher Patil

Trying to do better • 5m

RBI unlikely to rush into rate cuts despite US Federal Reserve easing, say experts. The US Federal Reserve recently cut its benchmark interest rate by 25 basis points (bps) to the 4-4.25 percent range. This was the first reduction since December. Thi

See Morefinancialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)