Back

Rohan Saha

Founder - Burn Inves... • 1y

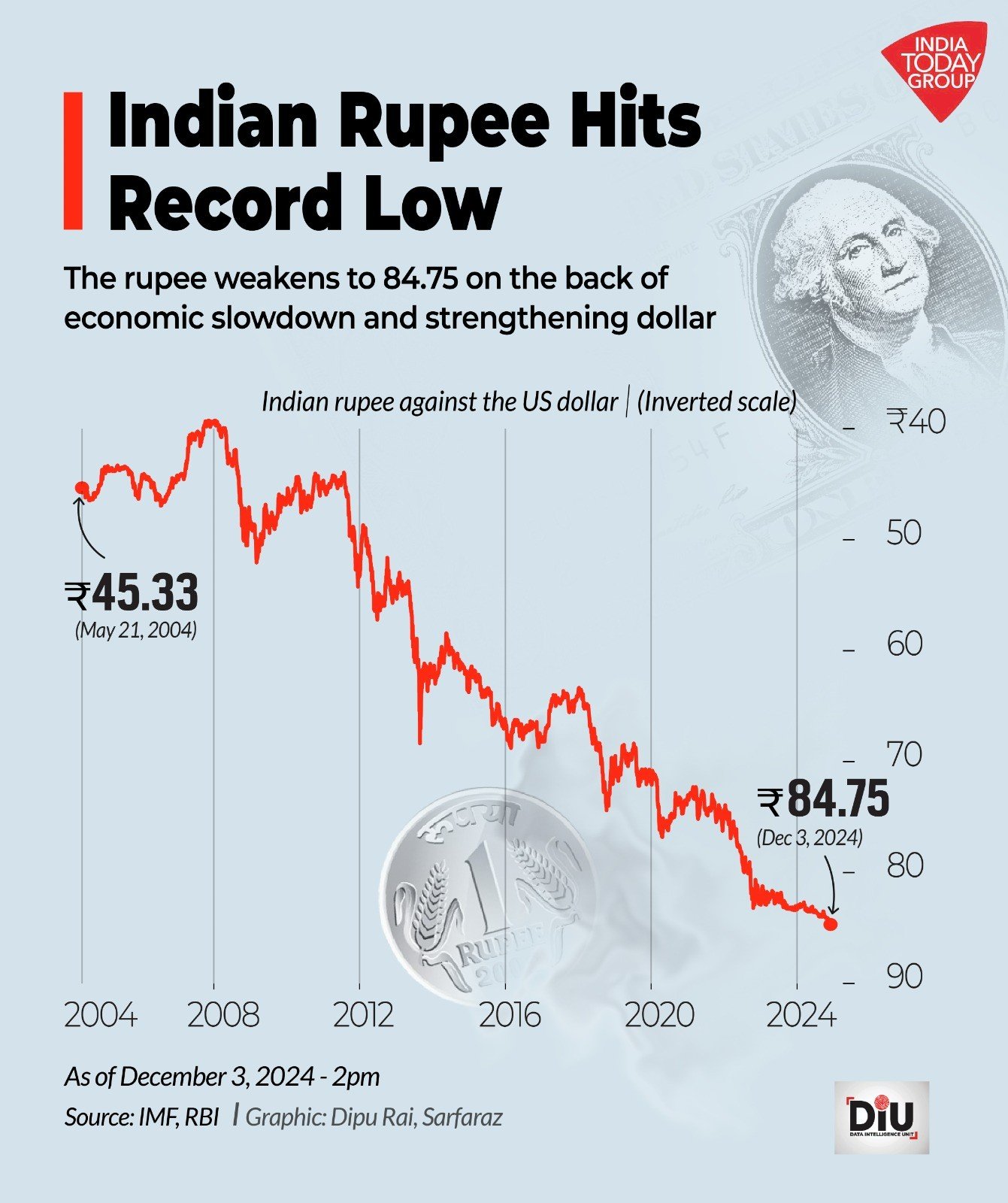

I think the RBI might consider another rate cut in the upcoming days to match growth. As for the stock market's fall, India needs three things: strong earnings, good GDP growth, and a strong rupee. Currently, market sentiment is shifting back towards China. If we don't find a solution quickly, there could be some problems.

Replies (4)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

UBS has advised shorting the Indian rupee for now, which means FIIs may remain outside the Indian market for some time. Indian GDP growth is not looking impressive; at one point, China achieved over 10% GDP growth, while we have only managed to reach

See MoreRohan Saha

Founder - Burn Inves... • 5m

The Indian rupee has slipped to a record low of 88 against the US dollar which is definitely not a positive sign since India is still a net importer bringing in far more than it exports this drop will have consequences for the market right now strong

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)