Back

theresa jeevan

Your Curly Haird mal... • 1y

Yeah, but these lower tax rates are beneficial only for the lower income group

Replies (1)

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

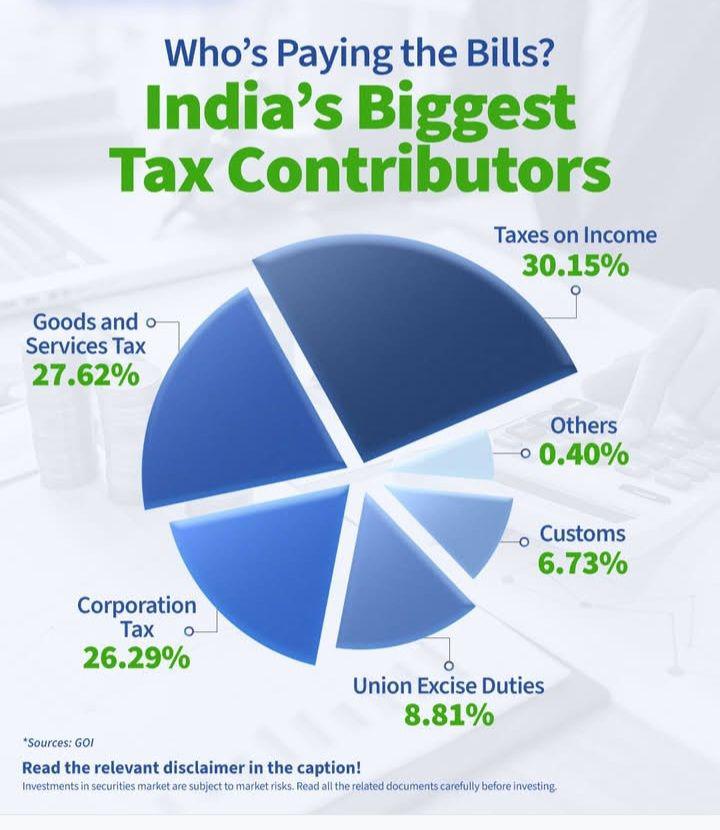

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreSanskar

Keen Learner and Exp... • 1y

There exists a market whose value is estimated to range between 20% to 30% of India's GDP. Yes, I am talking about the Black market (it refers to illegal trade and transactions that occur mainly to Avoid taxes or to trade illegal goods.) But do you

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)