Back

theresa jeevan

Your Curly Haird mal... • 1y

No the new Regime doesn’t let you claim any of these deductions. The only ones allowed under new are NPS and house property loan interest only if the house is let out.

Replies (1)

More like this

Recommendations from Medial

theresa jeevan

Your Curly Haird mal... • 1y

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

Anirudh Gupta

CA Aspirant|Content ... • 10m

🤯Understanding Capital Gains – Don’t Miss This! Let’s take an example: Mr. A owns a building along with a large piece of land. He enters into a Joint Development Agreement (JDA) with a builder. 😄What is a Joint Development Agreement (JDA)? In a

See More

Astrologer Bhraradwaj

The Road to sucess i... • 1y

1st House (Ascendant): Personal growth, increased confidence, and positive changes in self-image. Opportunities for new beginnings and self-improvement. 2nd House: Improvement in finances, speech, and family life. Opportunities for wealth accumulati

See More

Kamar Thakur

Real estate and fina... • 8m

> 🔊 Loan ki zarurat hai? Bank ke chakkar lagane ki koi zarurat nahi! Main hoon Kamar Thakur, aapka trusted Loan DSA Partner ✅ Personal Loan ✅ Business Loan ✅ Home Loan ✅ Car Loan ✅ Loan Against Property 💸 Loan amount: ₹1 lakh se ₹10 crore+ 🕒 Fa

See More

Rohan Saha

Founder - Burn Inves... • 7m

Whether to live on rent or buy a house I don’t know about others but here is how I see it if you have the option to buy your own home you definitely should even if it’s through a loan. A home loan is the only loan I actually support, because your

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

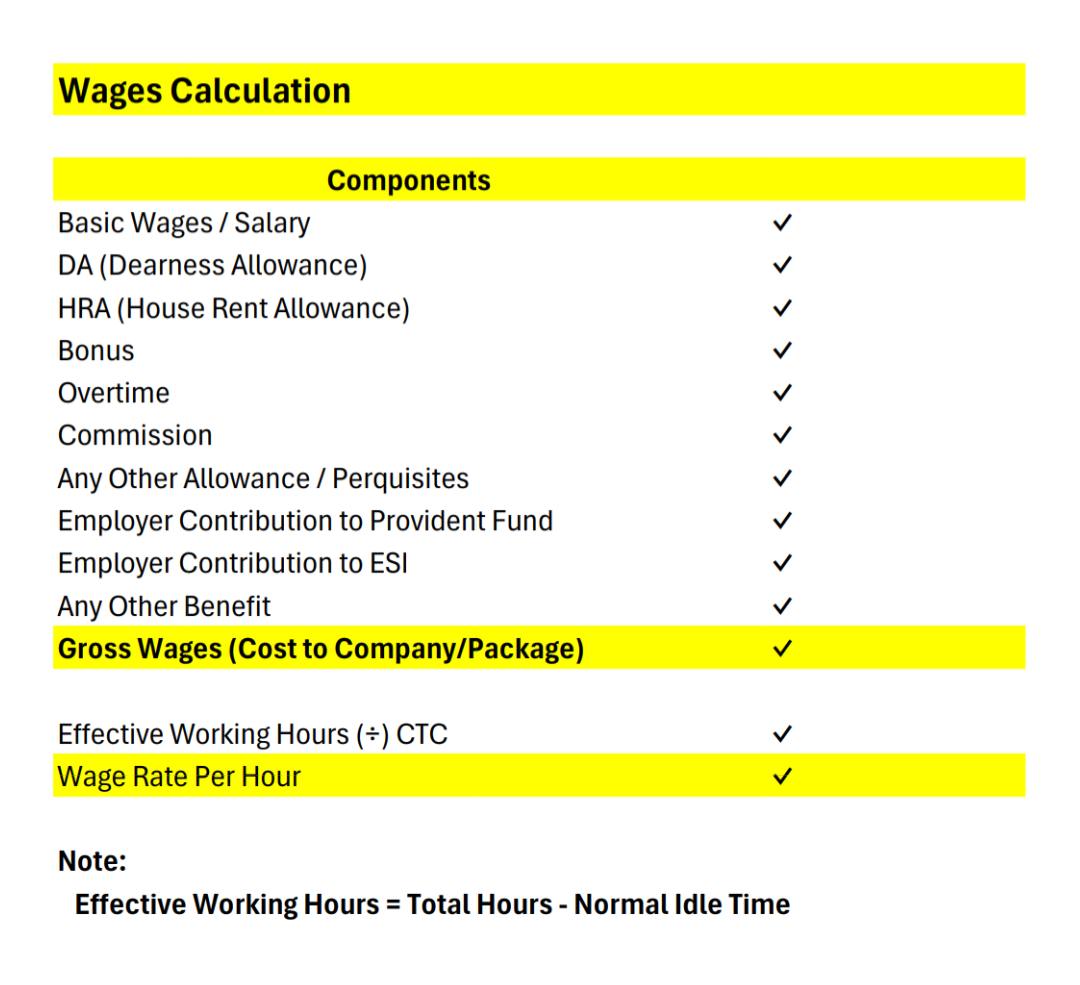

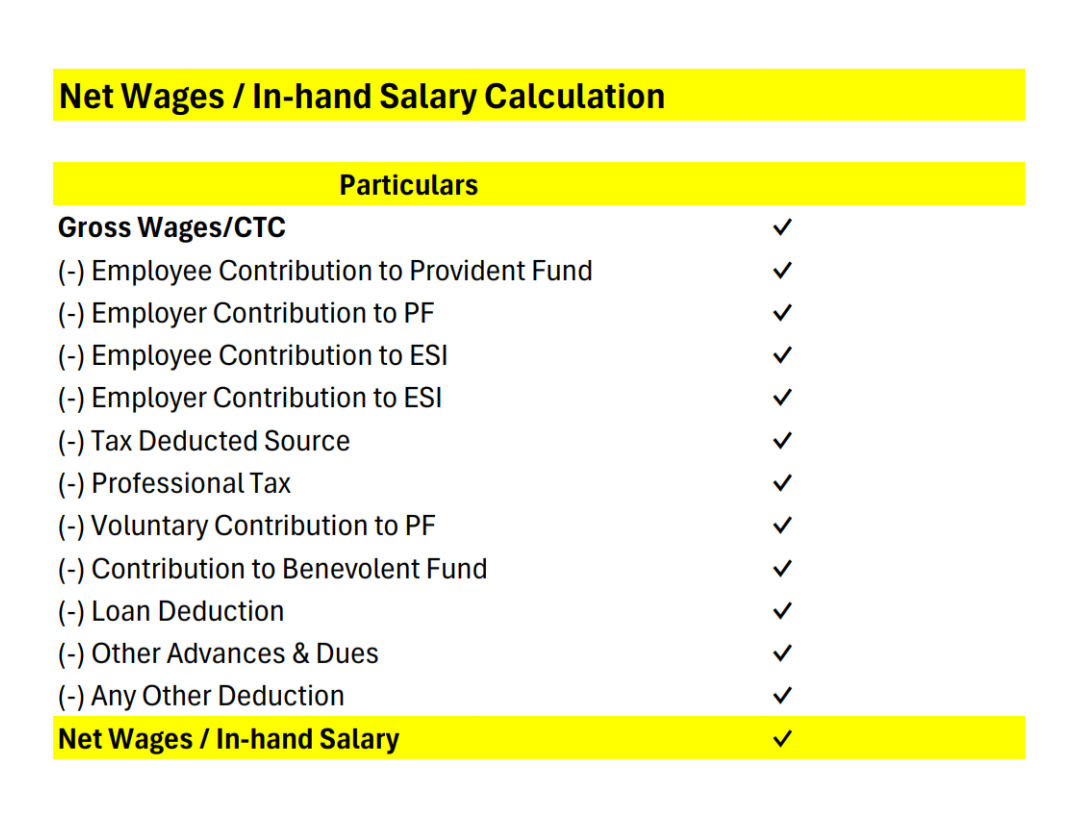

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)