Back

HEALTH BEYOND HEALING PVT LTD

Health begins after ... • 1y

this is meaningless! this is only to promote indirect taxation where you will pay in the name of tax saving instruments like insurance to no real avail

More like this

Recommendations from Medial

Vamshi krishna Nayini

Hey I am on Medial • 1y

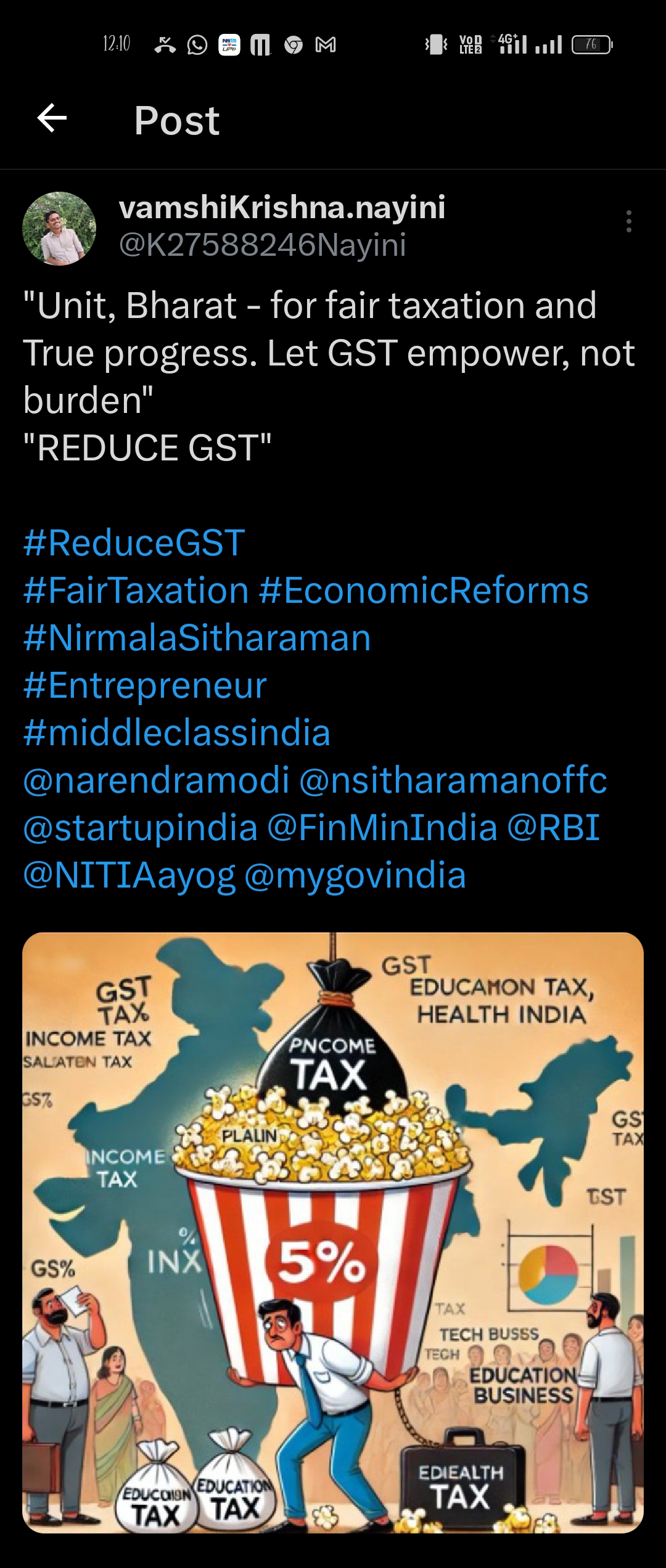

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

CA Kakul Gupta

Chartered Accountant... • 11m

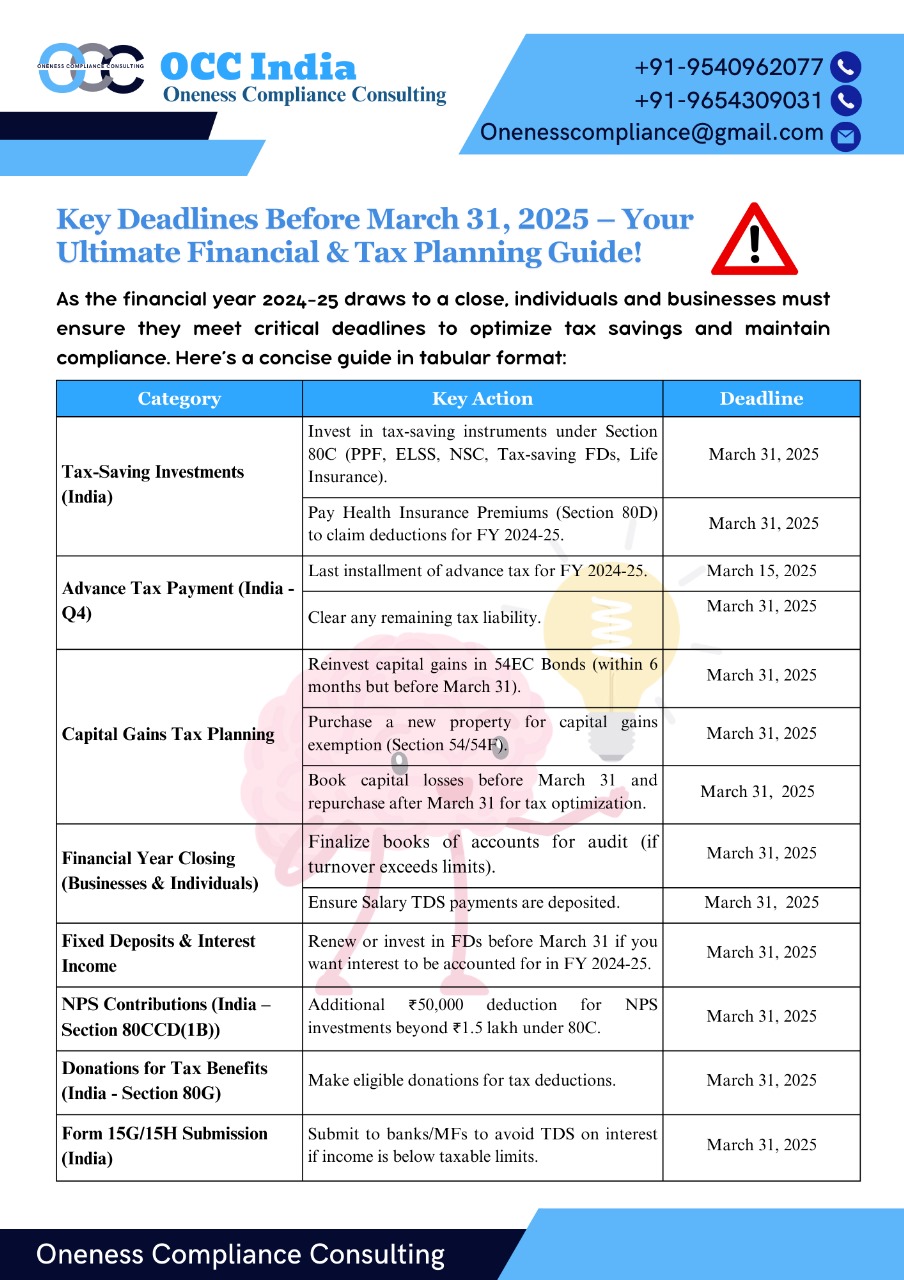

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreAryan Sukhdewe

Looking to work in ... • 1y

We are slowly moving towards a system of 30% taxation on capital gains. [1] A lot of retail folks used to enjoy the indexation benefits on Debt mutual Funds. This was taken away in 2023. Rational? Well, Equities have no indexation-- why should

See Moretheresa jeevan

Your Curly Haird mal... • 1y

🚨 Tax Saving Alert: Only 2 Months Left! 🚨 Hi there! 👋 Here’s a quick guide to help you maximize your savings: 🔹 80C - Save up to ₹1.5L PPF, ELSS (higher returns), NSC, LIC, Tax-Saving FDs (5 yrs). 🔹 80D - Health is Wealth Save ₹25K (self/fami

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)