Back

Aryan Sukhdewe

Looking to work in ... • 1y

We are slowly moving towards a system of 30% taxation on capital gains. [1] A lot of retail folks used to enjoy the indexation benefits on Debt mutual Funds. This was taken away in 2023. Rational? Well, Equities have no indexation-- why should debt have it? [2] Next 2 years: Let's apply Direct Tax Code. LTCG on Real Estate is 20% On Equities it is 10% Why should Equities have advantage here? [3] Some political parties: Let's apply Inheritance tax. In American when the rich pass on their wealth to their kids, they pay inheritance taxes. Why should people in India enjoy this unfair advantage? The point is no matter which political party comes to power, they will suck common people's blood through excessive taxation. Tax whom you can. And, doll out as much freebies as possible. This in-short is the future of India's economic policy.

Replies (6)

More like this

Recommendations from Medial

Rishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Shriharsha Konda

•

Start.io - A Mobile Marketing and Audience Platform • 9m

If you are a freelancer, or are just curious what it holds on the taxation front, Section 44ADA can mean huge tax savings. Here is a detailed breakdown - https://shriharsha.com/salary-to-contract-44ada/ Also bonus - a tool to compare your potentia

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Sai Vishnu

Income Tax & GST Con... • 11m

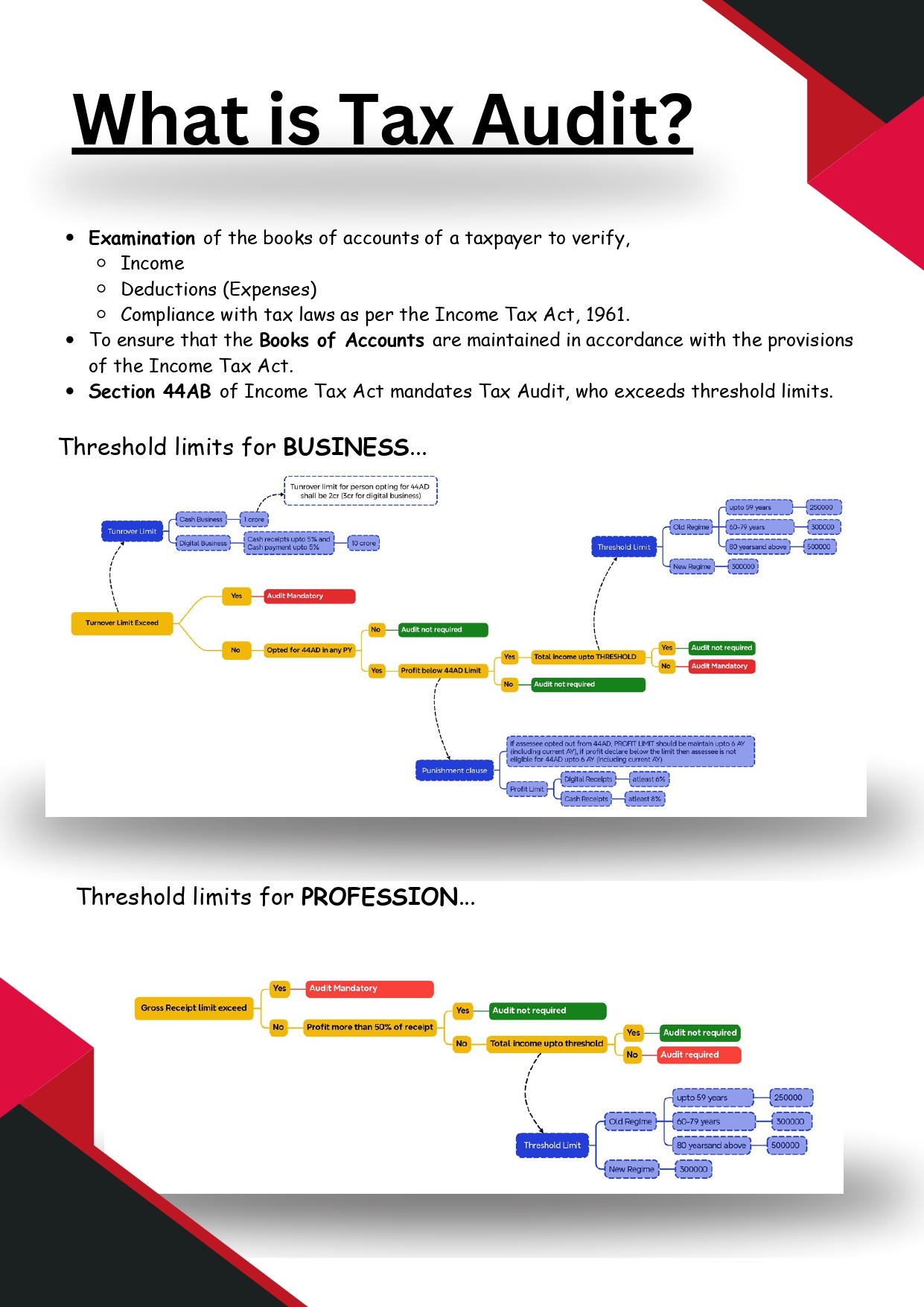

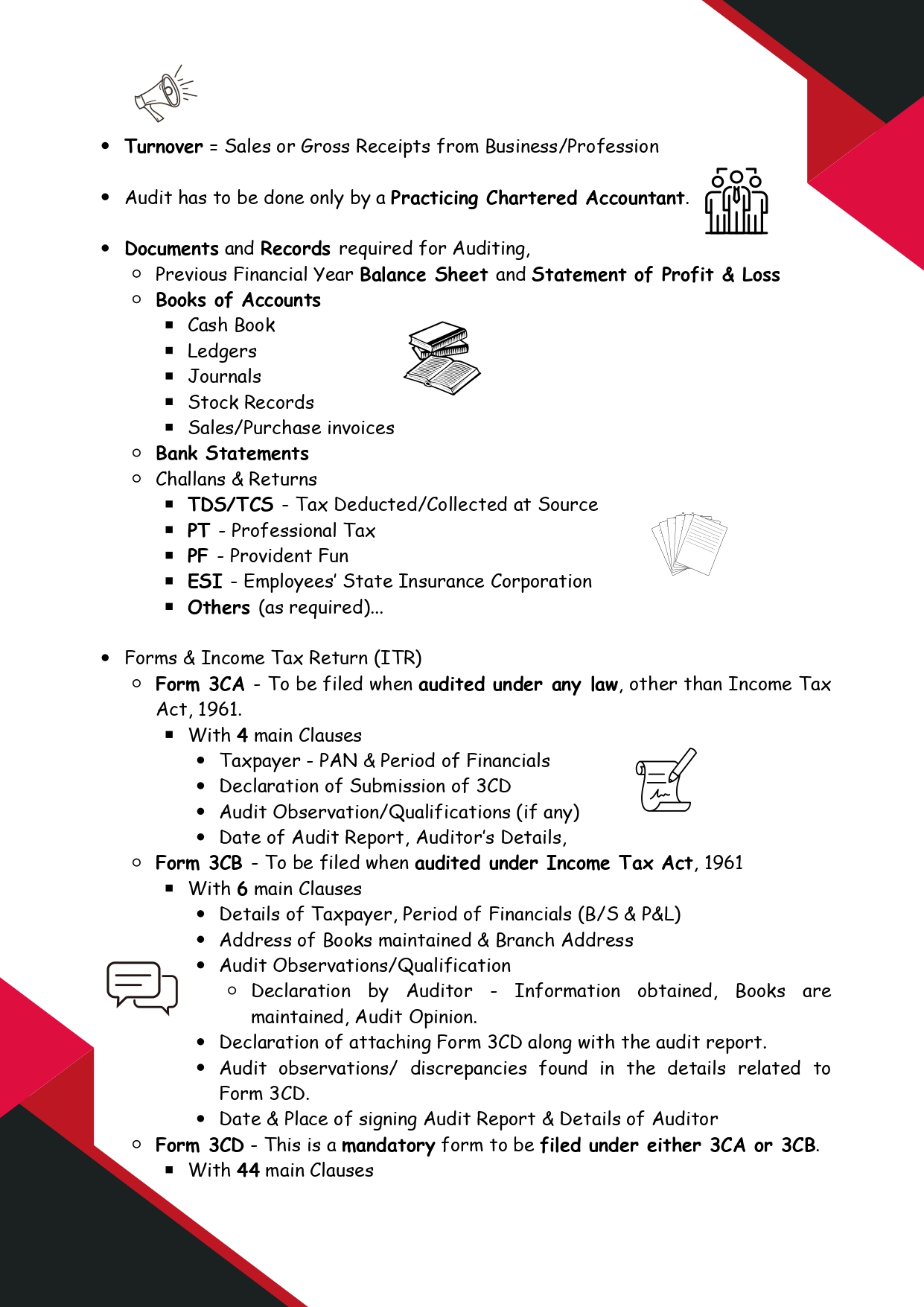

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

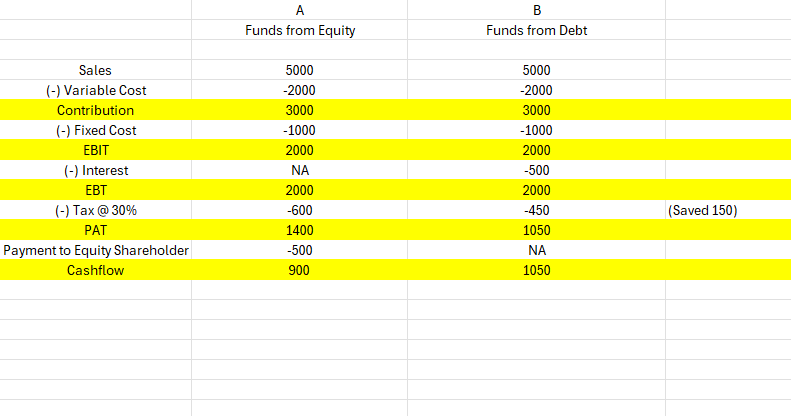

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)