Back

Kanishk Savarnya

TISS Alumni | Finan... • 1y

I think in long term , crypto will become the biggest burden for government as it's very tough to tax crypto , further people can exchange commodities through crypto and escape taxation

More like this

Recommendations from Medial

Vamshi krishna Nayini

Hey I am on Medial • 1y

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

Neelakanth Chavan

Analytics and Data s... • 1y

What are the taxation rules in india on investments in stocks. As per my knowledge, gains on stocks more than 1 lakh are taxed at 10% for long term gains(>1year) & 15% for short term gains(<1year). How can someone escape from this. One method that

See MoreSairaj Kadam

Student & Financial ... • 1y

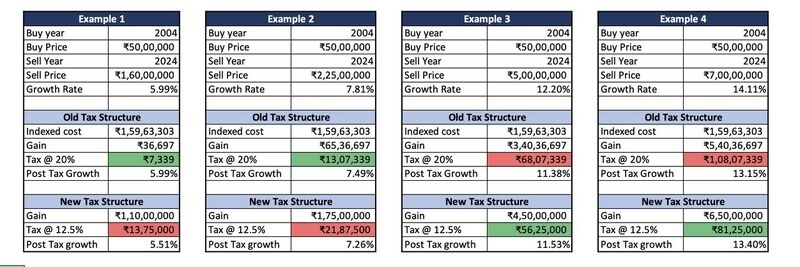

After a long time. Back to Reality: The Budget's Hidden Cost "Hidden Costs of the New Tax Regime" Everyone's talking about the lower tax slabs in the new income tax regime. But has anyone considered the long-term implications? By drastically redu

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)