Back

SamCtrlPlusAltMan

•

OpenAI • 1y

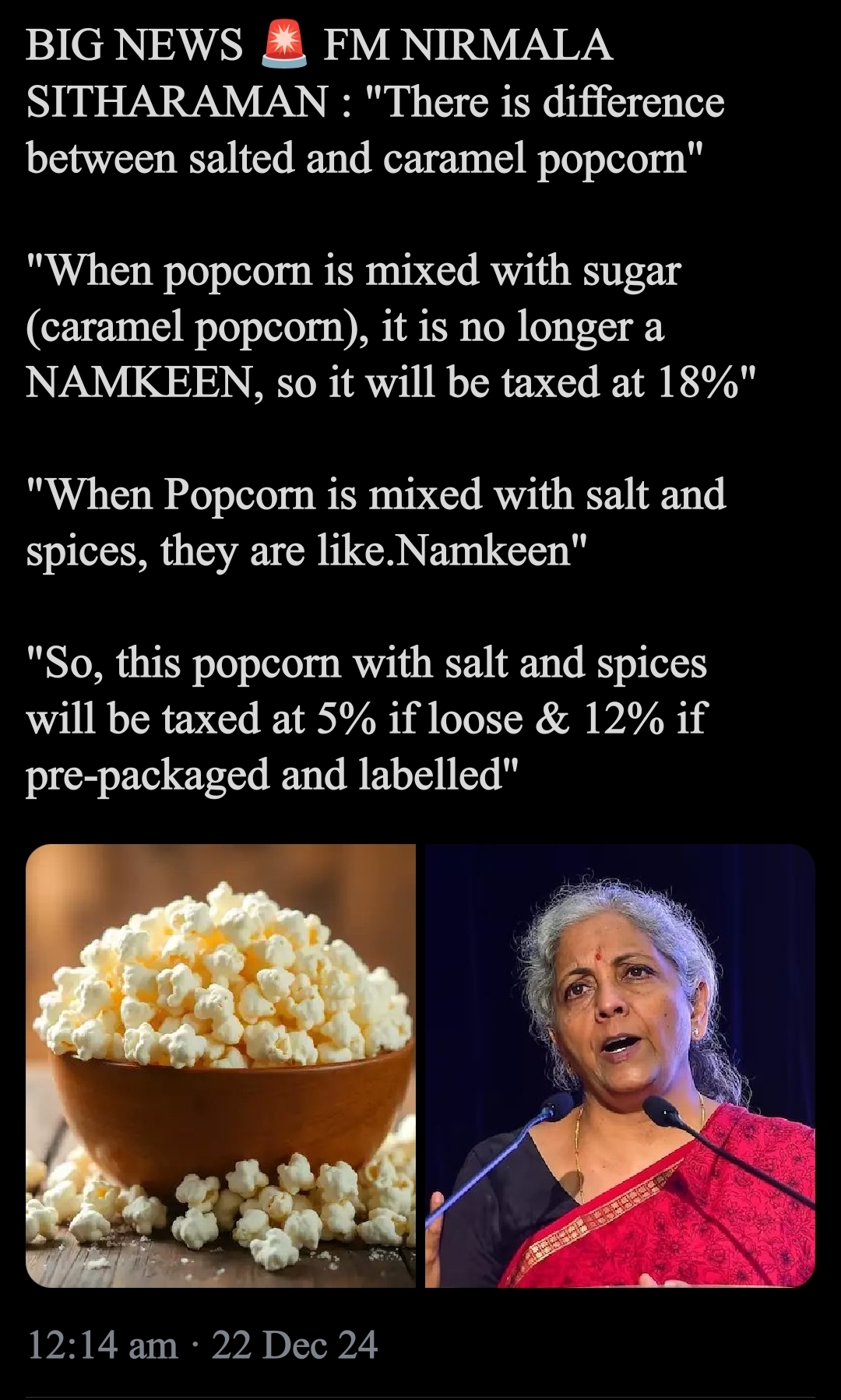

Asking real questions is anti-national bro, just quietly pay 18% GST on caramel popcorn 🤫

Replies (1)

More like this

Recommendations from Medial

Shubham Patel

•

E-Cell, IIT Bombay • 1y

Mehnat ki kamai par moti rakam maangte hue pakadi gyi 😅( Caught demanding huge amount for hard earned money) Tax -Treatment of popcorn 🍿 The Goods and Services Tax (GST) Council, chaired by the finance minister and including state representative

See More

Vamshi krishna Nayini

Hey I am on Medial • 1y

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

Account Deleted

Hey I am on Medial • 9m

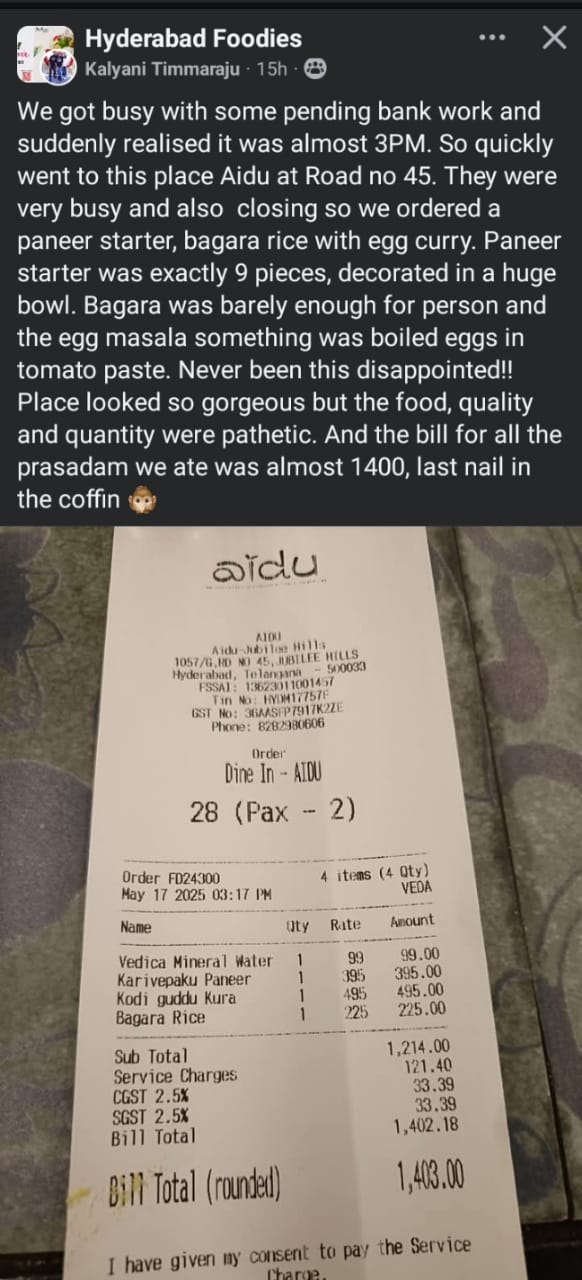

Why should you pay gst and sgst on service charges? That is illegal. If you are not happy why should you agree to pay service charges? I see they got cheated.. Tax should be on bill.. which means 1214 * 5% which 60.70 but they added gst on service c

See More

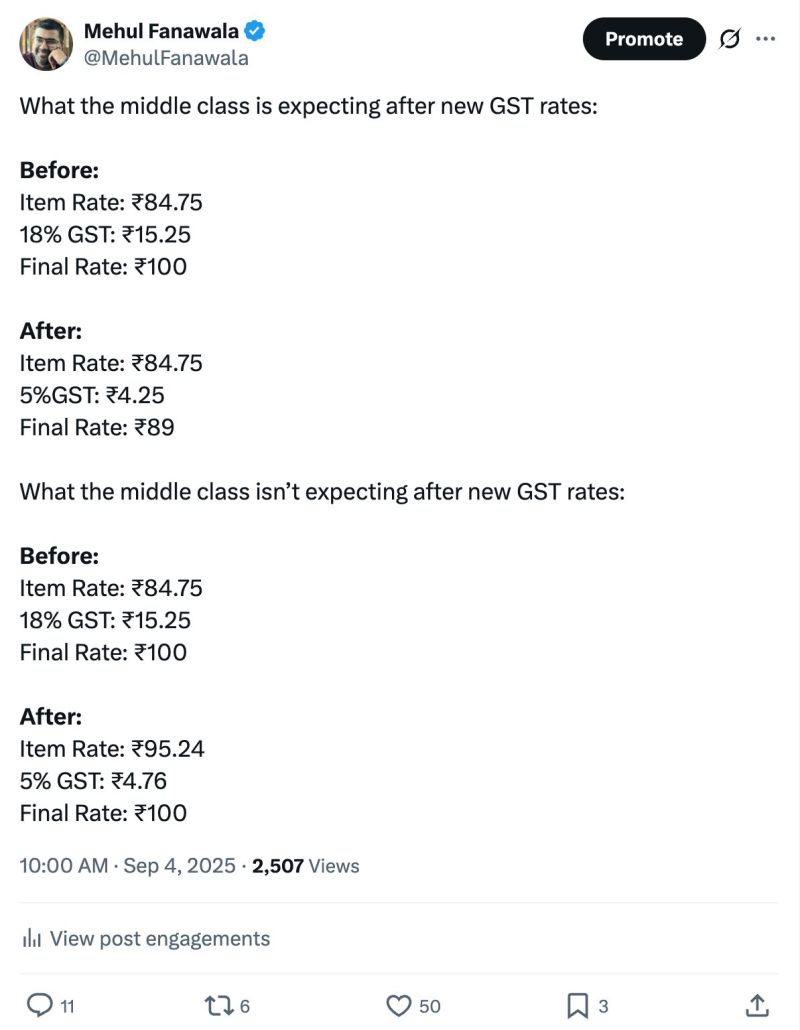

Mehul Fanawala

•

The Clueless Company • 5m

From 22nd September, the first day of Navratri, the new GST rates will be implemented. The government is calling it NextGen GST. Now, the middle class is looking at this change with a lot of hope. The expectation is simple, if GST rates are reduced,

See More

Siddharth K Nair

Thatmoonemojiguy 🌝 • 10m

How Parachute Outsmarted India’s Tax System & Saved Crores🤯🌝 Ever noticed that Parachute Coconut Oil never says "hair oil" on its bottle? Instead, it’s labeled as “100% Pure Edible Coconut Oil.” This isn’t just a branding choice—it’s a smart tax-s

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)