Back

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

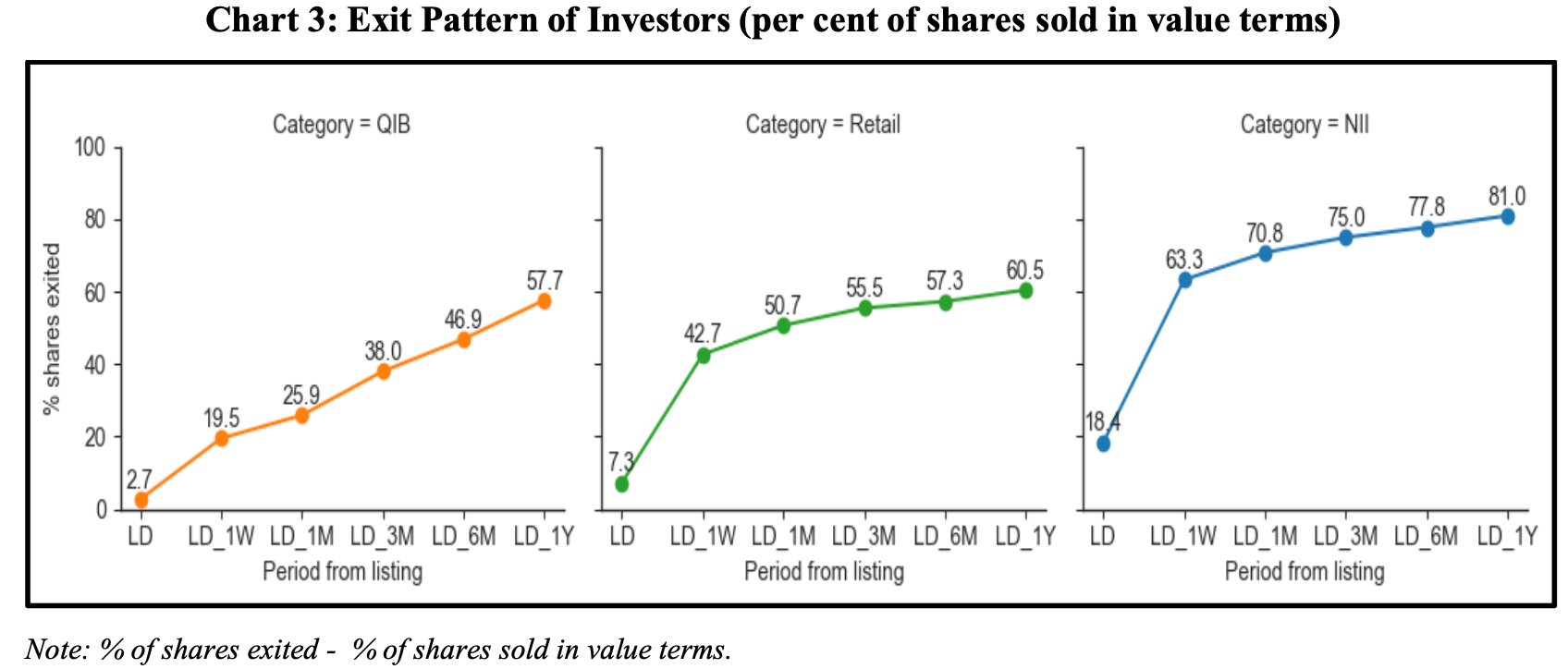

This year - IPO fundraise has picked up pace with 60 companies listing so far and raising ₹63,985 crore (+29% over 2023). 📄SEBI's report on Investor Behaviour in IPOs is an interesting reveal - - High Flipping Rate: Overall around 54% of IPO shares

See More

VCGuy

Believe me, it’s not... • 1y

On April 24th, Swiggy filed its DRHP with SEBI via the confidential route (this route restricts public access to the DRHP until an updated version is filed) 💡Would be super interesting to see how much of Swiggy: Accel and Elevation Capital still ow

See More

Rohan Saha

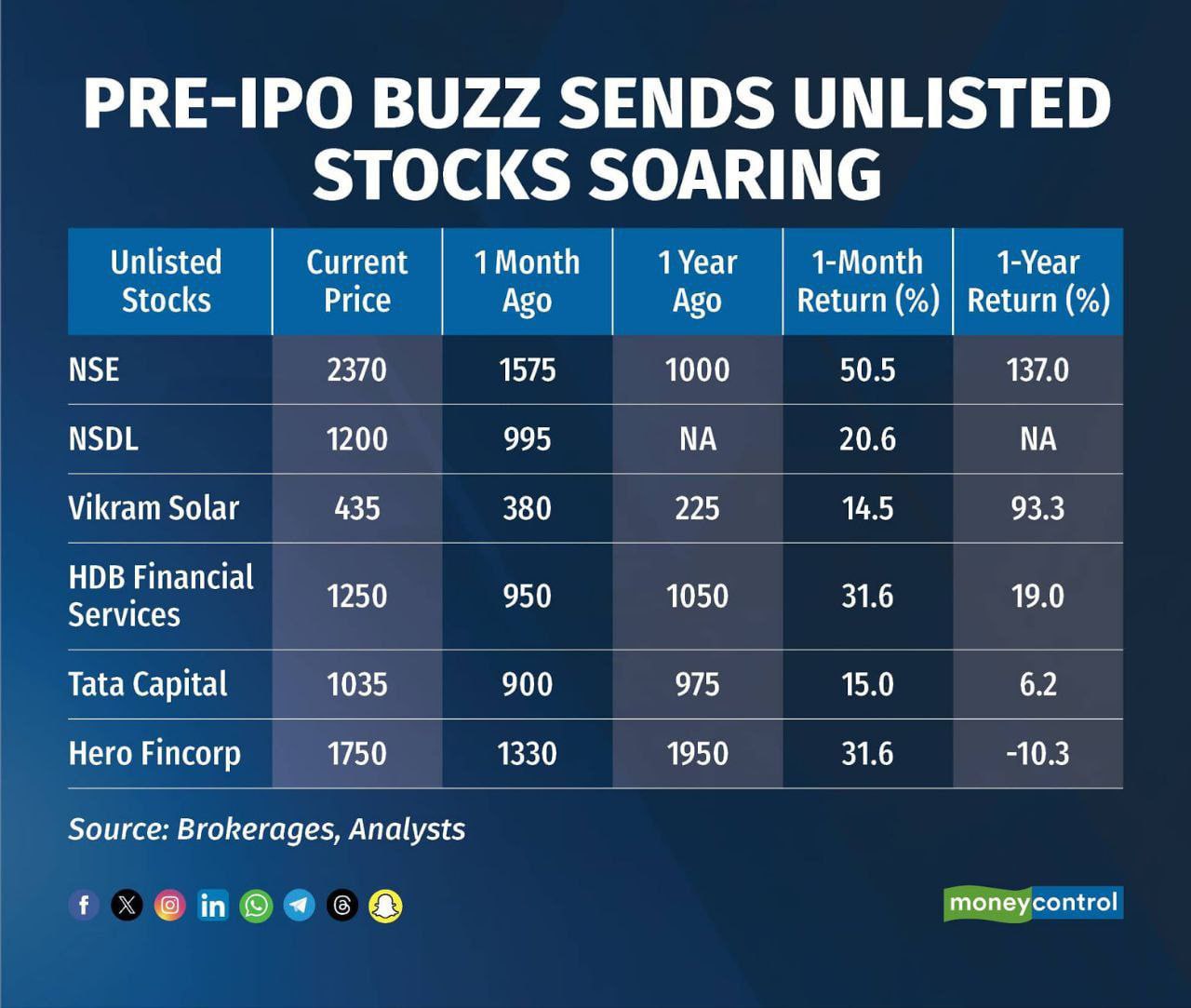

Founder - Burn Inves... • 8m

NSE has been on a crazy run in the unlisted market it's given over 100% returns in just a year, all because of the hype around its IPO. And the funny thing is, they haven’t even announced the IPO date yet. Once that happens, who knows how much higher

See More

Rohan Saha

Founder - Burn Inves... • 10m

Today marks the final day to bid for Ather Energy’s IPO, with the listing scheduled for May 6, 2025. As of now, the IPO has received only about 30% overall subscription. Interestingly, there’s been no participation from QIBs yet hopefully, they’ll st

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)