Back

VCGuy

Believe me, it’s not... • 1y

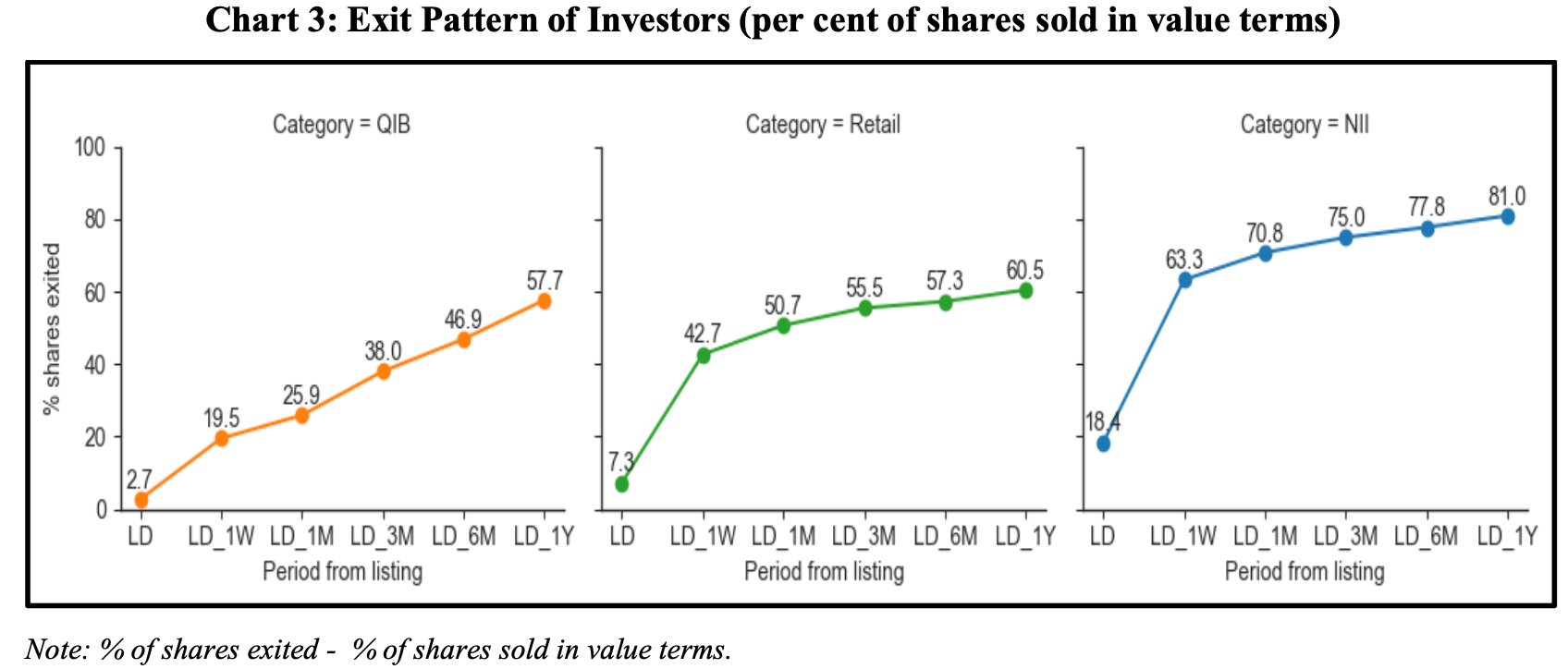

This year - IPO fundraise has picked up pace with 60 companies listing so far and raising ₹63,985 crore (+29% over 2023). 📄SEBI's report on Investor Behaviour in IPOs is an interesting reveal - - High Flipping Rate: Overall around 54% of IPO shares are sold in <1 week (~42% of retail investors and ~64% of HNIs and corporates sell in a week) - Institutional Behaviour: 1). Mutual funds held IPO shares longer, selling only 3.3% of their allotted value within a week. 2). Banks sold the most - 79.8% during the same period. -Geographical Concentration: 39.3% of retail IPO investors were from Gujarat, followed by Maharashtra (13.5%) and Rajasthan (10.5%). ⏭️With likely IPOS from --> Swiggy(₹11,000 Cr) and Hyundai(₹25,000 Cr), this year should soon be a record year!

Replies (3)

More like this

Recommendations from Medial

Nandishwar

Founder @StudyFlames... • 1y

INDIA'S IPO BOOM: A JOURNEY THROUGH YEARS! 🚀 India’s IPO market has been on fire, witnessing a massive surge in companies going public and raising huge funds. Here’s how the IPO trend evolved from 2017 to 2024: 📊 The Highlights 1️⃣ 2024: The B

See More

VIJAY PANJWANI

Learning is a key to... • 1m

About 200 Companies are either Approved or in the Pipeline for the IPO✨ ✅ About ₹2.5 Lakh Crore Potential Fundraise! ✅ Here are some Awaited Big Sized IPOs for 2026: 👉 Reliance Jio IPO - Expected by to be India's Biggest Ever IPO (₹40,000 Cr+)

See More

gray man

I'm just a normal gu... • 10m

Ahead of filing its draft red herring prospectus (DRHP), consumer services unicorn Urban Company’s founders cumulatively sold shares worth nearly INR 779.08 Cr through secondary transactions. According to the DRHP filed with SEBI on April 28 for a p

See More

VIJAY PANJWANI

Learning is a key to... • 2m

🚀 BIG IPOs COMING IN 2026! 📈💰 India’s startup & tech giants are lining up for the stock market 🔥 From PhonePe to Zepto, OYO, and more — 2026 could be a blockbuster year for IPO investors! 📊 Expected Mega IPOs: ✅ PhonePe – ₹13,500 Cr ✅ Zepto –

See More

Mohd Rihan

Student| Passionate ... • 1y

Zomato Finances of this year::: Revenue: 5405 cr Expenses: 5533 cr Loss:128 cr Non operating income (invested in FD, IPO and from other places): 252 cr Income- Loss=124 cr After tax: 59 cr Means, Zomato is earning from interest and FD's than actual

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)