Back

Nandishwar

Founder @StudyFlames... • 1y

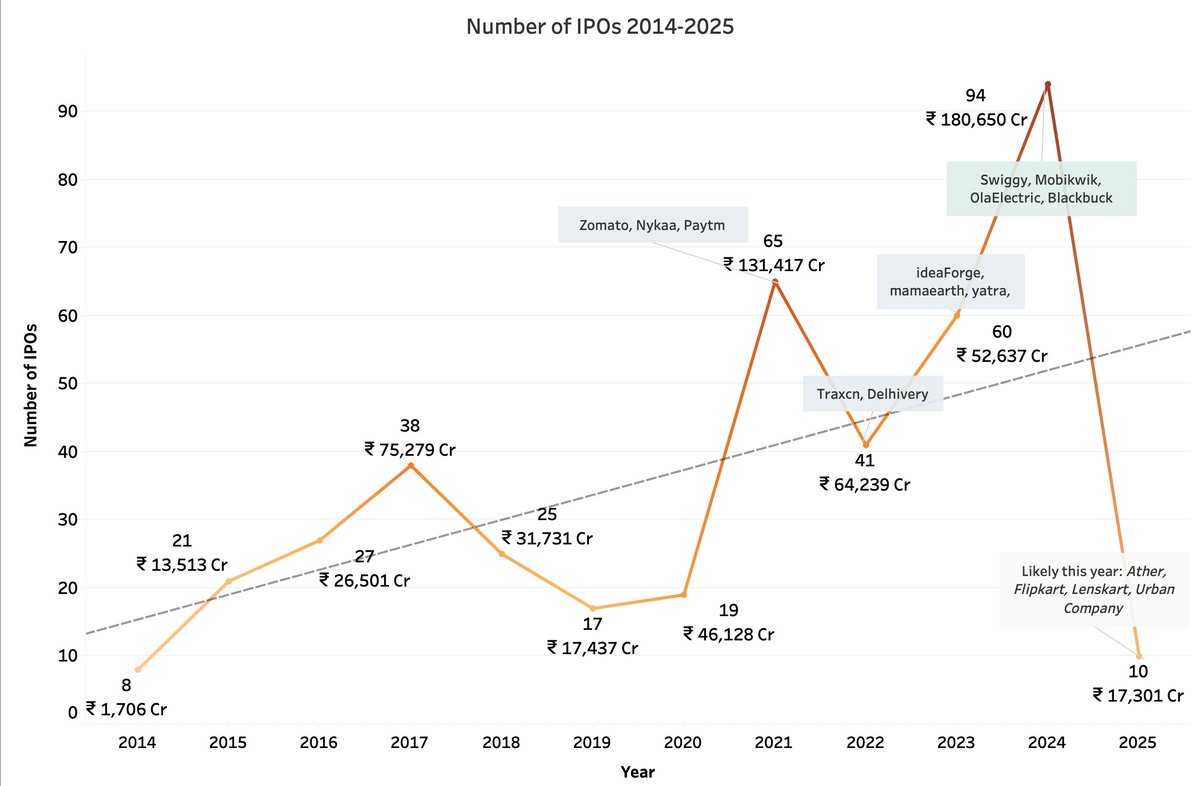

INDIA'S IPO BOOM: A JOURNEY THROUGH YEARS! 🚀 India’s IPO market has been on fire, witnessing a massive surge in companies going public and raising huge funds. Here’s how the IPO trend evolved from 2017 to 2024: 📊 The Highlights 1️⃣ 2024: The BIGGEST IPO year yet! 💰 ₹1,40,000 CR raised by companies like Digit & Unimech. 2️⃣ 2023: A year of promise with ₹49,436 CR raised, featuring IPOs from Tata Technologies & IdeaForge. 3️⃣ 2021: The year of unicorn IPOs – Zomato, Nykaa & PB raised a whopping ₹1,18,723 CR. 4️⃣ 2020: Despite challenges, ₹26,613 CR was raised, with SBI Card leading the pack. 5️⃣ 2017: The year that kicked off the IPO rush – ₹67,147 CR raised with giants like DMart & Bharat Matrimony. 💬 Which year do you think transformed the Indian IPO scene the most? Let us know! 👉 Follow us for more market insights and trends!

Replies (6)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 1m

About 200 Companies are either Approved or in the Pipeline for the IPO✨ ✅ About ₹2.5 Lakh Crore Potential Fundraise! ✅ Here are some Awaited Big Sized IPOs for 2026: 👉 Reliance Jio IPO - Expected by to be India's Biggest Ever IPO (₹40,000 Cr+)

See More

VIJAY PANJWANI

Learning is a key to... • 1m

🚀 BIG IPOs COMING IN 2026! 📈💰 India’s startup & tech giants are lining up for the stock market 🔥 From PhonePe to Zepto, OYO, and more — 2026 could be a blockbuster year for IPO investors! 📊 Expected Mega IPOs: ✅ PhonePe – ₹13,500 Cr ✅ Zepto –

See More

VCGuy

Believe me, it’s not... • 1y

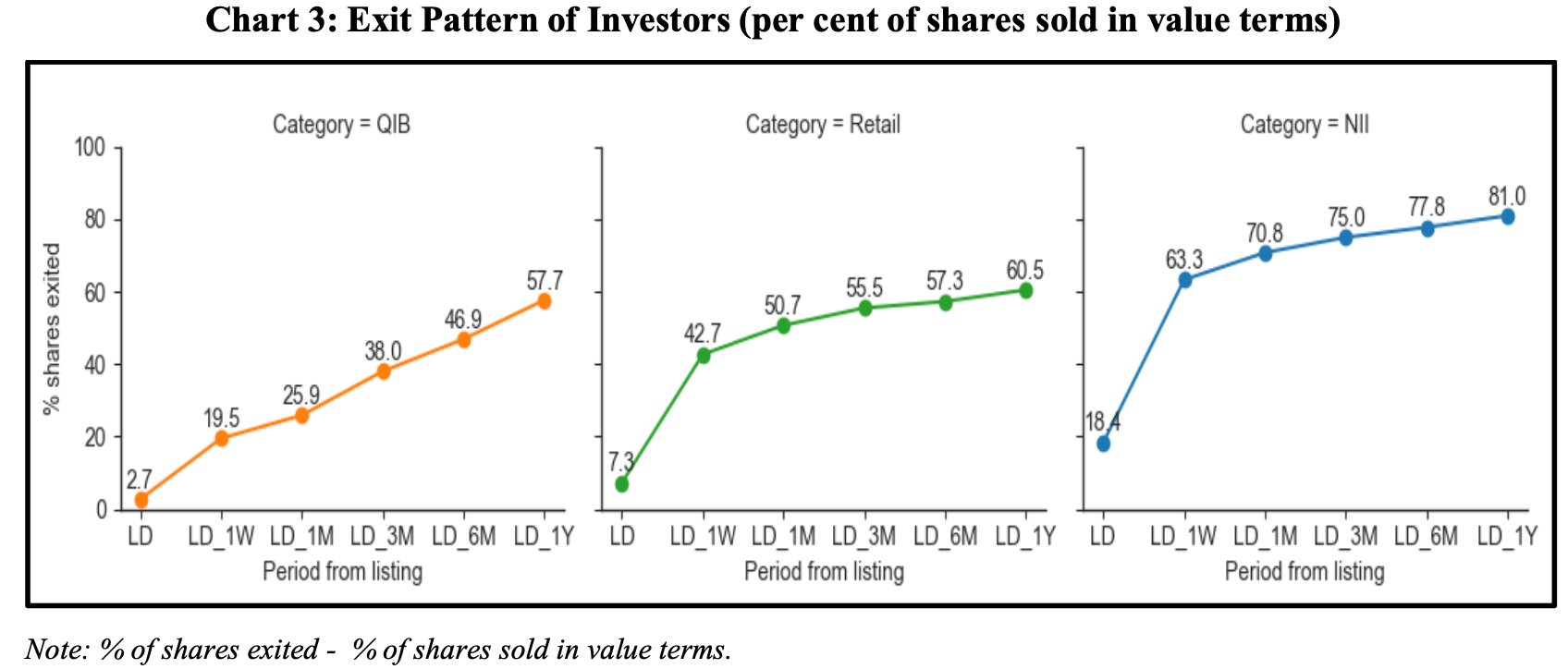

This year - IPO fundraise has picked up pace with 60 companies listing so far and raising ₹63,985 crore (+29% over 2023). 📄SEBI's report on Investor Behaviour in IPOs is an interesting reveal - - High Flipping Rate: Overall around 54% of IPO shares

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)