Back

Anonymous 1

Hey I am on Medial • 1y

VCs treat startups like disposable lottery tickets. They only care about the home runs and don’t mind cutting off others mid-game if they’re not yielding instant returns.

More like this

Recommendations from Medial

Vishwa Lingam

Founder of Simulatio... • 7m

🚫 Why VCs Reject Your Pitch — Even If It’s a Solid One 💡 You're not alone if your startup pitch got rejected by a VC. But here's the hidden truth most won’t tell you: VCs have limited capital from their LPs (Limited Partners) & they’re under pre

See Morebuild III

we help you build im... • 7m

TCS is cutting 12,000 jobs — mostly mid-level roles. The IT Ministry is watching. Should we be worried? Mid-level professionals were once the backbone of India’s IT services model. Now, they’re being let go quietly — replaced by automation, AI, and

See More

Account Deleted

Hey I am on Medial • 9m

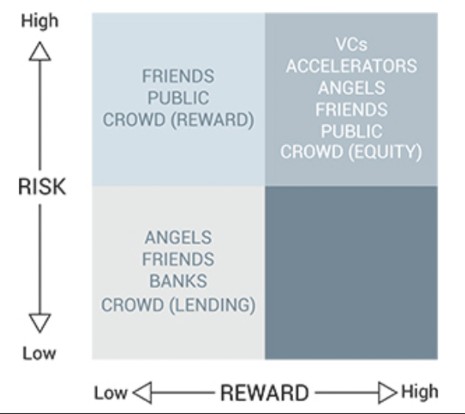

Before You Pitch Your Startup to Anyone, Ask These 2 Questions Most founders don’t raise money because their startup is bad. They fail because they’re pitching to the wrong kind of investor. Here’s what I mean. There are different kinds of investo

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 8m

🚀 Inside a VC Mentorship: What I Learned About How VCs Think. Recently, I had the privilege of attending a focused mentorship session from VC Partner Manik Gruver at Macwise Capital, alongside a few fellow founders. The session offered deep, behind

See More

Rahul Agarwal

Founder | Agentic AI... • 24d

Agentic coding isn’t coming. It’s already running inside top teams. Most companies just haven’t caught up yet. After digging into recent agentic development trends, one thing is obvious fast. AI shows up in daily workflows, but rarely runs the work

See MoreVamshi Yadav

•

SucSEED Ventures • 11m

VCs are exiting their funds at an increasing pace. The "Great GP Exit" is in full swing. More & more GPs are leaving big-name firms to build their ventures. And honestly? It’s not hard to see why. Here’s what’s driving the shift: 1. LPs Want Focus

See MoreVishwa Lingam

Founder of Simulatio... • 7m

🚨 Hard Commitments vs Soft Commitments in VC — A Founder’s Guide to Avoiding Betrayal If you're a startup founder raising capital, there's one concept that could make or break your round — and that’s understanding the difference between hard commit

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)