Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 7m

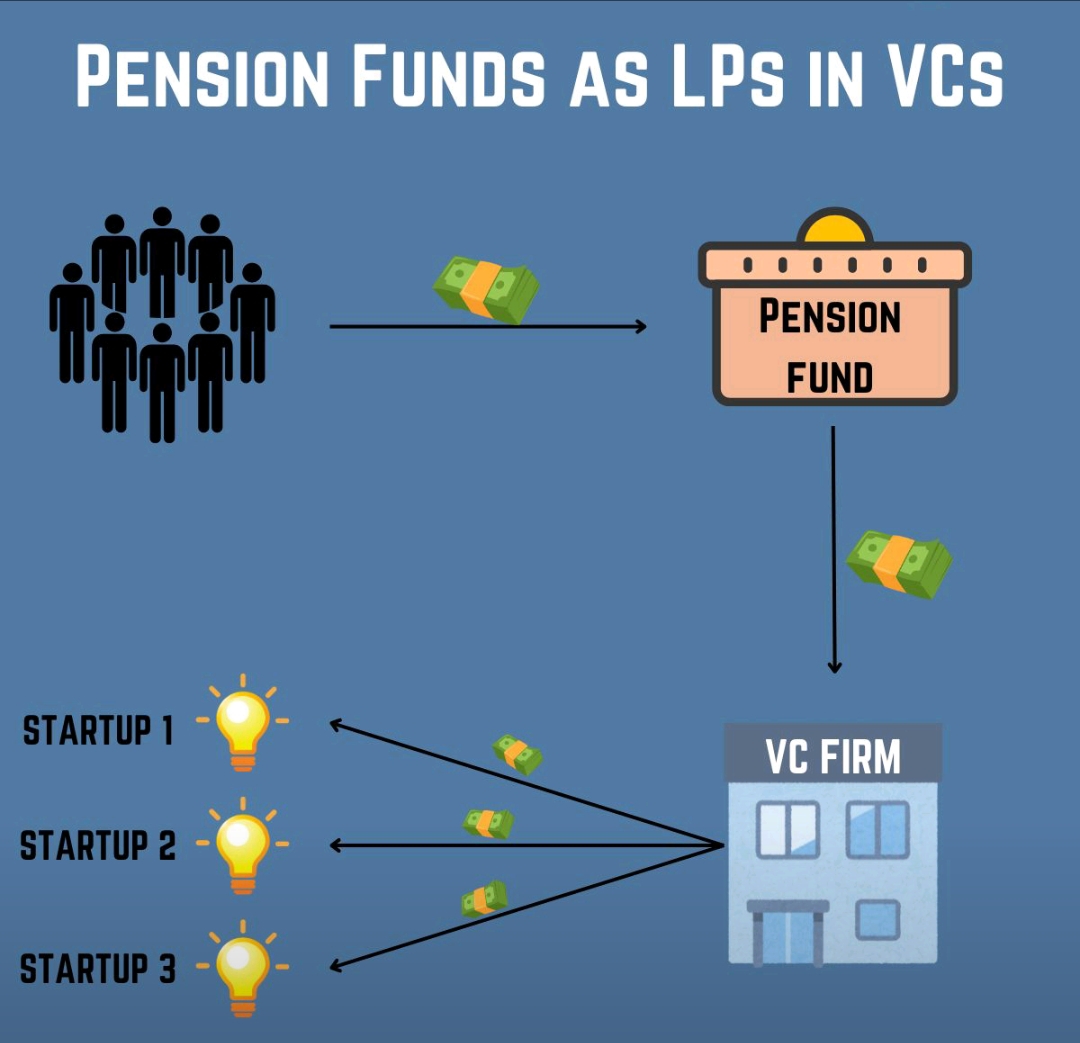

🚀 Inside a VC Mentorship: What I Learned About How VCs Think. Recently, I had the privilege of attending a focused mentorship session from VC Partner Manik Gruver at Macwise Capital, alongside a few fellow founders. The session offered deep, behind the scenes insights into how VCs operate, evaluate startups, and make decisions that shape the future of innovation. Here's a breakdown of the key learnings. 💼 How Venture Capital Funds Actually Operate? Venture capital firms don't just invest their own money, they raise capital from Limited Partners (LPs) like institutional investors, family offices, and ultra-HNIs. These LPs trust fund managers called General Partners (GPs) to invest their money wisely in high-potential startups as startups have higher ROI than the stock market And it gives great returns only if the funds are invested too early into startups. The entire Pool of fund typically runs on a 10 year cycle as it usually takes any startup to be a indicorn or unicorn. 🚀 Years 1-5: Capital is actively deployed into startups quickly because they want to get returns in 10 years. 🚀 Years 6-10: The focus shifts to helping portfolio companies grow by investing in multiple rounds and eventually exit, either via acquisition, secondary sale, or IPO. VCs must deploy capital early because idle funds generate no returns. That’s why GPs aim to invest in 20-30 startups per year, enough to build a diverse portfolio and improve the odds of hitting a “home run.” 📊 Returns and the Power Law in VC. Venture capital follows a power law distribution,. In simple terms: Out of 30 startups, 10+ may completely fail, Around 10-15 may survive but return only modest gains or breakeven, and The top 3–4 startups could generate 90%+ of the fund’s entire return. If a fund aims to 9x its capital over 10 years, each investment needs to deliver about 28% annualised returns, which is extremely difficult, especially in early-stage markets. This is why VCs make multiple bets: not every startup needs to succeed, just a few exceptional ones can carry the fund. 🧠 What VCs Look For in Founders and startups at the idea and MVP stage, is there any scope? - the most imp. question I asked. When startups don’t have traction or revenue, VCs bet on the founder. Key qualities that stood out: ✅️ Grit & adaptability - Founders who can navigate uncertainty and pivot quickly. ✅️ Unfair advantage - Deep domain expertise, early market access, or unique tech insight, and connections. ✅️ Ability to attract talent - Great founders don’t build alone; they attract A+ teams. ✅️ Clear thinking & storytelling - Can the founder articulate the vision in a way that earns belief? ✅️ Sales Skills - founders who can present more effectively and have great sales skills are funded easily. ✅️ Build in Public - Founders who are great at building in public and have a reputation and goodwill (Build your own personal brand along with your startup). Track record matters - not necessarily previous exits, but the ability to show progress, execution skills, and clarity of thought. Many great VCs say, “I don’t invest in startups; I invest in founders and teams.” 📐The Berkus Method - Valuing Pre-Revenue Startups! At the early stage, when there are no financials or revenue to analyse, VCs use frameworks like the Berkus Method. It assigns rough monetary values to five core startup components: 1. Quality of the Idea - Is it solving a real, large problem? 2. Prototype/Tech Progress - Is something already built or being built? 3. Founding Team Strength - Do they have the right mix of skills and leadership? 4. Strategic Relationships - Early customers, partnerships, or networks. 5. GTM Strategy- Is the plan for launch and scaling credible? This method helps evaluate risk-adjusted potential, even before revenue begins. 📚 Book Recommendations to Deepen VC Understanding! If you're serious about entering or understanding the VC world, these books are must-reads: ✅️ Break Into VC by Bradley Miles: A beginner-friendly guide on how venture capital works, perfect for aspiring investors and founders. ✅️ The Power Law by Sebastian Mallaby: A fascinating narrative on how venture capital firms like Sequoia and Benchmark built empires by betting on outliers. ✅️ Venture Deals by Brad Feld & Jason Mendelson: A tactical guide to understanding term sheets, fundraising, equity, and startup-investor dynamics.

Replies (20)

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Sairaj Kadam

Student & Financial ... • 1y

Exploring Venture Capital: Fueling Startup Growth Hello again, everyone! Today, let’s take a closer look at a powerful funding method that’s been behind some of the world’s most successful startups—Venture Capital (VC). If you’re aiming for rapid g

See MoreSanthosh Gandhi

Venture Capital Focu... • 1y

Venture Studio vs Pre-Seed VCs Venture Studios and Pre-Seed VCs have different approaches. While Pre-Seed VCs invest in existing businesses with potential in a very early stage, Venture Studios creates new startups from scratch, providing operation

See More

Vivek Joshi

Director & CEO @ Exc... • 6m

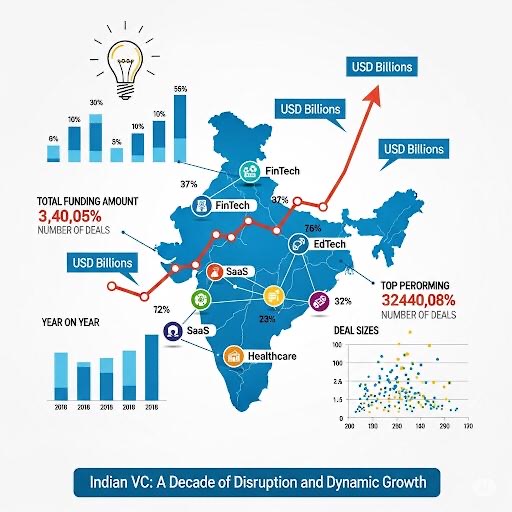

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)