Back

Vamshi Yadav

•

SucSEED Ventures • 10m

VCs are exiting their funds at an increasing pace. The "Great GP Exit" is in full swing. More & more GPs are leaving big-name firms to build their ventures. And honestly? It’s not hard to see why. Here’s what’s driving the shift: 1. LPs Want Focused Bets Limited Partners aren’t just backing the usual giants anymore. They’re pouring capital into specialized, thesis-driven funds, often led by smaller, agile GPs who know their space inside out. 2. Founder-Investors Have the Edge Operators who’ve built companies bring something most traditional VCs can’t which is real, hands-on experience. Founders want backers who’ve been in the trenches, not just those with deep pockets. 3. The Old VC Playbook Is Evolving Huge management fees and rigid fund cycles aren’t the only game in town. Rolling funds, SPVs, and micro-funds are giving investors more flexibility, and faster paths to returns. 4. Influence > Institutional Backing With the rise of content and community-driven investing (BTW are you interested in joining an exclusive startup community?), GPs don’t need a legacy brand to stand out. A strong personal brand and real relationships can open doors just as wide. If you’ve been an operator, advisor, or angel, there’s never been a better time to go independent. The barriers are down, and the playing field is wide open. The future of VC gonna shift from who you work for to what you bring to the table.

Replies (5)

More like this

Recommendations from Medial

Farhan Raza

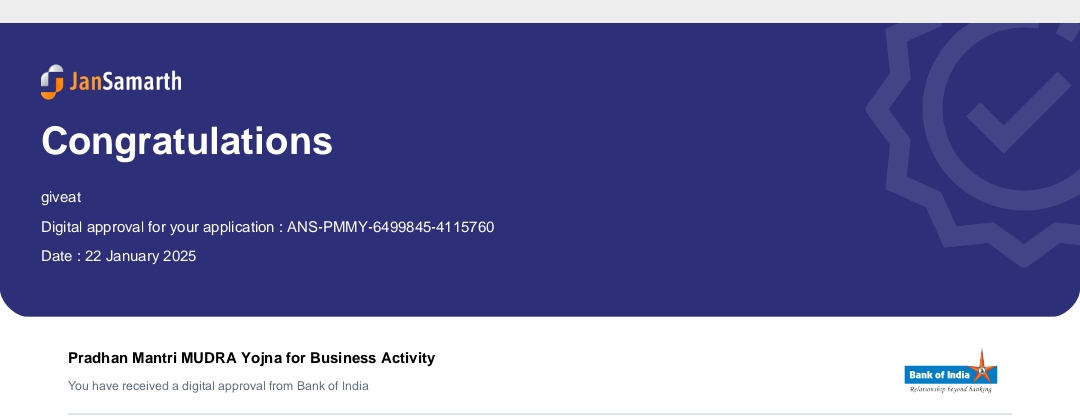

Founder And CEO Give... • 1y

We applied for a Mudra Loan through the Medial platform's tracker option, and this has been approved for our startup. Medial Premium offers a wide range of resources, including a comprehensive list of VCs and government grants, which has been incredi

See More

Mayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreMuhammed Mukthar

Solving overlooked p... • 7m

🚀 Calling founders & early-stage operators in banglore! We’re building DabbaDeals — a platform that helps restaurants earn from surplus food and gives budget-conscious users access to affordable meals. The problem is real. The opportunity is massi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)