Back

Vishwa Lingam

Founder of Simulatio... • 6m

🚫 Why VCs Reject Your Pitch — Even If It’s a Solid One 💡 You're not alone if your startup pitch got rejected by a VC. But here's the hidden truth most won’t tell you: VCs have limited capital from their LPs (Limited Partners) & they’re under pressure to deliver 10x+ returns on that capital. That means they cherry-pick a few bets they believe can go big and say no to most others, even great ones. 🧠 They don’t invest in every promising idea, they invest in ideas that fit their fund thesis, timing, and target market size. It’s not always about you, it’s about them and what they’re optimizing for. 🔍 🧭 Early-stage founders? Don’t rely solely on VCs. Instead, look for angel investors, operator-investors, syndicates, etc who bring belief, support, & flexibility. 💬 Rejection from a VC doesn’t mean your idea lacks value. It means you need to find aligned capital, not just smart capital. 💥 Finally remember that your investors are not just investing on vision but also for returns.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

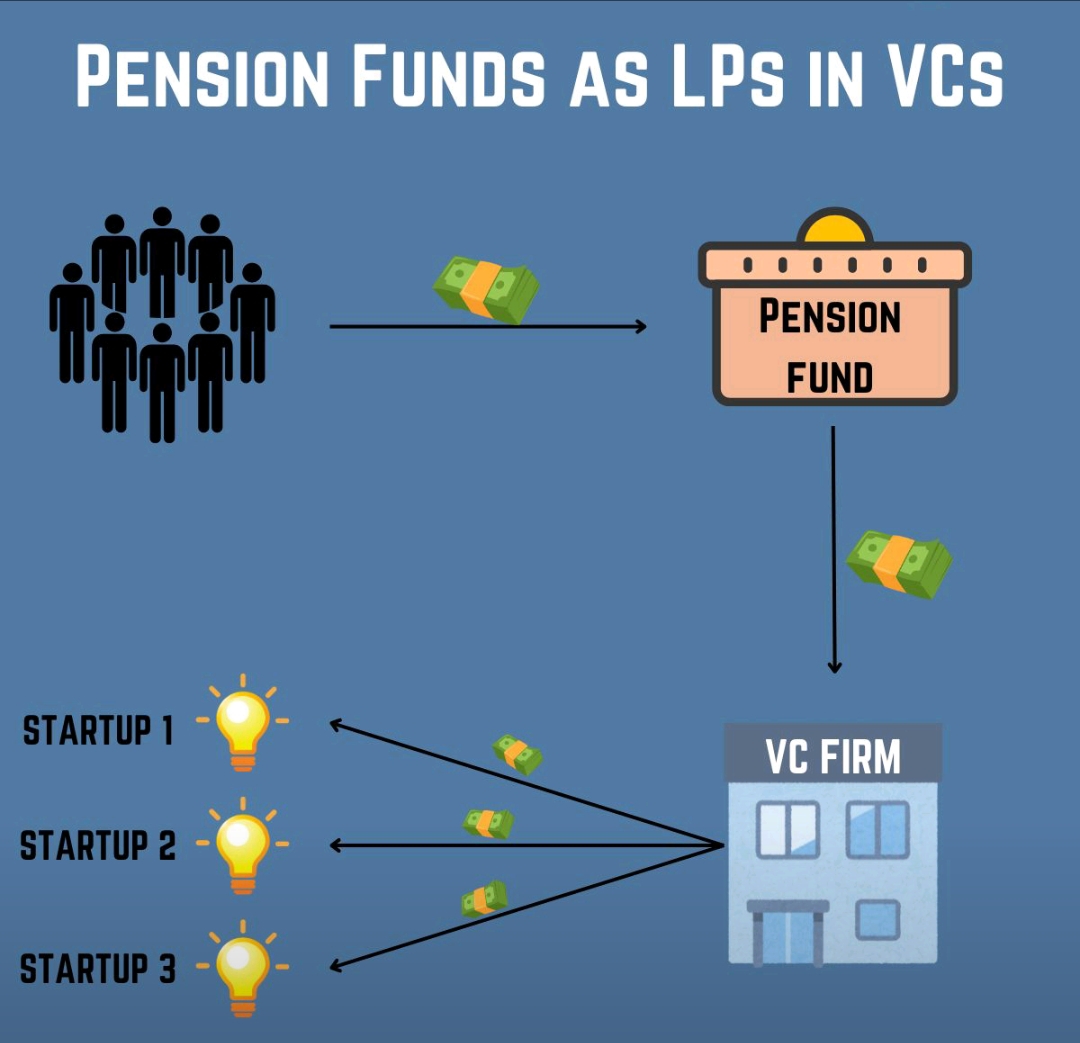

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

VCGuy

Believe me, it’s not... • 1y

Swiggy's upcoming IPO will be a multibagger win for early VC investors. 🎯Detailed insights will be available once their DRHP is public, but if you look at the history - - Elevation Capital: Investment of $5.9 M turned into $61.8 M (~10x returns) -

See MoreAccount Deleted

Hey I am on Medial • 11m

Raising VC Money? Tips No One Tells You : 1) Don’t Chase VCs, Attract Them - Build something so good they can’t ignore you. 2) Traction > Decks - Fancy pitch decks don’t matter if your numbers don’t add up. 3) Investors Follow Other Investors - G

See MoreSairaj Kadam

Student & Financial ... • 1y

Exploring Venture Capital: Fueling Startup Growth Hello again, everyone! Today, let’s take a closer look at a powerful funding method that’s been behind some of the world’s most successful startups—Venture Capital (VC). If you’re aiming for rapid g

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)