Back

Account Deleted

Hey I am on Medial • 9m

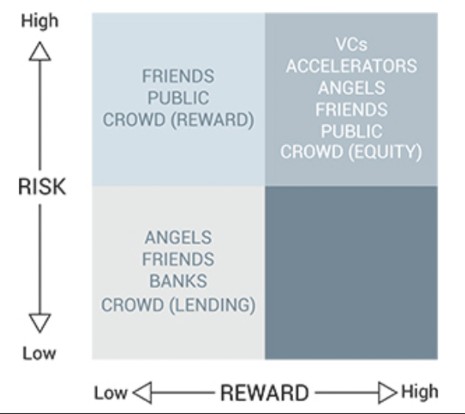

Before You Pitch Your Startup to Anyone, Ask These 2 Questions Most founders don’t raise money because their startup is bad. They fail because they’re pitching to the wrong kind of investor. Here’s what I mean. There are different kinds of investors, and each one has a different appetite for risk and a different expectation of reward. Some want safety, some want 100x returns and some just want to support a friend. So before you pitch, ask yourself two simple questions: 1. How risky is my idea? 2. How big is the potential reward? Now match that to who you’re approaching: ● Low Risk, Low Reward: Banks, lending platforms. They want predictable returns. No surprises. ● High Risk, Low Reward: Friends, family, early backers on Kickstarter. They’re investing in you, not just the idea. ● Low Risk, High Reward: Rare. Maybe an angel who likes you and sees traction. But they’ll want validation. ● High Risk, High Reward: VCs, accelerators, equity crowdfunding. These folks want to swing big. They’re betting on scale. So if you’re building something early-stage and unproven, pitching a VC might not make sense yet. But if you’ve got traction, a big vision, and a team that can execute do look for a VC to invest.. The key is alignment when it comes to the right investor, right stage and the right story. But That’s just half of the battle.

Replies (6)

More like this

Recommendations from Medial

Medial User

Hey I am on Medial • 11m

Hello everyone! I have an simple but effective and low risk business idea. Its just a raw idea, if anyone interested let's discuss more about it. It can solve the problem of small merchants, business owner, shop owners and different different servic

See MoreHarshal Tiwari

Equity Research Anal... • 1m

📊 Technical Analysis – Eicher Motors Ltd (Academic Purpose Only) Target = 9905 Entry = 7482 Stop loss = 7157 Risk = 325 Reward = 2423 🎯 Risk Reward ratio = 1:7.4 📈 RSI: 66+ (Strong Momentum) 📉 EMA Crossover: Bullish Confirmation Candle = Green

See More

GOLLAVILLI SANJAYKUMAR

Building in noise is... • 9m

I've applied for over 100 Founder’s Office roles, and every single one has rejected me due to a lack of "relevant experience." The irony? They're looking for high-risk-takers with multitasking abilities—yet they aren’t willing to take a risk on a fr

See MoreAtharva Deshmukh

Daily Learnings... • 1y

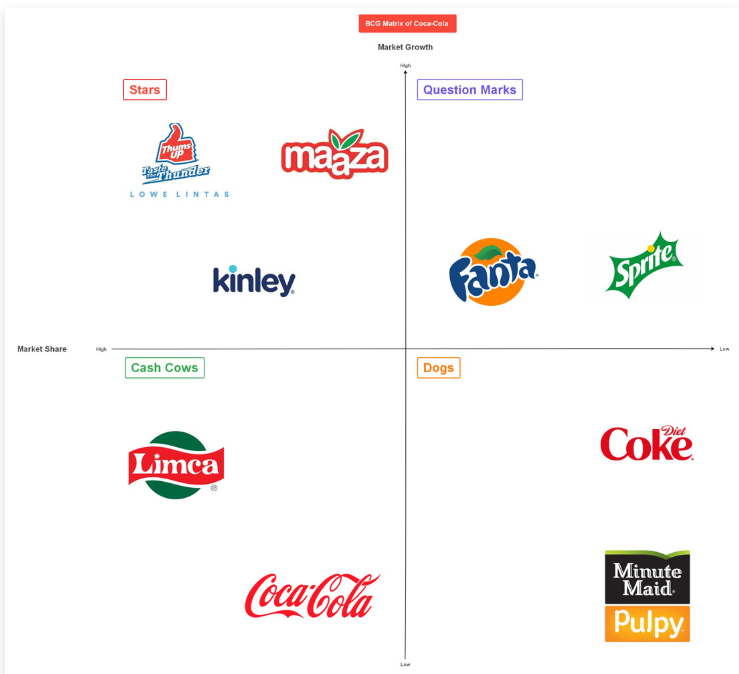

BCG Growth Matrix is a framework for analyzing a company's product portfolio. There are 4 quadrants, each of which represents a particular product or business, the vertical axis represents market growth (cash generation) and the horizontal axis repr

See More

Harshal Tiwari

Equity Research Anal... • 1m

👉Hindalco Industries Limited: 👉Only for Academic Research Current market price = 925 Target price = 1200 Stop loss = 876 Reward = 275 Risk = 49 Risk Reward ratio = 1:6 This is not a buy sell recommendation 👍 #HINDALCO #StockMarketIndia #Techni

See More

Account Deleted

Hey I am on Medial • 10m

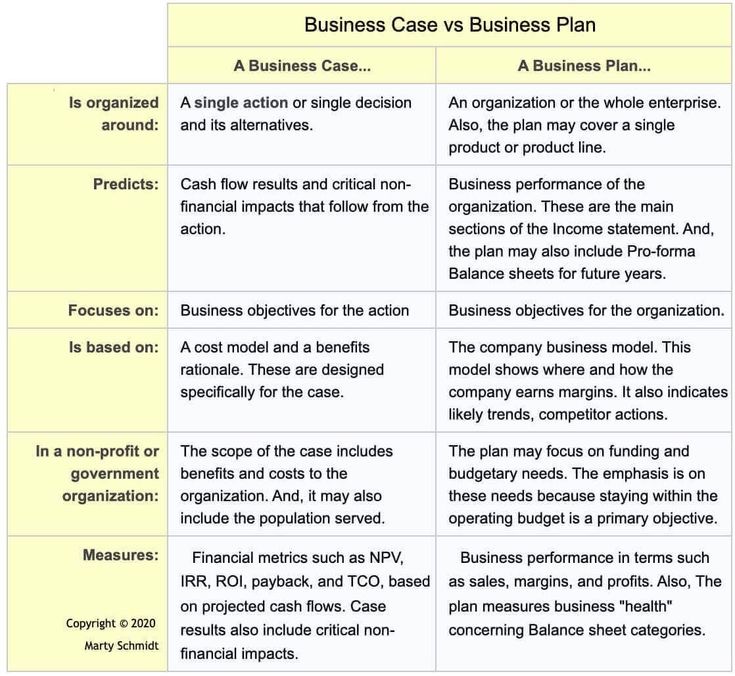

Folks, found yourself confused between a business case and a business plan? I used to blur the lines a lot. A business case is all about justifying one specific decision - think of it like pitching a move with clear ROI, risks, and impact. On the o

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)