Back

Atharva Deshmukh

Daily Learnings... • 1y

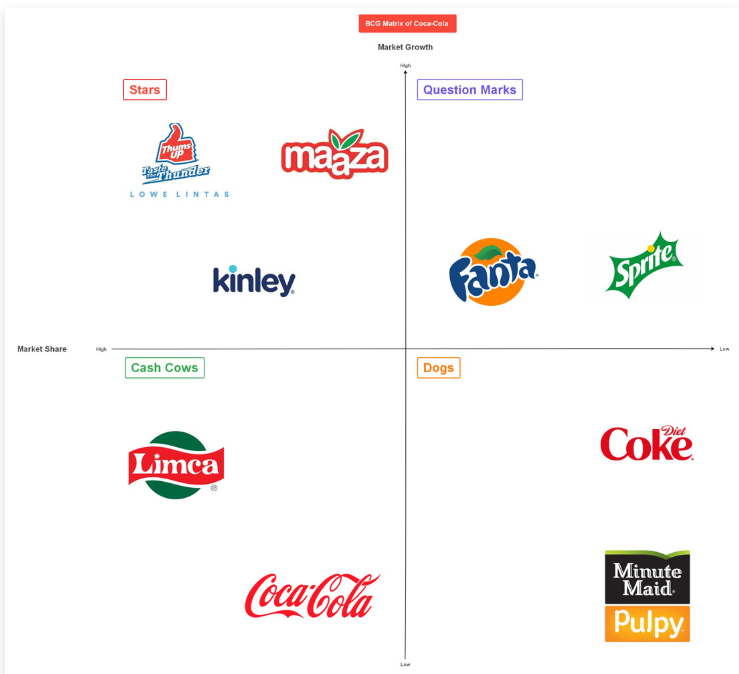

BCG Growth Matrix is a framework for analyzing a company's product portfolio. There are 4 quadrants, each of which represents a particular product or business, the vertical axis represents market growth (cash generation) and the horizontal axis represents market share (cash usage). The 4 quadrants are: 1] Star: High market growth and high market share 2] Question Mark: High market growth and low market share 3] Cash Cow: Low market growth and high market share 4] Dog: Low market growth and low market share E.g.: BCG Growth Matrix of Coca-Cola

Replies (4)

More like this

Recommendations from Medial

Aadi Karani

Learning is key to s... • 1y

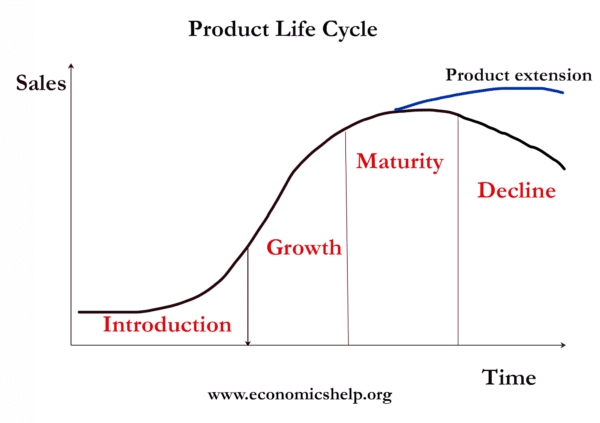

Hey guys yesterday we learnt about Product now let's learn about product life cycle.There are main 4 stages INTRODUCTION,GROWTH,MATURITY,DECLINE. Let's learn about these 4 stages. 1.INTRODUCTION- In this stage the product is just launched into the ma

See More

Vansh Khandelwal

Full Stack Web Devel... • 1y

Nirma revolutionized India's detergent market by making high-utility products affordable and accessible. Leveraging supply scarcity, Nirma filled the gap with a low-priced, high-quality detergent, gaining a significant market share. The iconic "Sabki

See MoreHemant Prajapati

•

Techsaga Corporations • 1y

Checkout our profile How to Verify Your Startup's Growth 1. 📊 Monitor Key Metrics - Revenue Growth: Track consistent increases in revenue. - User Growth: Watch the rise in active users/customers. - Engagement: Measure traffic, time spent,

See More

jaspreet Singh

Time equals to money... • 5m

Hello, Mera naam Jaspreet Singh hai (Mob/WhatsApp: 7837654140). Meri business idea ek unique aur growth-oriented concept hai jo market me long-term demand rakhta hai. Ye project customer needs ko target karta hai with high scalability, low competiti

See More

jaspreet Singh

Time equals to money... • 5m

Hello, Mera naam Jaspreet Singh hai (Mob/WhatsApp: 7837654140). Meri business idea ek unique aur growth-oriented concept hai jo market me long-term demand rakhta hai. Ye project customer needs ko target karta hai with high scalability, low competiti

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)