Back

LIKHITH

"You never know" • 1y

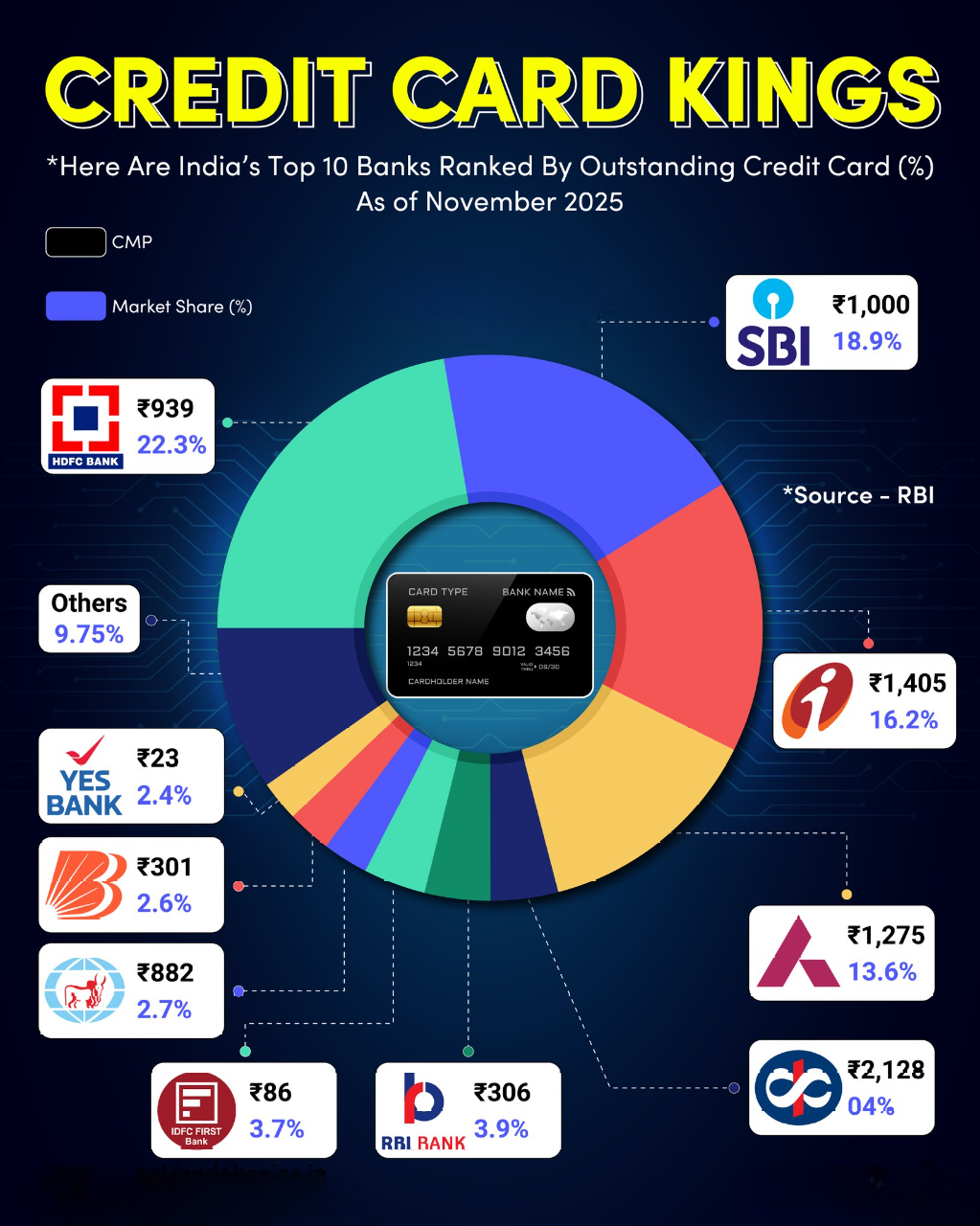

STAY UPDATED !! Credit cards usage growing by 22% in india Top 5 players (market share) 1.Hdfc bank = 27% 2.Icici bank = 19% 3.SBI = 15% 4.Axis bank = 11% 5.Kotak bank = 4% Like and follow to stay update & Which Credit card do you have ?

24 Replies

15

Replies (24)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

8 Startup-Friendly Banks in India 1. YES Bank Startup Banking https://www.yesbank.in/business-banking/startup-banking 2. HDFC Bank SmartUp https://www.hdfcbank.com/personal/pay/cards/startup-services/smartup 3. ICICI Bank InstaBiz for Startups htt

See More

10 Replies

60

46

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)