Back

Havish Gupta

Figuring Out • 1y

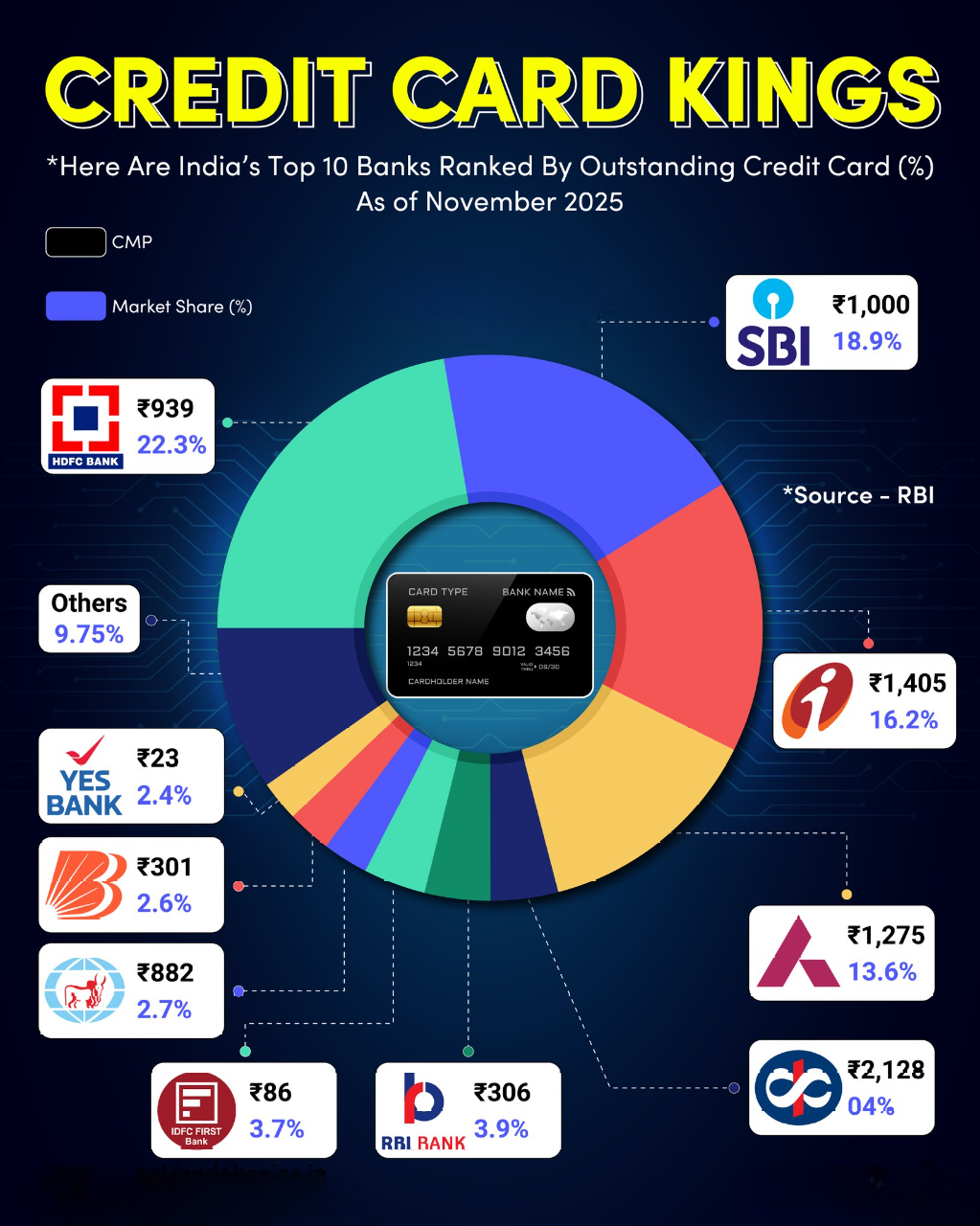

Actually Axis Bank got the best credit cards. So they have good chance of leading the market. Alsa Neon Banks like SBM which partners with credit card company like Slice, etc have a great scope

1 Reply

1

Replies (1)

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)