Back

Anonymous 5

Hey I am on Medial • 1y

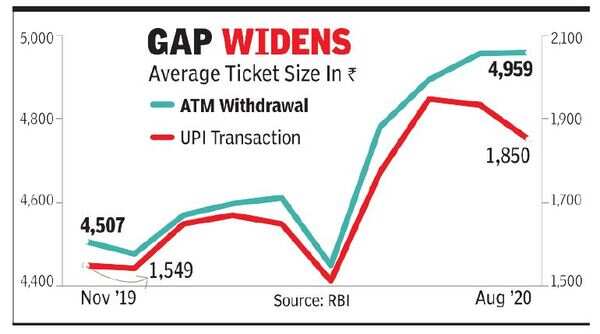

Makes sense. UPI and digital payments have made things so convenient that fewer ATMs are needed. It's good to see banks adapting to tech trends because I haven't used an ATM for 3 years now straight and I have been around here and there in India and UPI just works. everywhere.

More like this

Recommendations from Medial

OMPRAKASH SINGH

Founder of Writo Edu... • 1y

How ATMs Make Money – Let's Find Out! 🤑💸 1. Transaction Fees: When you withdraw money from an ATM, you are charged a certain fee. This fee goes to the ATM operator and is a significant source of their income. 2. Balance Inquiry Fees: Checking yo

See MoreRohan Saha

Founder - Burn Inves... • 5m

Free Payments for Us Big Losses for Them The UPI Puzzle UPI has become a daily part of life in India People use it everywhere from paying at a tea stall to buying groceries to transferring money to friends In July 2025 more than 15 billion transacti

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)