Back

Replies (1)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How Silicon Valley Companies Thinks? What Matters 'Profits' or 'Valuations'........🤔 let me tell you a secret. In silicon valley, companies often operate differently from traditional businesses. here the focus is less on making immediate profits a

See More

Pulakit Bararia

Founder Snippetz Lab... • 1y

So how do you calculate your company’s valuation? Here’s the simplest way to think about it: 1. Forecast Future Earnings: Start with what your business makes now and apply a growth rate. Example: Year 1: $100K → Year 2: $120K → Year 3: $144K. 2.

See MorePulakit Bararia

Founder Snippetz Lab... • 1y

I recently posted how do you calculate violation, many people were saying most startup doesn't earn profit , so there are two more ways you can go about Revenue Multiples Method 1. Focus on Revenue: Use your company’s current or projected revenue

See MoreVIJAY PANJWANI

Learning is a key to... • 2m

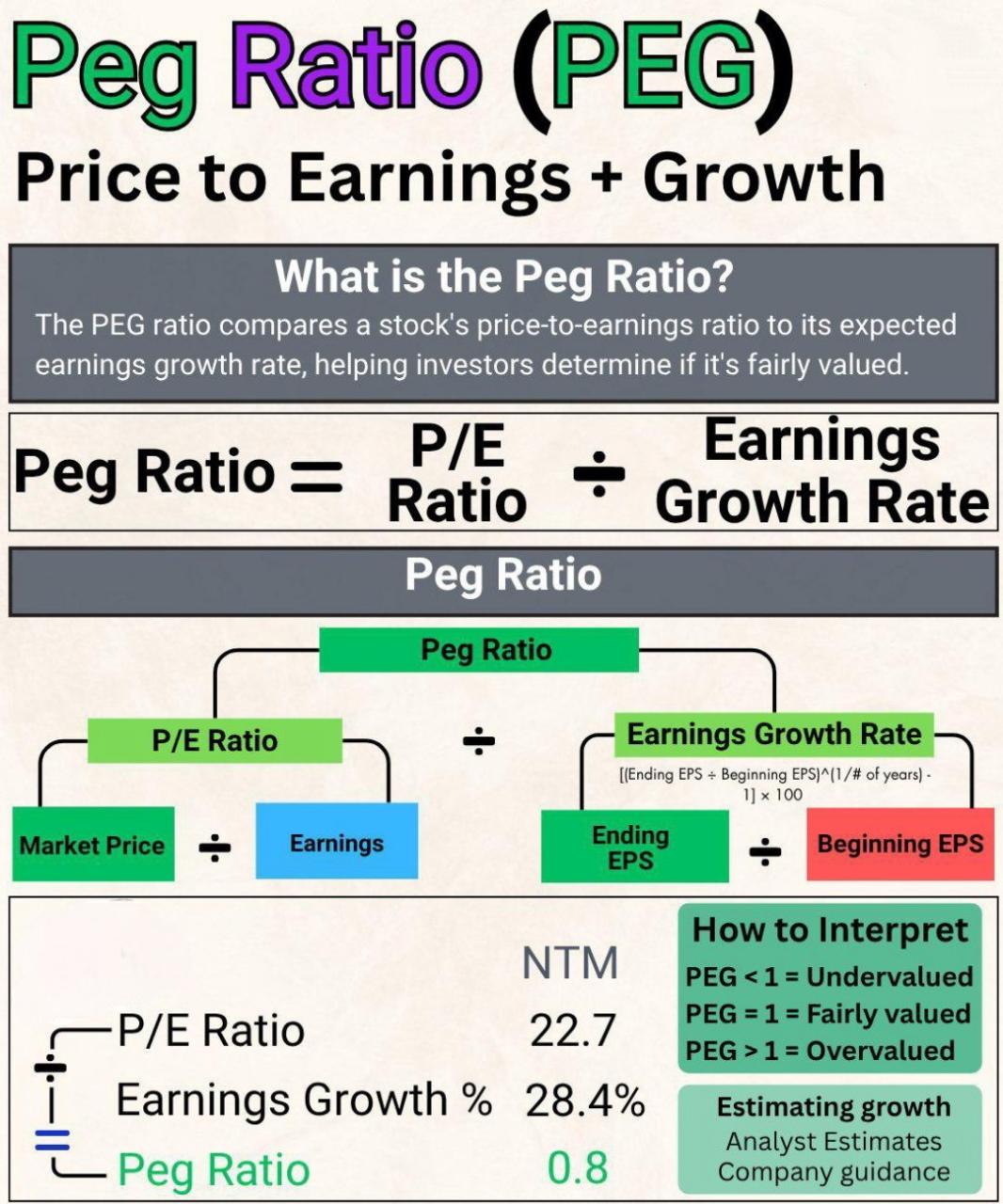

PEG Ratio Explained in 30 Seconds! Want to know if a stock is undervalued or overvalued? Use the PEG Ratio one of the smartest tools used by pro investors! 🧮 Formula: PEG = P/E Ratio ÷ Earnings Growth Rate ✅ PEG < 1 = Undervalued ⚖️ PEG = 1 = Fai

See More

financialnews

Founder And CEO Of F... • 1y

Stock Market Correction: Jefferies Highlights Significant Earnings Downgrades, Largest Since Early 2020 Jefferies Highlights Healthy Stock Market Correction and Earnings Downgrades Since 2020 Chris Wood from Jefferies recently emphasized that the c

See MoreRohan Saha

Founder - Burn Inves... • 6m

Zomato PE ratio has reached around 994 in the Indian market I mean can you even imagine? The company valuation still does not look worth buying yet people are investing in it what I keep thinking is how badly is this one stock affecting the Nifty? A

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

VIJAY PANJWANI

Learning is a key to... • 4m

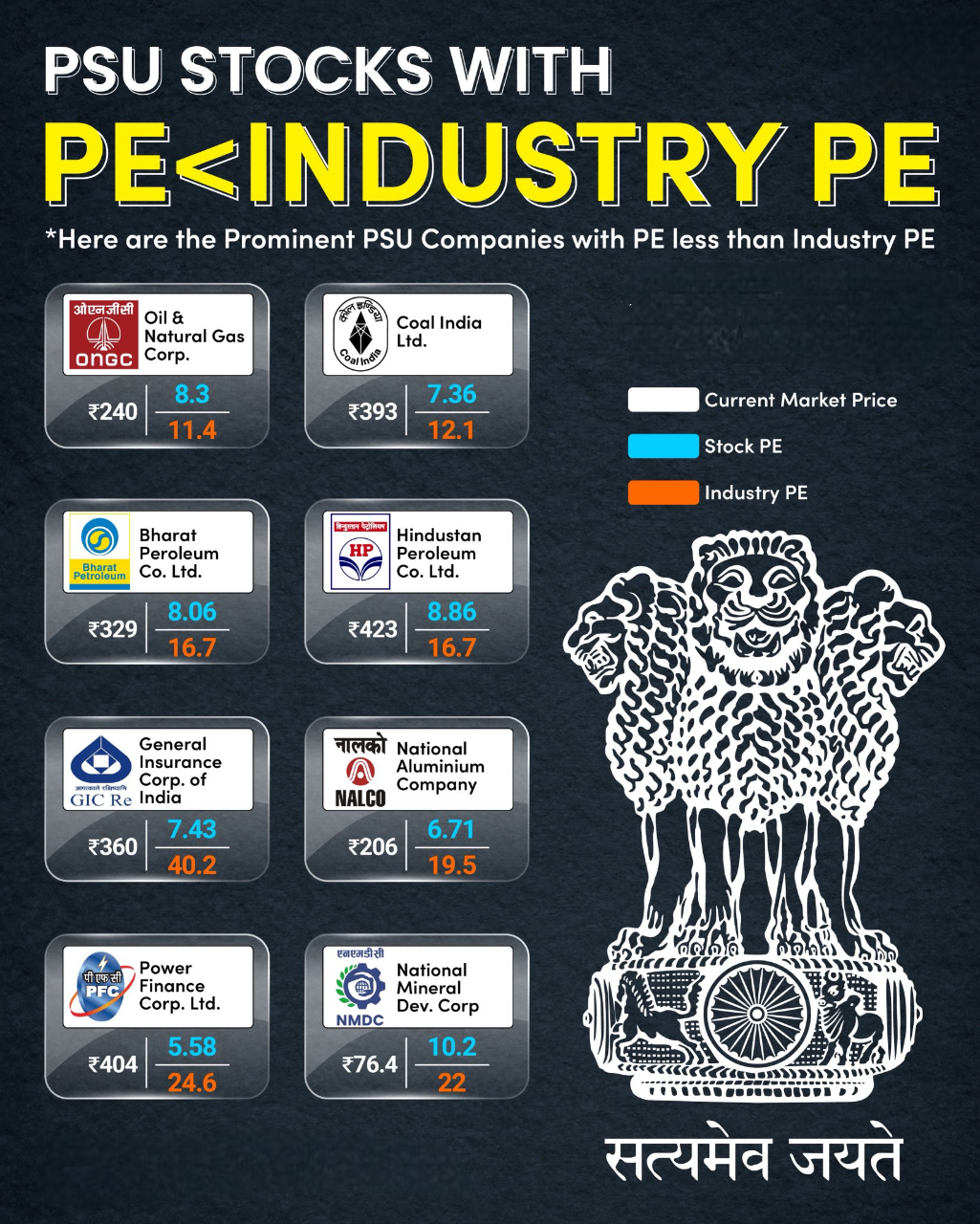

PSU Stocks with PE < Industry PE In the current market, valuation matters more than ever. One strong indicator is the Price-to-Earnings (PE) ratio. When a company’s PE is below the industry average, it can signal undervaluation and opportunity for i

See More

Download the medial app to read full posts, comements and news.