Back

VIJAY PANJWANI

Learning is a key to... • 4m

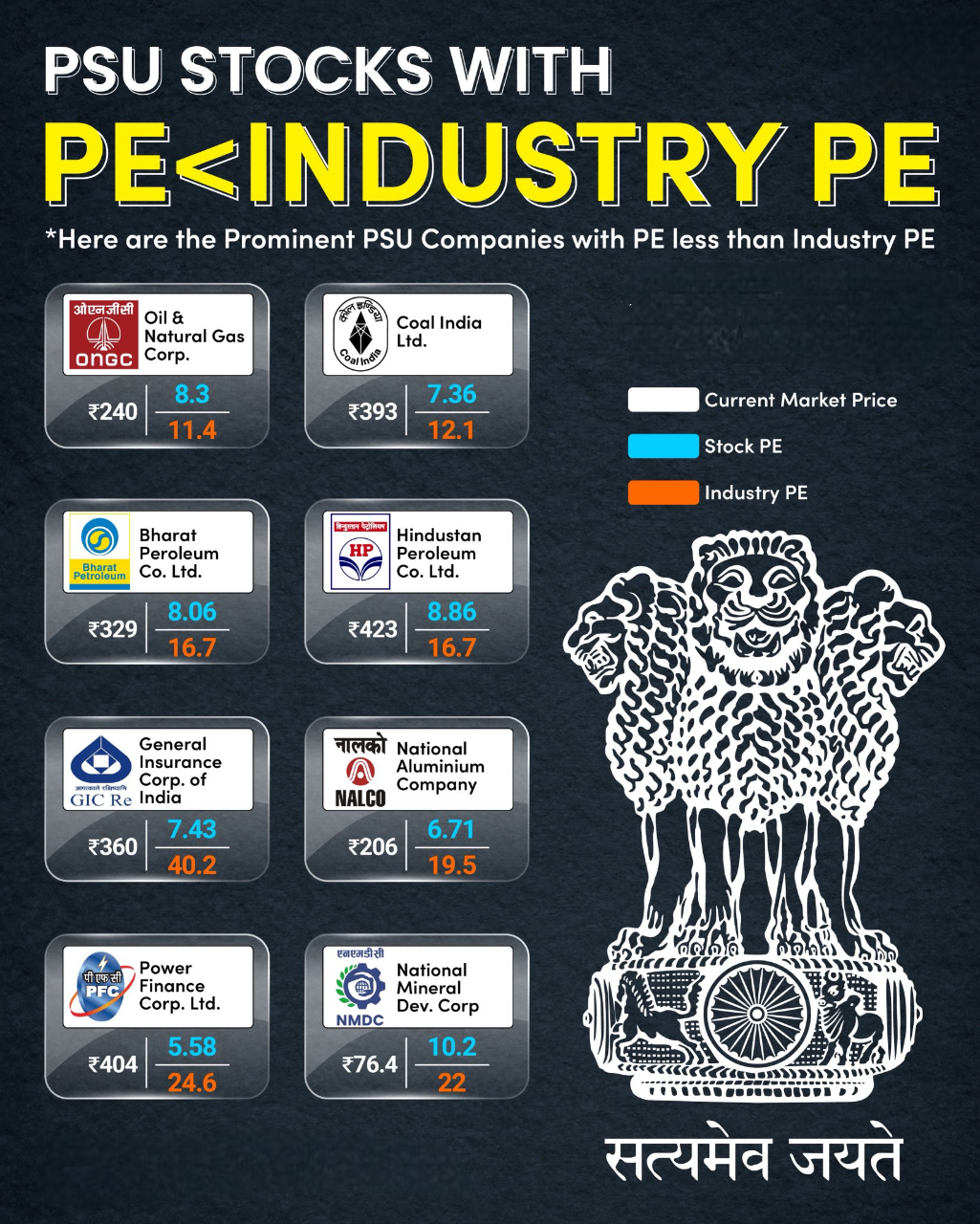

PSU Stocks with PE < Industry PE In the current market, valuation matters more than ever. One strong indicator is the Price-to-Earnings (PE) ratio. When a company’s PE is below the industry average, it can signal undervaluation and opportunity for investors. Here are some prominent PSU companies trading at attractive valuations. Takeaway: PE < Industry PE often suggests undervaluation, but thorough research and risk assessment are essential before investing. Do you see these PSUs as value picks for long-term portfolios?

Reply

5

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)