Back

Chintan Udani

I'm a pro medialist • 11m

The Shutdown of Bowery Farming: A Case Study in What Went Wrong Bowery Farming, once a celebrated innovator in the vertical farming industry, has ceased operations as of late 2024, marking the end of a journey that began with high promise and a valuation of $2.3 billion. The New York-based agtech company aimed to revolutionize agriculture by growing fresh produce indoors using advanced technology, targeting urban markets with a sustainable, locally sourced solution. However, its closure underscores critical missteps and broader industry challenges that ultimately led to its downfall. Here’s an analysis of what went wrong. First, financial mismanagement appears to have played a pivotal role. Bowery raised over $700 million from prominent investors, including General Catalyst, GV, and Fidelity, yet burned through capital at an unsustainable rate. Reports from former employees highlight excessive spending on unnecessary equipment and high-end technology—such as unused devices and oversized displays—that failed to deliver operational value. This reckless allocation of funds eroded financial stability, leaving the company vulnerable when market conditions tightened. The decision to take on $150 million in debt from KKR in 2022, even during a period of accessible equity, further strained its balance sheet, saddling Bowery with obligations it couldn’t meet as revenue growth lagged. Second, operational inefficiencies compounded these financial woes. Vertical farming promises high yields and resource efficiency, but Bowery struggled to scale its model profitably. The high costs of energy, labor, and maintenance for its indoor facilities outpaced the premiums consumers were willing to pay for its produce. Unlike traditional farming, which leverages natural sunlight and established supply chains, Bowery’s reliance on artificial lighting and complex logistics drove up expenses. Multiple rounds of layoffs in 2023 and the delay of planned expansions in Georgia and Texas reflect a company unable to align its ambitious vision with practical execution. The introduction of a pathogen roughly a year ago, as noted by former staff, may have further disrupted production, though details remain scarce. Third, Bowery misjudged market demand and competitive dynamics. The vertical farming sector has faced skepticism about its economic viability, with consumers often unwilling to pay a premium for “cleaner” or locally grown greens when cheaper alternatives abound. Competitors like AeroFarms and AppHarvest, which also faced bankruptcy, illustrate a broader industry reckoning. Bowery’s focus on specialty crops—lettuces, herbs, and berries—may have limited its appeal in a market dominated by cost-conscious buyers and established agricultural giants. The company’s leadership, criticized by some ex-employees as disconnected and overly focused on optics rather than operational grit, failed to pivot effectively in response to these realities. Finally, external pressures amplified internal failures. Rising interest rates and a shift away from the zero-interest-rate policy (ZIRP) era squeezed funding for capital-intensive startups like Bowery. Venture capital, once plentiful, dried up as investors grew wary of agtech’s unproven returns. The company’s valuation plummeted—Fidelity marked down its stake by over 99%—signaling a loss of confidence that hastened its demise. Combined with sector-wide challenges, including high startup costs and low margins, Bowery’s closure reflects both its own missteps and a turbulent environment it couldn’t navigate. Bowery Farming’s shutdown is a cautionary tale for the agtech sector. It highlights the need for disciplined financial management, realistic scaling strategies, and a deep understanding of market fit. While the vision of sustainable, tech-driven agriculture remains compelling, Bowery’s experience suggests that execution, not just innovation, determines survival. As the industry mourns the loss of a once-promising player, attention now turns to what lessons can be learned—and whether vertical farming’s broader promise can still be realized.

More like this

Recommendations from Medial

calapatapu Balaji

Hey I am on Medial • 1y

Idea 1: Vertical Farming Description:Vertical farming is a method of growing plants in vertically stacked layers, often in an indoor environment. This method uses hydroponics, aeroponics, or aquaponics to cultivate crops. Why it's futuristic: Verti

See MoreSanskar

Keen Learner and Exp... • 1y

Vimpa Organics officially known as Vimpa Private Limited was founded by Ram Veer Singh after being inspired by hydroponic farming techniques he observed in Dubai in an agricultural event, leading him in transforming his own home into a hydroponic far

See MoreAtharva Deshmukh

Daily Learnings... • 1y

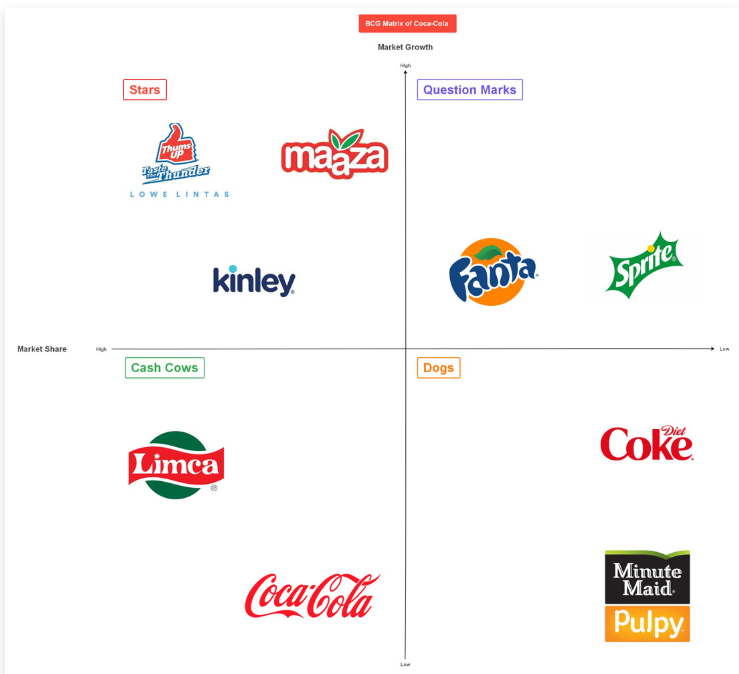

BCG Growth Matrix is a framework for analyzing a company's product portfolio. There are 4 quadrants, each of which represents a particular product or business, the vertical axis represents market growth (cash generation) and the horizontal axis repr

See More

Mr Shiva Raj

Challenging Norms, C... • 1y

"Farming content on YouTube is in high demand, but most focus on large farms or theory. I want to showcase real village farming—its challenges, techniques, and innovations. This will help educate and inspire people about agriculture. With quality vid

See MoreMedial Startup Trivia

Trivias Around start... • 1y

Pets.com: The Rise and Fall of a Dot-com Era Icon In the late 1990s, the dot-com boom was in full swing, and investors were eager to get in on the latest internet startups. One such company that captured the attention of investors and pet lovers ali

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)