Back

VIJAY PANJWANI

Learning is a key to... • 2m

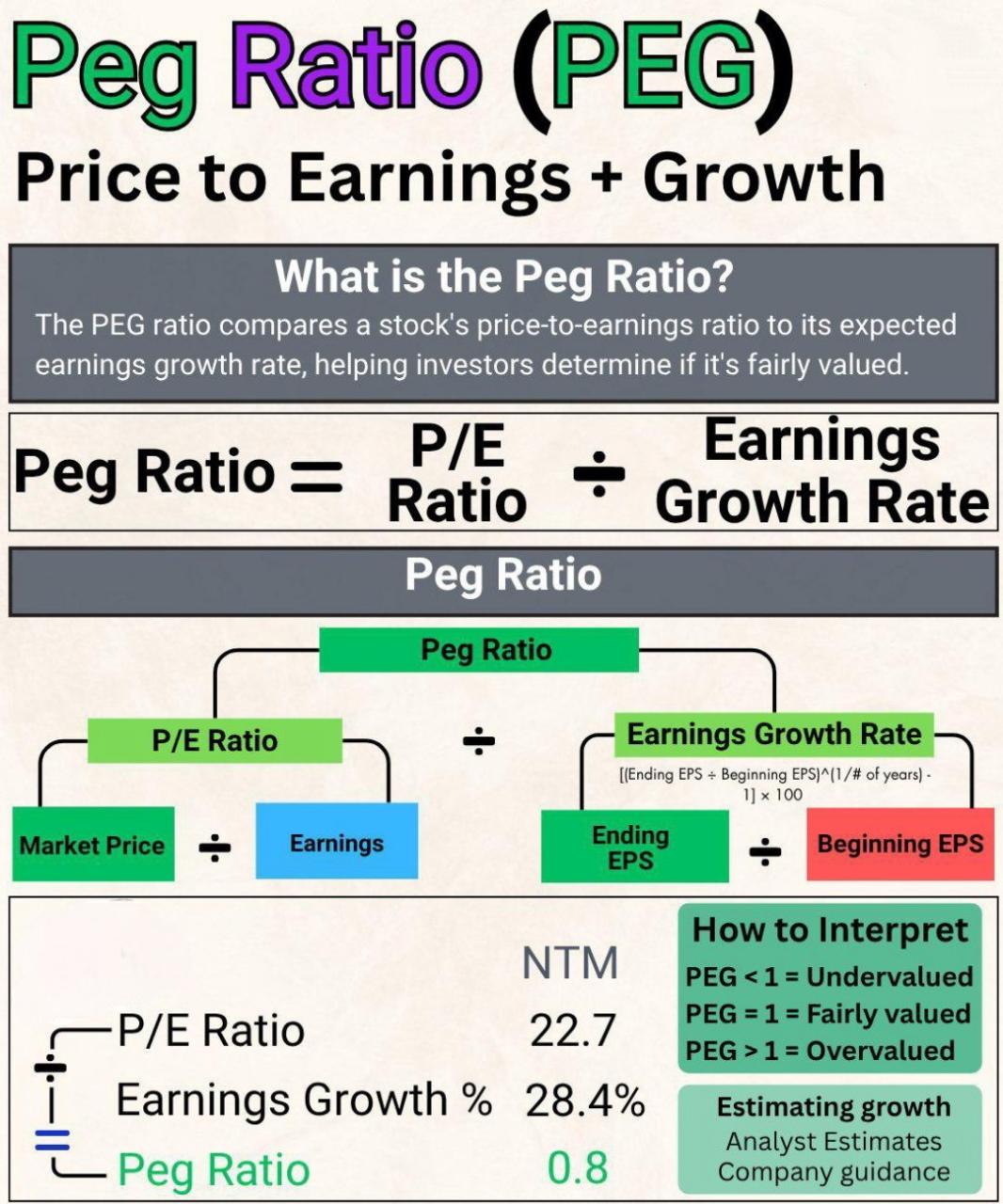

PEG Ratio Explained in 30 Seconds! Want to know if a stock is undervalued or overvalued? Use the PEG Ratio one of the smartest tools used by pro investors! 🧮 Formula: PEG = P/E Ratio ÷ Earnings Growth Rate ✅ PEG < 1 = Undervalued ⚖️ PEG = 1 = Fairly Valued ❌ PEG > 1 = Overvalued This simple metric helps you identify whether a stock's price truly matches its growth potential. If you’re into investing, stock market analysis, and smart valuation, this one’s for you!

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 6m

Zomato PE ratio has reached around 994 in the Indian market I mean can you even imagine? The company valuation still does not look worth buying yet people are investing in it what I keep thinking is how badly is this one stock affecting the Nifty? A

See MoreVIJAY PANJWANI

Learning is a key to... • 1m

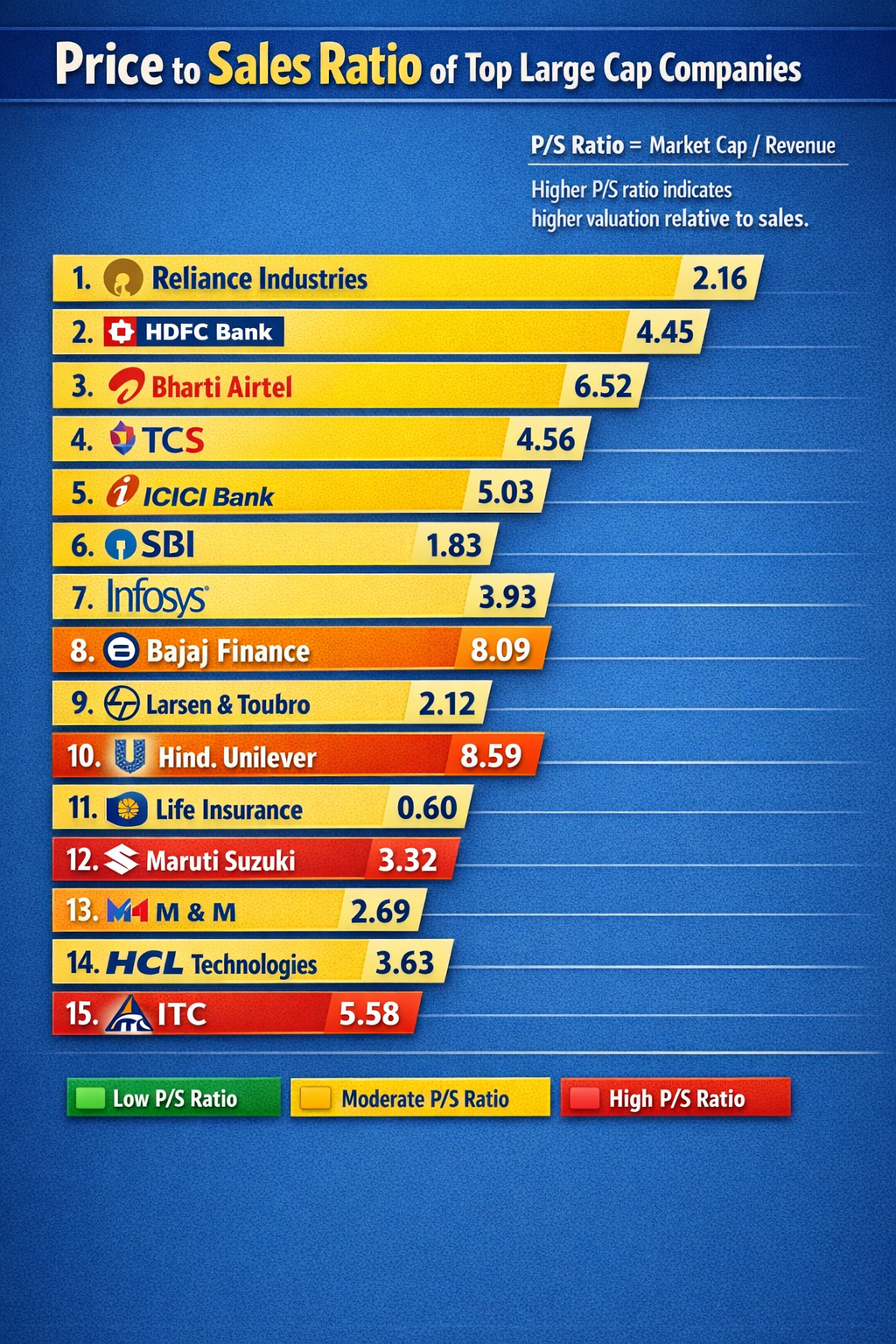

Price to Sales (P/S) Ratio of India’s Top Large-Cap Stocks 🇮🇳 Ever wondered which big companies are cheap vs expensive relative to their sales? That’s where P/S Ratio helps 👇 🔹 Low P/S → Potentially undervalued 🟡 Moderate P/S → Fairly valued �

See More

Rohan Saha

Founder - Burn Inves... • 9m

I’ve read a lot of articles since morning saying that the reason for the US stock market crash is the fall in the US GDP, etc. But no one in the entire world is talking about the valuation of the US stock market. Not even in India. The main point is

See MoreOMPRAKASH SINGH

Founder of Writo Edu... • 1y

How do some stocks suddenly rise in the stock market? Let’s find out 🤯 Market and Economic Factors 1. Demand and Supply: When the demand for a stock increases and supply decreases, its prices rise. 2. Economic Growth: If a company's business is

See MoreThe Outlier

Hey I am on Medial • 11m

₹1 Cr salary? You take home ₹65L after taxes. ₹1 Cr business profit? You keep ₹80L after deductions. ₹1 Cr in stock growth? ₹₹87.65L remains after 12.5% tax. The system wasn’t designed for workers. It was built for owners. Still chasing promotions

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)